10 Best Layer 1 Crypto Projects to Watch in 2024

Many cryptocurrency investors prefer layer 1 networks over secondary tokens, such as those following the ERC-20 or BEP-20 standards. After all, layer 1 blockchains determine their own consensus models, governance, and transaction processing.

This guide analyzes the 10 best layer 1 crypto projects for investors. We explore each layer 1 network in terms of performance, efficiency, scalability, use cases, and price action.

The Top Layer 1 Cryptocurrencies Ranked

Listed below are the 10 best layer 1 crypto projects to consider right now:

- Ethereum: Layer 1 blockchain supports thousands of ERC-20 tokens, all paying network fees in ETH. Ethereum is the leading smart contract network for gaming, metaverses, decentralized finance, and other Web 3.0 projects.

- BNB: Another popular layer 1 project for secondary tokens, BNB follows the BEP-20 standard. It’s an efficient blockchain that’s backed by Binance. BNB is used for paying fees, providing liquidity, and securing reduced commissions.

- Ripple: Established layer 1 network for cross-border payments, Ripple is used by over 200 banks. It offers near-instant and near free transactions, and XRP provides liquidity when cross-currency transfers take place.

- Sei: A brand-new layer 1 network, Sei can handle up to 20,000 transactions per second. Block confirmation times take under a second. Sei has increased by over 3,000% since hitting exchanges in August 2023.

- Solana: This so-called ‘Ethereum Killer’ can handle thousands of transactions per second. Transaction fees cost a fraction of a cent. Solana – which is up over 330% in the past year, facilitates smart contracts and dApps efficiently.

- Bitcoin: The original cryptocurrency and layer 1 blockchain, Bitcoin is the best option for buy-and-hold investors. Some analysts believe Bitcoin could surpass $100,000 next year. Investors can look forward to a Bitcoin ETF approval too.

- Bitcoin Cash: Created to compete with Bitcoin, Bitcoin Cash increased the maximum block size limit to facilitate faster, cheaper, and more scalable transactions. Bitcoin Cash aims to become the de facto cryptocurrency for digital payments.

- Stellar: A diverse layer 1 blockchain that supports the tokenization of real-world assets, Stellar was launched nearly a decade ago. Its network also supports cross-border fiat payments, with an average settlement time of 5.8 seconds.

- Polkadot: Offers ‘true’ blockchain interoperability for any layer 1 network, Polkadot can handle all forms of digital data. Not only cross-blockchain token transfers but also NFTs, smart contracts, dApps, and DAOs.

- Kaspa: This trending cryptocurrency supports a new layer 1 network with strong price performance. Kaspa – which uses proof-of-work, has increased by 1,800% in the prior 12 months; and has a market capitalization of $3 billion.

Analyzing the Best Layer 1 Tokens

Read on for our analysis of the top layer 1 blockchain projects listed above.

1. Ethereum: Leading Smart Contract and dApp Network With Thousands of Secondary Tokens

In our view, Ethereum is one of the best layer 1 crypto projects to invest in. At its core, Ethereum is a smart contact network, enabling developers to build decentralized applications. ERC-20 projects benefit from Ethereum’s security, decentralization, and fast transactions. In turn, projects pay transaction fees in Ethereum’s native cryptocurrency, ETH.

There are thousands of projects operating on Ethereum, with new ones being launched every day. This includes leading stablecoins like Tether, USD Coin, and Dai, Ethereum is also the go-to network for metaverse experiences and play-to-earn games. Some popular examples include Axie Infinity, Tamadoge, the Sandbox, and Decentraland.

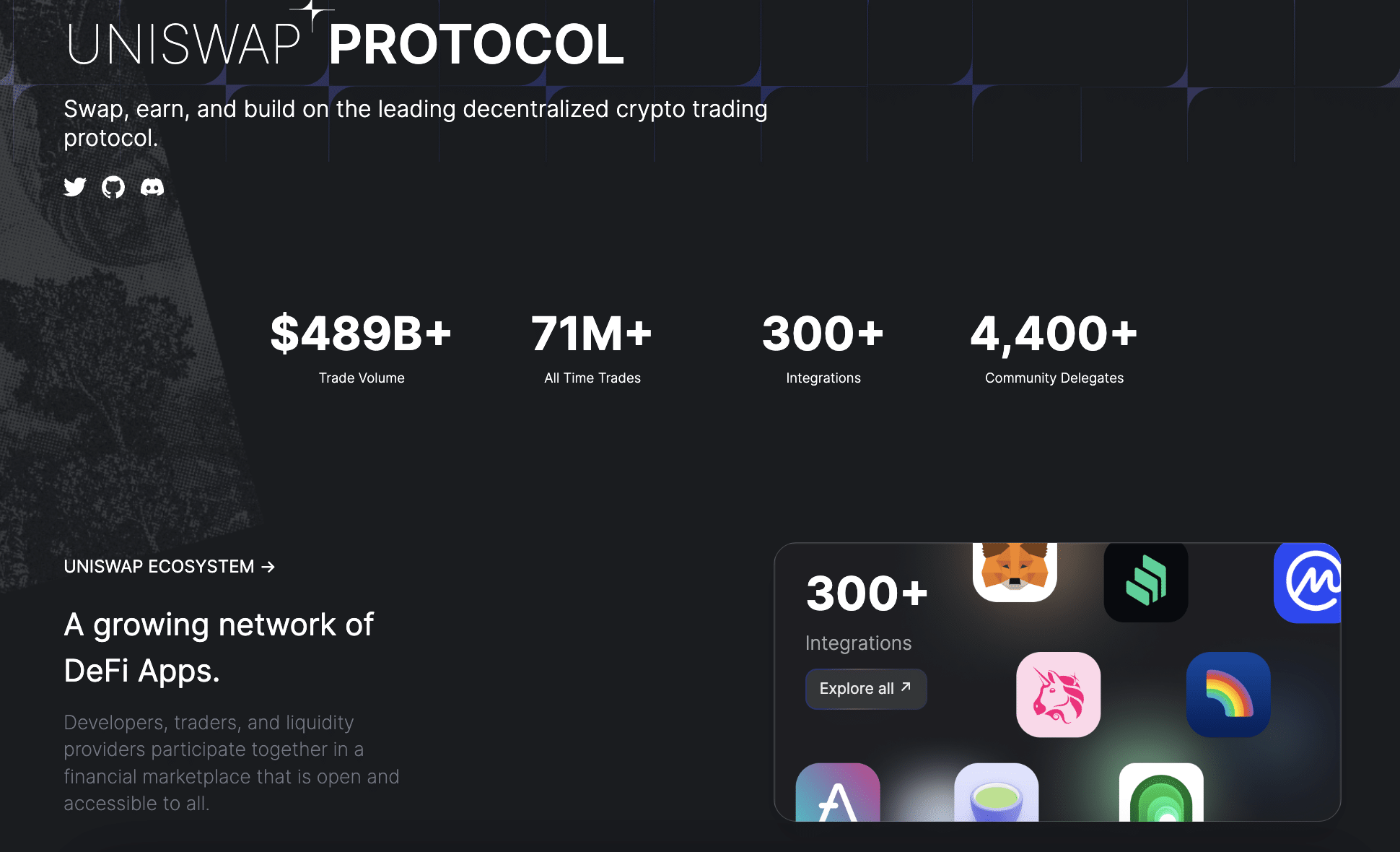

In addition, Ethereum is popular with decentralized finance projects. This includes everything from SushiSwap and Maker, Lido Dao, Uniswap, Yearn.finance, and SushiSwap. Ethereum has become so popular that it constantly faces network congestion. This is why layer 2 solutions have been developed, such as Arbitrum and Polygon.

Nonetheless, Ethereum is working on improving network efficiency, scalability, and cost-effectiveness. Once this happens, layer 2 solutions might become irrelevant. In terms of valuation, Ethereum is the second-largest cryptocurrency by market capitalization. It has increased by over 70% in the past year. Since its inception, Ethereum is up over 1 million percent.

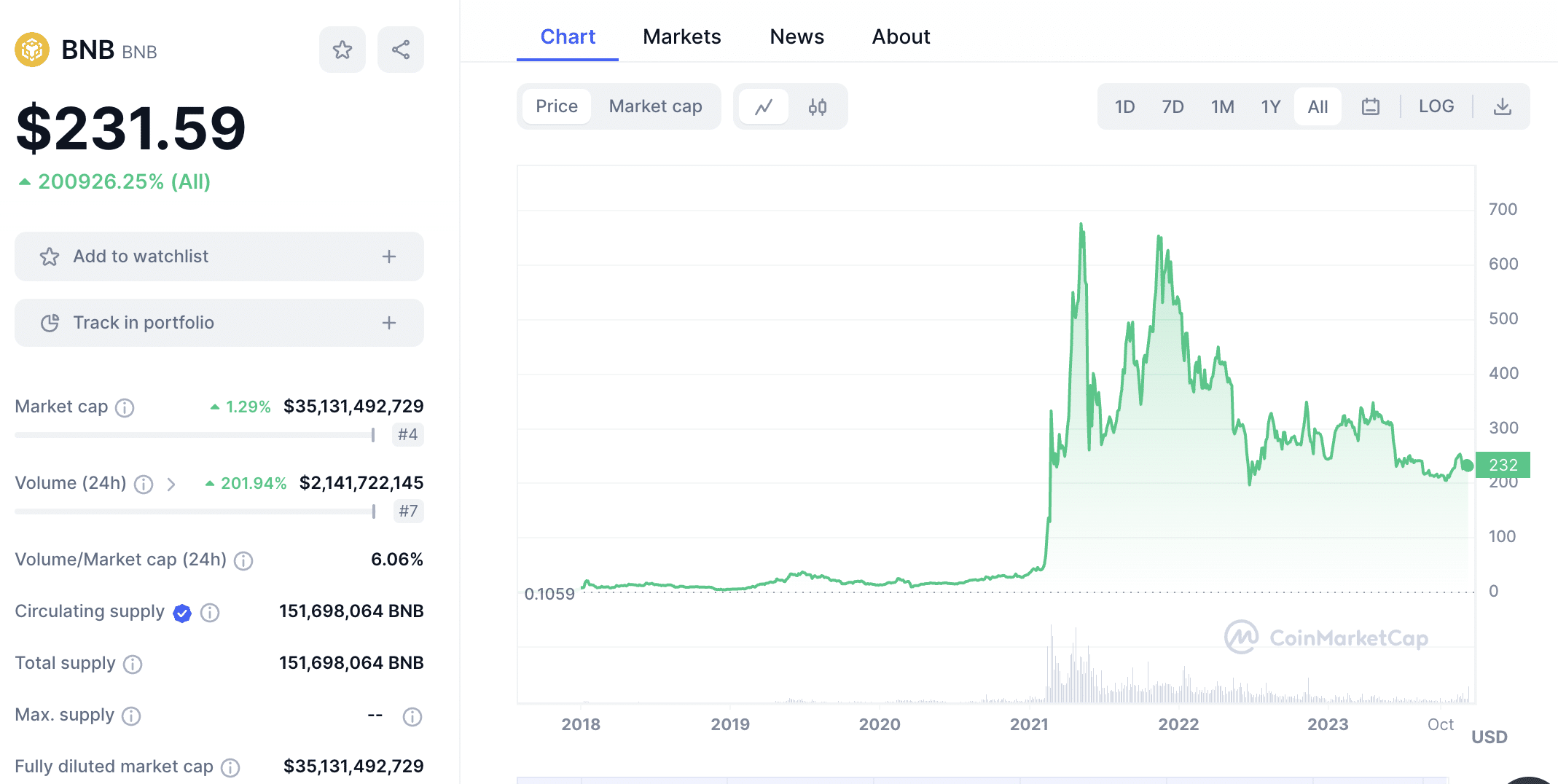

2. BNB: Deflationary Layer 1 Cryptocurrency Supporting dApps and a Burning Mechanism

BNB is the native cryptocurrency of the BNB Chain. It was created in late 2017 by Binance. The original BNB use case was for reduced commissions on the Binance exchange. Put simply, those paying fees in BNB will benefit from a 25% discount. BNB now supports a fully-fledged ecosystem.

For example, the BNB Chain handles thousands of secondary tokens. The BNB Chain also supports smart contracts, so an increasing number of developers are choosing the network for their dApp creations. This includes play-to-earn games, staking protocols, and some of the best no KYC crypto exchanges.

Based on the proof-of-stake consensus mechanism, the BNB Chain is both efficient and cost-effective. What’s more, BNB offers exposure to Binance, the world’s largest exchange. BNB is trading at an attractive price right now. According to CoinMarketCap, the BNB price is almost 55% below its all-time high, which was hit in 2021.

We should also mention that Binance has developed a burning mechanism for BNB. Unlike other burning programs, Binance uses retained profits to repurchase BNB from public exchanges. This makes the burning mechanism sustainable. This will continue until the total BNB supply is reduced by 50%.

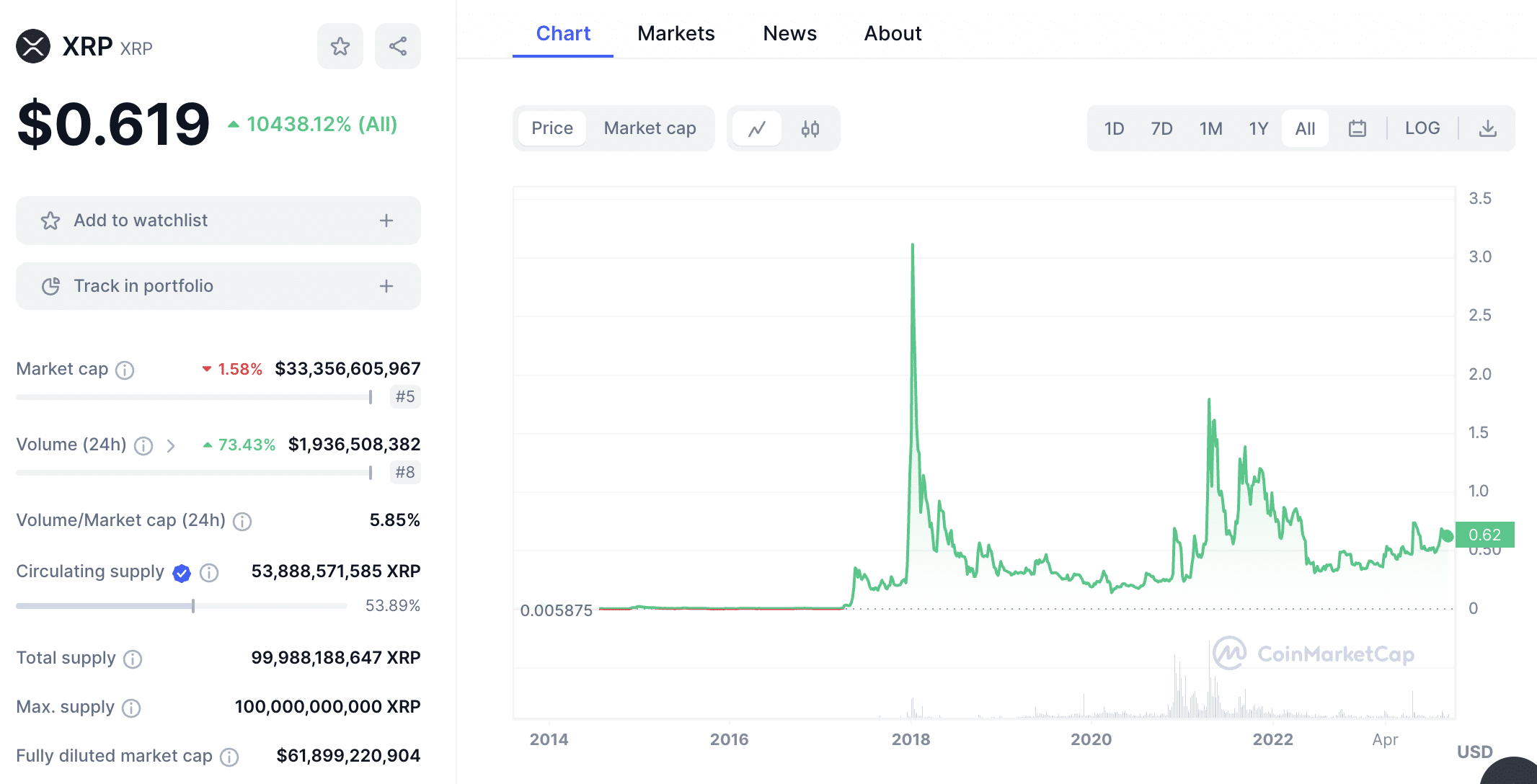

3. Ripple: Invest in the Future of Layer 1 Cross-Border Finance

Ripple is a layer 1 blockchain that was launched in 2012. It has an average transaction speed of under five seconds and fees cost just 0.00001 XRP (about $0.0000062). The Ripple network was created to revolutionize the trillion-dollar interbank market. In its current form, most cross-border payments go through SWIFT.

SWIFT transactions can be expensive and slow, especially when exotic currencies are being used. Ripple solves this through its layer 1 payments network. To streamline cross-currency transfers, Ripple uses XRP tokens as a bridge of liquidity. This makes corresponding banking networks redundant.

Ripple is already being used by many financial institutions. This includes PNC Bank, Bank of America, Standard Chartered, and Cuallix. As more banks adopt the technology, this will increase demand for XRP tokens. However, it’s important to note that XRP is only needed for liquidity purposes. Moreover, transacting parties only need to hold XRP tokens for several seconds.

Nevertheless, Ripple remains one of the best layer 1 crypto projects. In terms of valuation, XRP tokens have increased by over 10,400% since they were launched over 10 years ago. In the past year, XRP tokens returned 58%. Although just under 54% of XRP tokens are currently in circulation, the balance is locked in escrow with strategic releases.

4. Sei: Newly-Launched Layer 1 Network Supporting 20,000 Transactions per Second

While Sei is one of the best layer 1 crypto projects around, it was only launched in mid-2023. This makes it the newest layer 1 network on this list. What’s more, Sei also has the lowest market capitalization, currently valued at just over $600 million. This will appeal to investors who want exposure to an up-and-coming layer 1 blockchain with plenty of upside.

That being said, Sei has already produced significant returns after launching just a few months ago. According to CoinMarketCap data, Sei has increased by over 3,400% since its August 2023 listing. Considering the bull market hasn’t officially started, Sei could have a lot more upside left in the tank.

In terms of its underlying technology, Sei claims to be the fastest layer 1 blockchain in the market. It has an average transaction settlement time of 380 milliseconds. It also excels in the scalability department; Sei can handle up to 20,000 transactions per second. Sei already has some notable backers, including Coinbase, Frax, Jump, and Multicoin Capital.

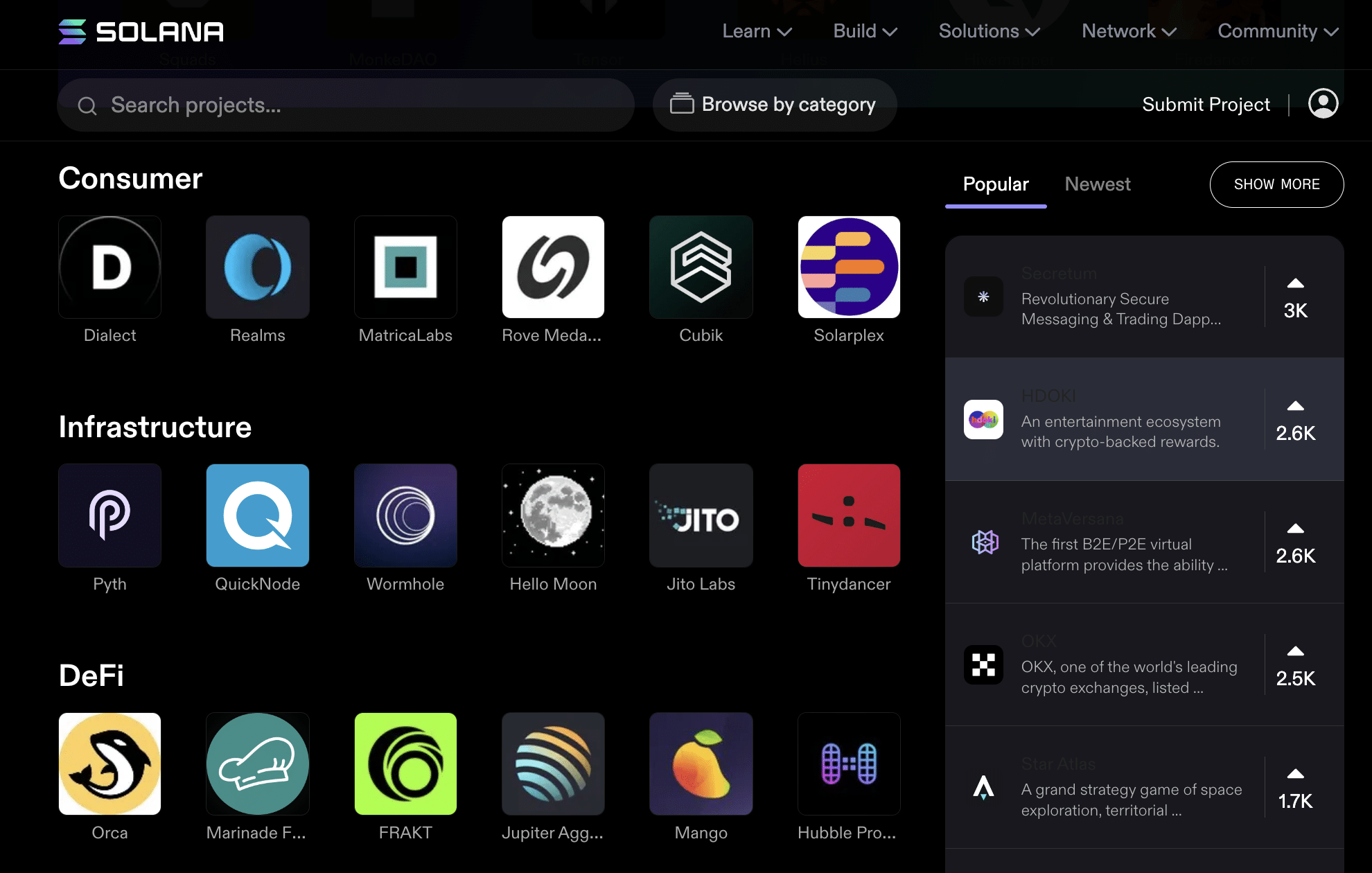

5. Solana: Powering the Future of dApps and Web 3.0 Projects With Low Fees and High Scalability

For many investors, Solana is one of the best layer 1 crypto projects. It’s often called an Ethereum Killer, considering it facilitates smart contracts and dApps much more efficiently. In particular, Solana can handle thousands of transactions every second, making it ideal for Web 3.0 projects.

For instance, consider a decentralized finance project. Every buy and sell order requires a new transaction on the blockchain. This isn’t an issue for Solana, while Ethereum is limited to under 30 transactions per second. Solana is also cost-effective, transactions average a tiny fraction of a cent. Speed is also impressive; Solana achieves transaction finality in milliseconds.

Although the Solana ecosystem is small when compared to Ethereum, an increasing number of dApps are being developed. This covers payment solutions, NFT marketplaces, decentralized finance, and other Web 3.0 niches. Solana has a lot of price momentum right now, SOL tokens have increased by almost 330% since last year.

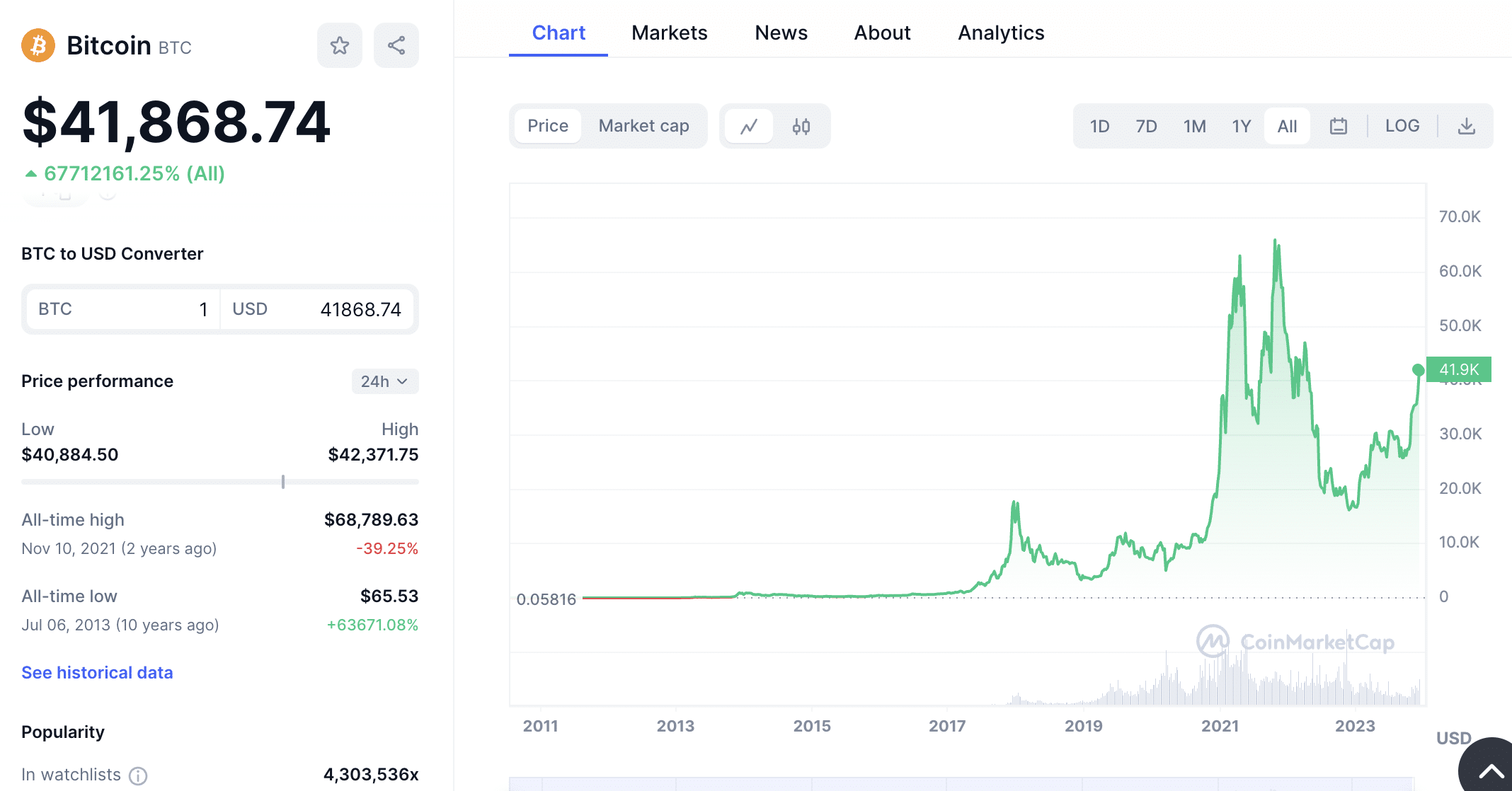

6. Bitcoin: The Original Layer 1 Blockchain With a Potential ETF Approval in 2024

Bitcoin is the original layer 1 blockchain and the best crypto to buy. Although Bitcoin was initially created as a medium of exchange, it now functions as a store of value. This is largely because of Bitcoin’s immutable and fixed supply. Every 10 minutes, 6.25 BTC tokens enter circulation. However, this will be reduced to 3.125 BTC when the next Bitcoin halving event takes place.

Expected in April 2024, Bitcoin halving events have historically resulted in prolonged price increases and new all-time highs. Another event expected in 2024 is an SEC approval for a Bitcoin ETF. BlackRock, among other large-scale applicants, has a solid chance of getting the green light. This will provide exposure to Bitcoin for institutional investors.

Bitcoin has been on a solid run since the turn of 2023. Year-to-date, Bitcoin has increased by over 150%. However, Bitcoin is currently trading at just over $40,000, almost 40% below its prior all-time high. According to some analysts, Bitcoin could hit $100,000 by the end of 2024. Ark Invest CEO Cathie Wood believes Bitcoin could hit $1.48 million by 2030.

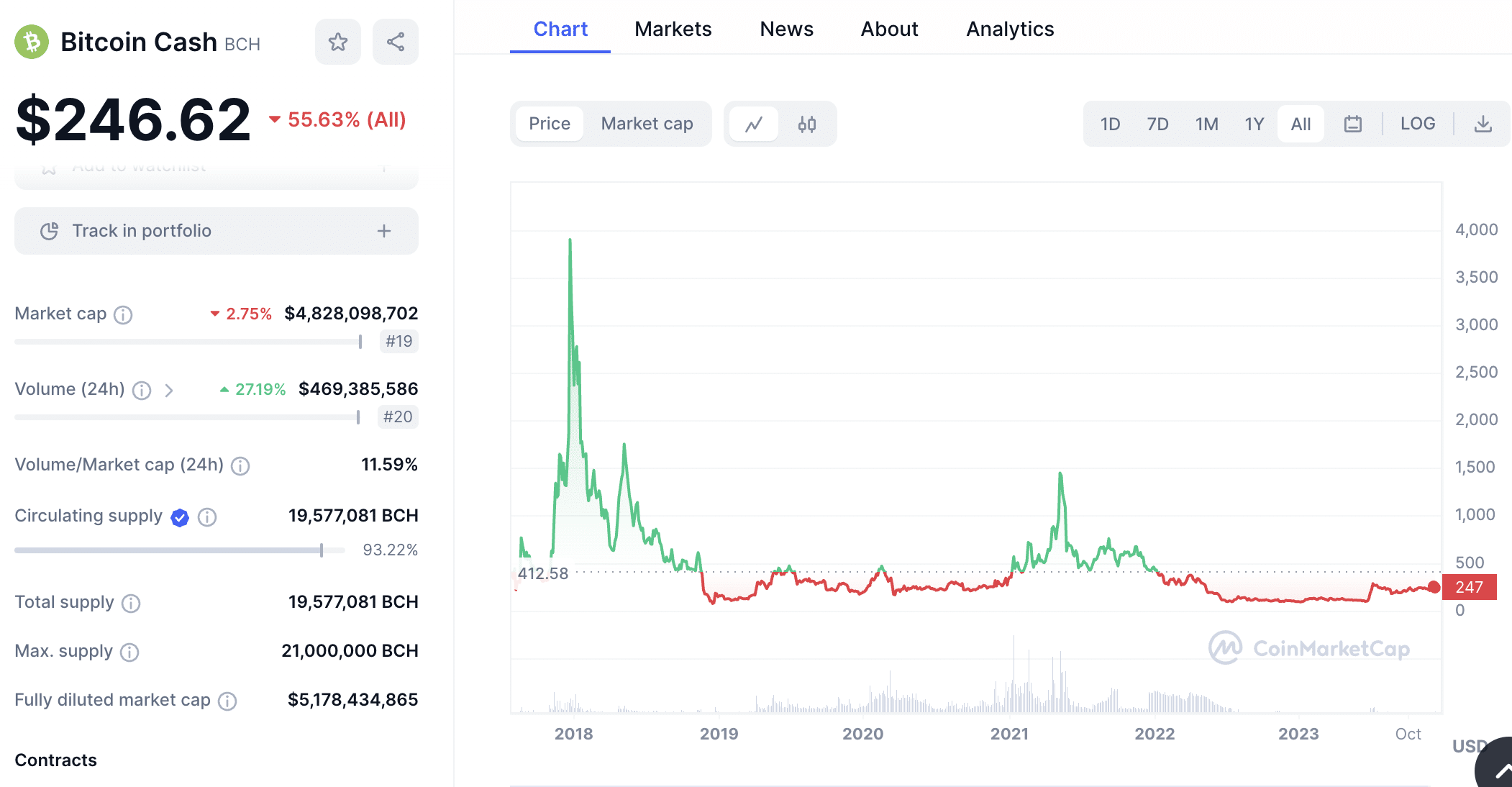

7. Bitcoin Cash: Medium-of-Exchange Aiming to Become the De Facto Payment Currency

Bitcoin Cash is a layer 1 crypto project that spun off from the original Bitcoin in 2017. While Bitcoin is now considered a store of value, Bitcoin Cash functions as a medium of exchange. This means that BCH tokens are used primarily as a payment currency.

When compared to Bitcoin, Bitcoin Cash is a more efficient blockchain network.

Not only in terms of speed but scalability and fees too. This is because Bitcoin Cash increased the block size limit, making it more suitable for day-to-day transactions. Bitcoin Cash has a market capitalization of over $4.8 billion. Over the prior year of trading, BCH tokens are up 120%.

However, Bitcoin Cash hasn’t recorded new all-time highs since late 2017. Right now, the tokens are trading at a 94% discount. Although the jury is out on Bitcoin Cash’s long-term potential, it’s still one of the most traded cryptocurrencies globally. For instance, in the past day, nearly $470 million worth of BCH tokens have been traded.

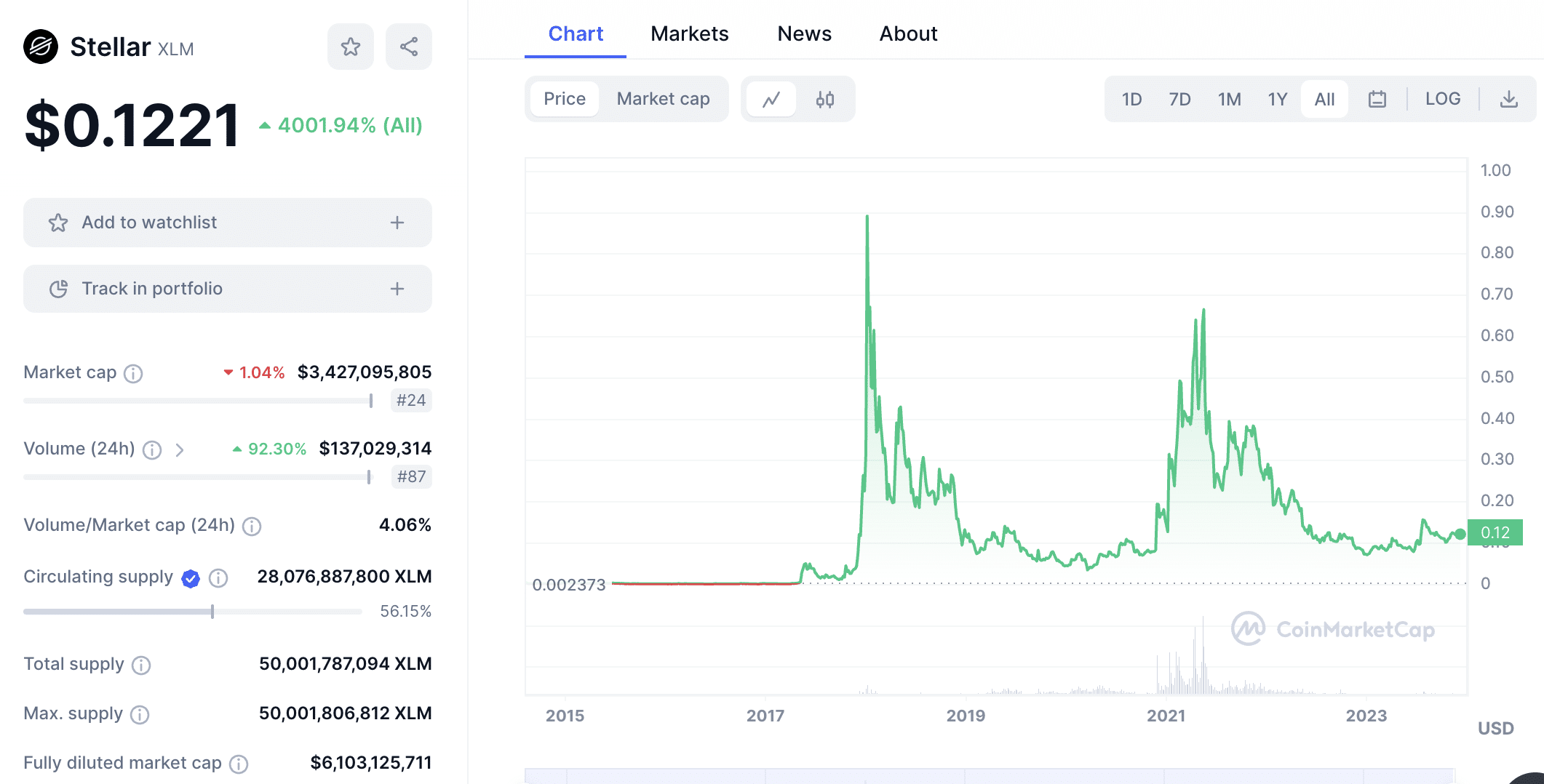

8. Stellar: Cheap Fiat Cross-Border Payments and Tokenization of Real-World Assets

Stellar is one of the most diverse layer 1 crypto networks. It has many use cases, including cheap and fast cross-border payments. Unlike other blockchains, this includes fiat money transfers. XLM, its native token, provides liquidity, meaning any currency can be used. According to Stellar, the average settlement time is currently just 5.8 seconds.

Another use case for Stellar is the tokenization of real-world assets. Anyone can create, issue, and store digital versions of currencies, stores on value, and much more. Stellar even enables users to implement KYC protocols, ensuring their tokenized assets remain compliant with global regulators.

Stellar has worked with many recognized companies, including MoneyGram, Circle, IBM, BitGo, Fireworks, and Franklin Templeton. However, while Stellar continues to broaden its ecosystem, XLM tokens still trade at a fraction of their former all-time highs. Investors will get an 87% discount when compared to XLM’s peak of $0.93.

9. Polkadot: True Blockchain Interoperability Supporting All Forms of Digital Data

Polkadot is one of the best layer 1 crypto projects for ‘blockchain interoperability’. In a nutshell, interoperability allows two completely different blockchains to share data. However, unlike other interoperability protocols, Polkadot doesn’t just support cross-chain token transfers. On the contrary, it can handle all forms of digital data.

For example, Polkadot facilitates everything from smart contracts and dApps to NFTs. It can also connect decentralized autonomous organizations (DAOs), even those operating on different consensus models and network standards. DOT is the ecosystem token that bridges everything together.

DOT tokens are ‘bonded’, meaning they create a bridge for cross-blockchain transfers. This creates a solid use case, as Polkadot cannot be used without sufficient DOT tokens. In terms of price performance, DOT tokens are up 18% in the prior month. However, they’ve declined by 1% on a 12-month basis. Nonetheless, DOT is one of the best utility tokens to buy.

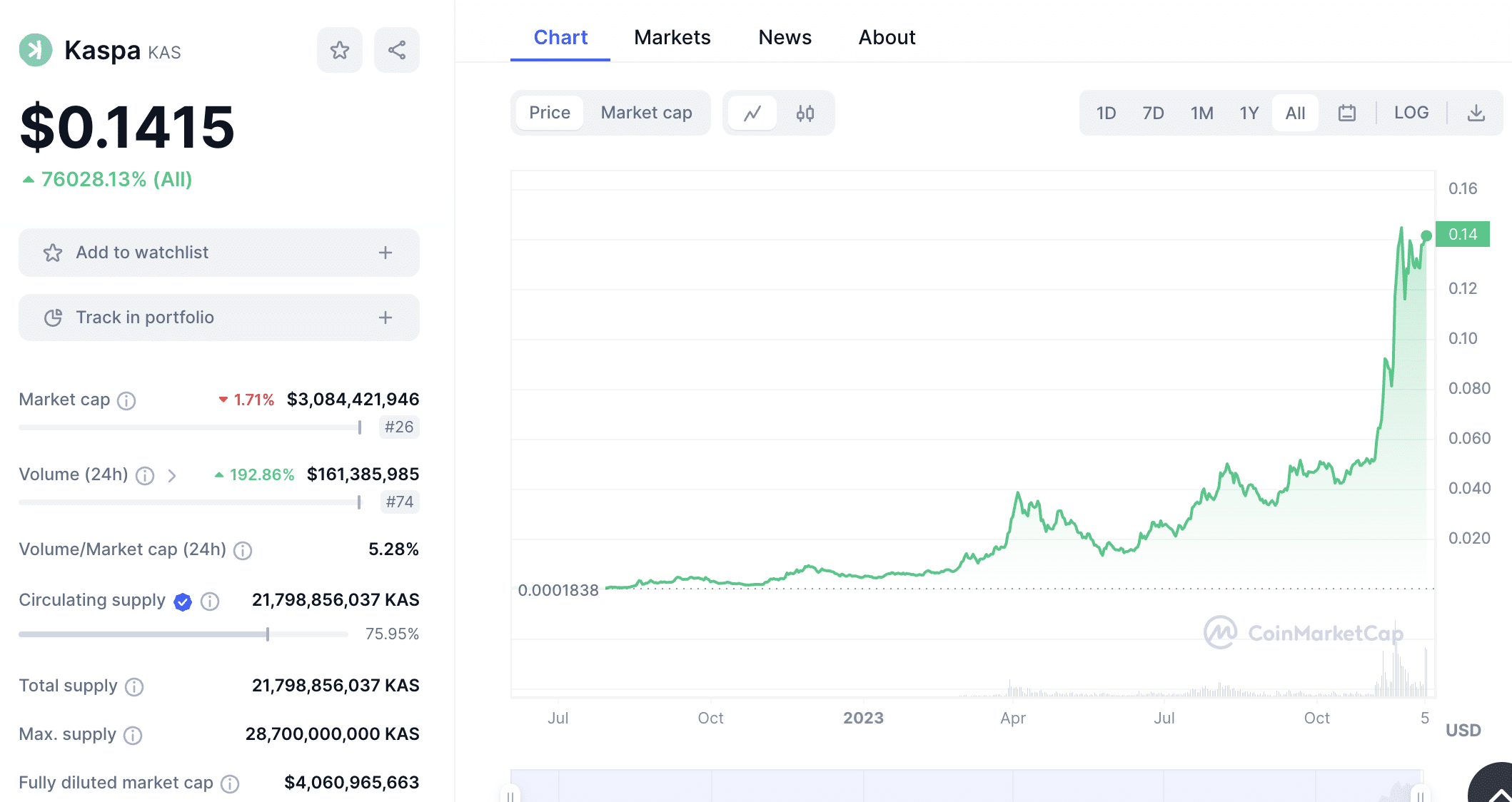

10. Kaspa: Innovative Layer 1 Network With Proof-of-Work Consensus in 1 Second

Kaspa is an innovative layer 1 blockchain that uses the proof-of-work consensus mechanism. Although proof-of-work is known for unparalleled security and transparency, transactions are typically slow. This is where Kaspa comes in. Through a ‘kHeavyHash’ hashing algorithm, Kaspa has reduced block confirmation times to just one second.

This means that Kaspa offers the perfect balance between security and speed. Kaspa is also one of the top trending cryptocurrencies right now, considering its past performance. According to CoinMarketCap data, Kaspa was launched in mid-2022 at $0.0001838.

Today, Kaspa trades over 7,600% higher at $0.14. What’s more, Kaspa is already trading on some of the best crypto exchanges, including MEXC. As such, while Kaspa is still a new layer 1 cryptocurrency, it has access to plenty of liquidity. Kaspa also has a relatively modest valuation when compared to similar projects; it has a market capitalization of just over $3 billion.

What is Blockchain Layer 1?

Layer 1 blockchains are the foundation of a decentralized network. The easiest way to understand layer 1 blockchains is to use Solana as an example. Solana is a layer 1 blockchain with a proprietary cryptocurrency, SOL. However, Solana also enables other cryptocurrencies to build on its network.

These are secondary cryptocurrencies, as they merely follow Solana’s underlying code. This is fundamental for several reasons. For a start, Solana-based cryptocurrencies must pay transaction fees in SOL, rather than their own native token. This is the case with similar layer 1 networks, be it Ethereum, BNB, or Cardano.

Therefore, as more projects build on Solana, demand for SOL also increases. In addition, layer 1 blockchains have their own governance models. This means they determine which consensus mechanism to use, such as proof-of-stake or proof-of-work. Put otherwise, the best layer 1 crypto projects have proprietary technology.

How do Layer 1 Networks Make Money?

- Most layer 1 networks make money from transaction fees. These are settled in their native cryptocurrency token.

- For example, Solana-based dApps pay fees in SOL. While dApps on the BNB Chain pay fees in BNB.

- Not only does this create demand for the respective layer 1 cryptocurrency but it can increase its value over time.

In contrast, projects built on a layer 1 blockchain have no say in governance, network proposals, transaction fees, or other network metrics. This is why layer 1 cryptocurrencies are so popular with investors. They’re generally viewed as long-term projects, as it often takes many years to develop a fully functional ecosystem.

This isn’t the case with secondary cryptocurrencies. For example, anyone can build an ERC-20 token on the Ethereum blockchain. Although there are plenty of solid projects like Uniswap and Chainlink, most ERC-20 tokens have no utility or value.

Blockchain Layer 1 vs Layer 2

Layer 1 and layer 2 blockchains can both play a vital role within a decentralized network. If you’re unaware of how the two terms differ, let’s start with a relatable example.

- Bitcoin is a layer 1 blockchain. It uses the proof-of-work consensus mechanism, which governs how transactions are verified and posted to the ledger. Put simply, transactions take around 10 minutes to reach finality.

- Now consider a layer 2 solution like the Bitcoin Lightning Network. Although it can’t make changes to the original Bitcoin network, it can streamline transactions.

- Going through the Lightning Network means that Bitcoin transactions are reduced to seconds, rather than 10-minute cycles.

Still confused? Now consider the Ethereum blockchain, which is a layer 1 network.

- Ethereum uses the proof-of-stake consensus mechanism and fees must be paid in ETH tokens.

- However, as Ethereum struggles with scalability, layer 2 solutions like Optimism, Polygon, and Arbitrum are widely used.

- This enables Ethereum-based projects to increase efficiency, reduce fees, and amplify transaction throughput.

Ultimately, layer 2 projects provide solutions for layer 1 blockchains. This can come in various forms, such as adding smart contract compatibility, increasing scalability, or simply reducing fees.

Why Invest in Layer 1 Blockchain Coins?

This section explains why layer 1 blockchain coins could be a great addition to your investment portfolio.

Invest in the Foundation of a Decentralized Network

A great analogy when exploring the layer 1 crypto projects is to consider ‘land’ and ‘buildings’. For example, a layer 1 network like Ethereum is the ‘land’. While ERC-20 tokens are the ‘buildings’ erected on Ethereum’s land. This means that Ethereum is the ultimate beneficiary.

It determines everything from network fees and consensus models to tokenized standards and circulating supplies. While ERC-20 tokens can build unique and innovative projects, they must adhere to Ethereum’s underlying code. From an investment perspective, Ethereum allows you to invest directly in its network, rather than opting for secondary projects.

Secondary Tokens Create Demand for Layer 1 Cryptocurrencies

We’ve established that most layer 1 blockchains allow other projects to build on their respective networks. This is hugely beneficial, as secondary projects create demand for the native network cryptocurrency. This is because transaction fees must be paid in the layer 1 token.

For example, consider a decentralized exchange like Uniswap, which is built on the Ethereum network. In the prior 24 hours, nearly $1 billion worth of trades have been conducted on Uniswap. Every time a trader swaps a cryptocurrency, they’ll need to pay fees in ETH.

Now consider that thousands of dApps operate on Ethereum. That’s a significant amount of ETH required for the Ethereum ecosystem to function.

Similarly, consider Polkadot, which allows competing blockchains to share data and communicate without centralized providers. To engage in cross-blockchain transfers, DOT tokens are required. In other words, it’s mandatory for developers to ‘bond’ DOT, should they wish to use the Polkadot framework.

Layer 1 Networks and Decentralized Governance

- The best layer 1 crypto projects have created a democratic ecosystem. For example, the Ethereum Improvement Proposals (EIP) provide a governance framework for ETH holders.

- This includes the ability to make suggestions, ask for improvements, and even vote on key network changes. This is similar to stockholders voting in an Annual General Meeting, where the only requirement is to own at least 1 share.

- Many other layer 1 cryptocurrencies have similar systems. This includes Polkadot, Solana, Avalanche, Cardano, Tezos, and Near Protocol.

Conclusion

In summary, the best layer 1 crypto projects offer a more favorable upside when compared to secondary tokens. Layer 1 ecosystems set their own rules, whether that’s consensus, transaction fees, or governance proposals.

What’s more, secondary tokens must pay fees in the respective layer 1 cryptocurrency. This creates long-term demand. Before investing in layer 1 projects, make sure you conduct your own research and consider the risks.

References

- https://www.cnbc.com/2023/07/17/ripple-hopes-judge-ruling-in-sec-case-will-lead-to-us-banks-using-xrp.html

- https://www.reuters.com/business/finance/sec-has-8-10-filings-possible-bitcoin-etf-products-gensler-2023-10-26/

- https://www.cnbc.com/2023/12/04/bitcoin-price-at-100000-in-2024-crypto-execs-say-bull-run-has-begun.html

- https://www.thestreet.com/crypto/markets/bitcoin-price-will-pass-1-million-by-2030-says-cathie-wood-ark-invest

- https://eips.ethereum.org/

FAQs

What are the top layer 1 cryptos?

The top layer 1 cryptocurrencies include Bitcoin, Ethereum, Polygon, Avalanche, BNB, and Solana.

Which is the fastest layer 1 blockchain?

Sei claims to be the fastest layer 1 blockchain, with average transaction times of just 380 milliseconds.

Is Dogecoin a layer 1?

Yes, Dogecoin is a layer 1 network – it has its own native blockchain and cryptocurrency token.