11 Best No KYC Crypto Exchanges for 2024

No KYC exchanges allow you to buy and sell cryptocurrencies anonymously. In many cases, you won’t be required to open an account – let alone upload verification documents.

In this guide, we rank and review the 11 best no KYC crypto exchanges for 2024. We compare legitimate exchanges for supported cryptocurrencies, trading fees, wallet storage, tools, safety, and much more.

Top Non-KYC Crypto Exchanges Shortlisted

We’ve analyzed the markets for the best no KYC crypto exchanges – here’s a list of the top 11 providers:

- Best Wallet: In our view, Best Wallet is the best no KYC crypto exchange in the market. This provider doubles up as a decentralized wallet – allowing you to trade and store cryptocurrencies under one anonymous roof. The Best Wallet exchange supports all tokens on the Ethereum and Binance Smart Chain. There’s no need to register – let alone provide personal information. Best Wallet doesn’t charge any commissions – fees are determined by the respective liquidity pool.

- MEXC – A leading no-KYC crypto exchange offering over 1,800 spot and many futures trading pairs with 0% maker and taker fees for spot trading. Users can withdraw up to 30 BTC daily, extendable to 80 BTC with basic KYC.

- Margex – Renowned for its no-KYC policy, Margex provides up to 100x leverage on futures and high security measures. It features beginner-friendly resources, copy trading, staking options, and easy deposit options via Visa and Mastercard.

- Phemex – A dynamic crypto platform offering over 150 trading pairs without mandatory KYC. Phemex allows trading using traditional currencies, provides benefits for KYC-compliant users, and features copy trading and up to 5x leverage in margin trading.

- CoinEx – Based in Hong Kong, CoinEx enables spot and futures trading without compulsory KYC, offering a 0.2% starting trading fee, reducible with CET tokens. It supports credit card purchases and has a $10,000 daily transaction limit for non-KYC users.

- ChangeNOW – A non-custodial, no-KYC exchange supporting over 450 cryptos, offering advanced security and user control. ChangeNOW provides fast, limit-free swaps, crypto lending, and staking options, with 24/7 customer support via live chat and social media.

- Uniswap: Uniswap is a popular crypto exchange that offers cross-chain trading. It supports multiple networks, including Ethereum, Binance Smart Chain, and Polygon. Uniswap is a decentralized exchange that uses automated market makers. You won’t need to open an account to trade – simply connect your wallet.

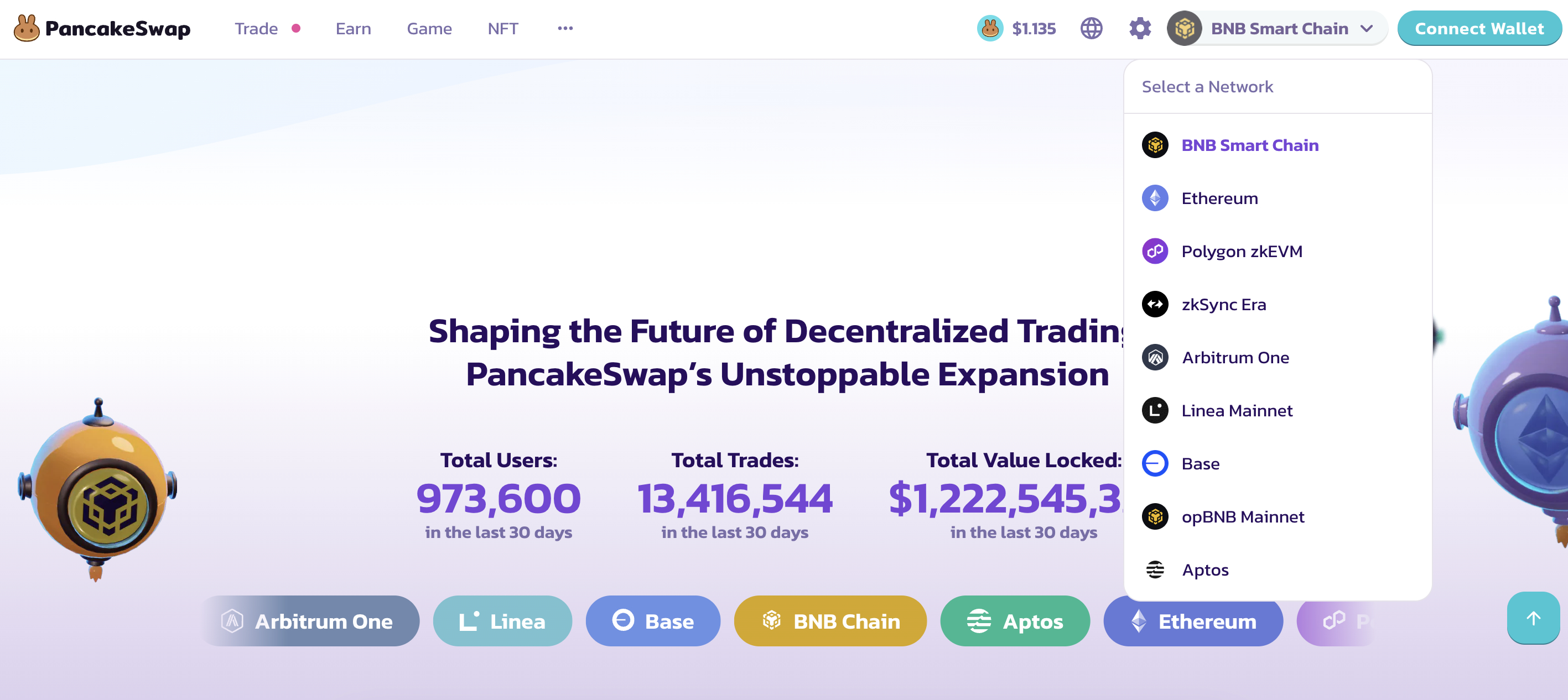

- PancakeSwap: PancakeSwap is the go-to exchange for trading BSC tokens. It supports thousands of markets and you’ll be able to trade anonymously. No accounts are required, as you’ll trade from your private wallet. PancakeSwap also supports yield farming and liquidity staking, allowing you to earn passive income anonymously.

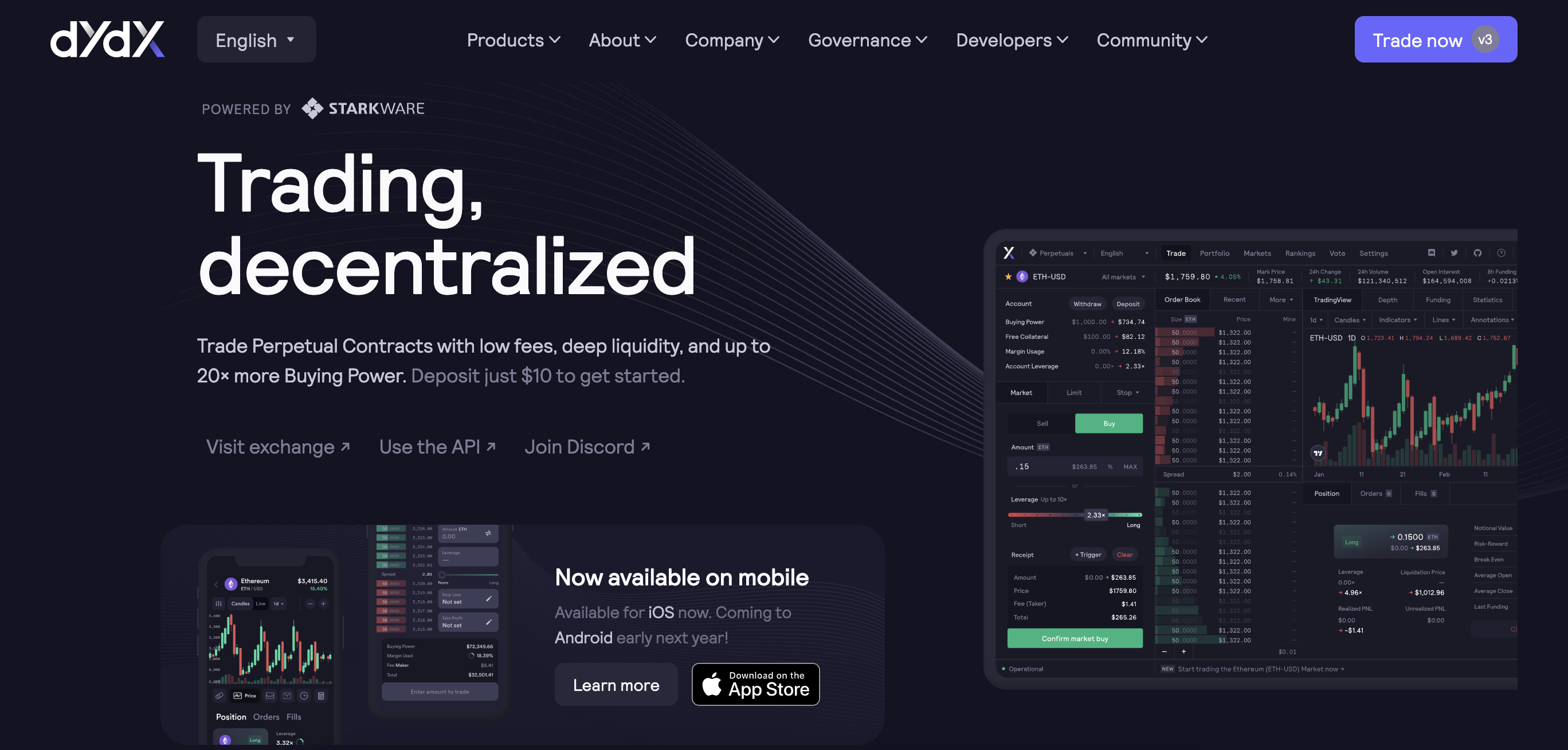

- dYdX: dYdX is one of the largest KYC-free exchanges for trading volume. It specializes in leveraged derivatives and supports plenty of cryptocurrencies. Markets are backed by perpetual futures, allowing you to go long or short. dYdX is best suited for experienced traders who seek advanced features – such as technical indicators and drawing tools.

- SushiSwap: SushiSwap is a decentralized crypto exchange with no KYC requirements. After connecting your wallet to SushiSwap, you can trade thousands of tokens. Although SushiSwap specializes in ERC20 tokens, it also has a cross-chain protocol. This gives you access to more than a dozen other networks, including Kava, Polygon, and Base.

- Raydium: Raydium is one of the few KYC-free exchanges built on the Solana network. It allows traders to swap SOL-based tokens anonymously and with very low trading fees. Raydium – which is a web-based platform, also supports yield farming and crypto staking with competitive APYs.

Best No KYC Exchanges – Full Reviews

Let’s move on to our full reviews of the 11 best no KYC crypto exchanges for 2024. We take a much closer look at key metrics, such as fees, supported networks, security, and user-friendliness.

1. Best Wallet – Overall Best No KYC Crypto Exchange for 2024

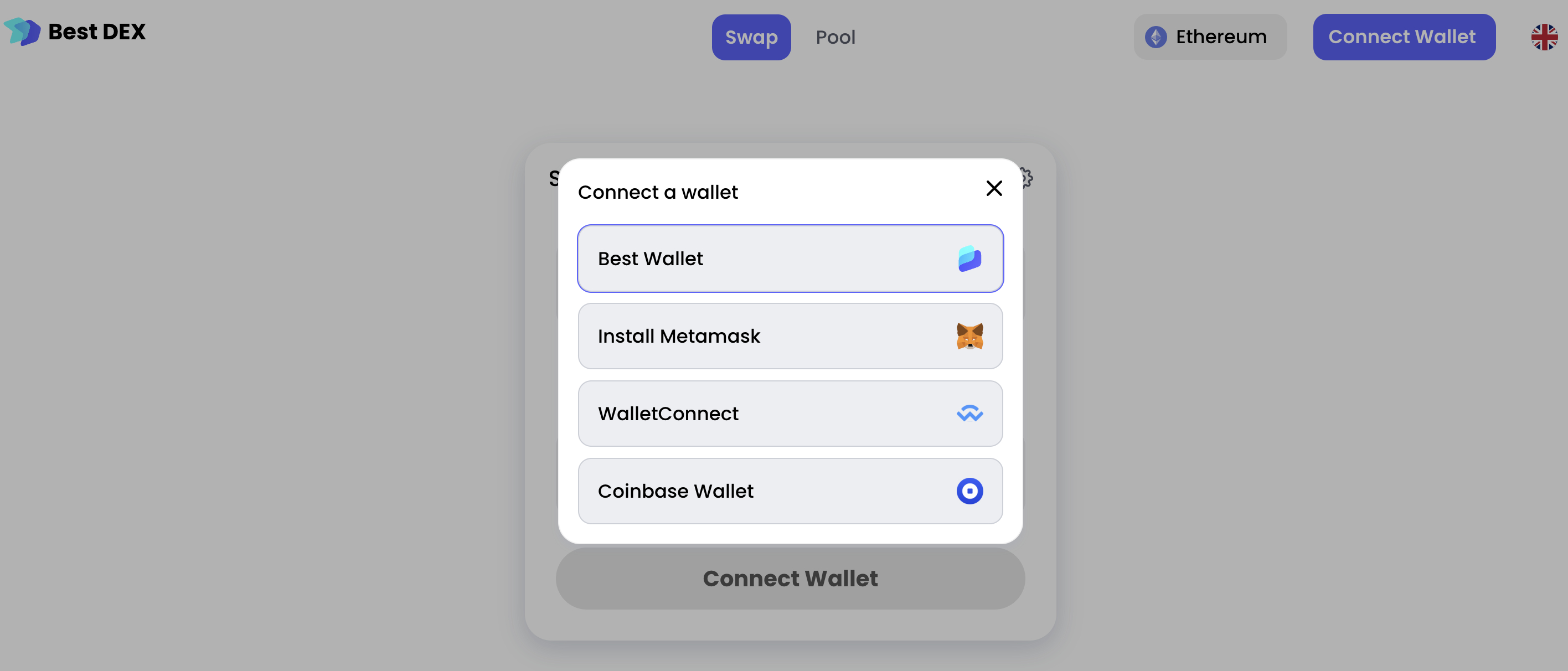

Best Wallet is our top pick from all the exchanges we reviewed. In a nutshell, Best Wallet offers a decentralized crypto wallet that doubles up as an exchange. This means that you can buy, sell, and store tokens under one roof. Crucially, Best Wallet does not require users to register an account.

Instead, you’ll be using Best Wallet in complete privacy. Its decentralized exchange – which is called Best DEX, supports two blockchain networks – Ethereum and Binance Smart Chain. This means that you’ll have access to thousands of ERC20 and BSC tokens. What’s more, Best Wallet is supported by multiple devices.

It comes as a mobile app for iOS and Android, and can also be accessed via standard web browsers. The trading process is very straightforward – you’ll first need to deposit some cryptocurrency tokens to Best Wallet. Alternatively, you can connect your own wallet to Best DEX – options include MetaMask, Coinbase Wallet, and WalletConnect.

Then it’s just a case of choosing which crypto tokens to swap. For instance, BNB for BUSD or ETH for DAI. Either way, Best DEX gets you the most competitive exchange rates in the market. This is because Best DEX uses exchange aggregation tools. In simple terms, this means that it will complete your trade with the best-priced liquidity pool.

We also like that Best DEX doesn’t charge commissions. Although you’ll still pay a trading fee, this is determined by the liquidity pool completing the swap. Many other features will soon be launched on Best DEX. This includes fully-fledged market analytics – allowing you to assess the best cryptocurrencies to buy – and which ones to avoid.

What’s more, TradingView will be integrated into the exchange. This opens the doors to experienced traders who want to deploy advanced charts and technical indicators. Additionally, Best DEX will provide token sentiment scores, highlighting whether the broader markets are bullish or bearish on each project.

We also found that Best Wallet will be launching its own cryptocurrency token – BEST. This will fuel the Best Wallet and Best DEX ecosystem, offering holders plenty of benefits. This includes access to premium features, participation in NFT drops, and the ability to vote on key proposals. Those using Best Wallet will be the first to receive BEST tokens via a proposed airdrop.

| Supported Coins | All tokens on the Ethereum and Binance Smart Chain networks |

| Trading | Does not charge commissions – fees are determined by the respective liquidity pool |

| Devices | iOS/Android app and web browsers |

| Top Features | Decentralized exchange and wallet combined, Does not charge trading commissions, Secures the best exchange rates via liquidity pools |

Pros

- Overall best no KYC crypto exchange for 2024

- No account registration, personal information, or documents required

- Supports thousands of ERC20 and BSC tokens

- No trading commissions – simply cover the liquidity pool’s respective fee

- Sources the best exchange rates via an in-built aggregation tool

- Also offers one of the best decentralized crypto wallets

Cons

- Many features are still in development

- While Best Wallet supports Bitcoin – Best DEX doesn’t

2. MEXC – Popular No-KYC Exchange with 1800+ Cryptos And Low Fees

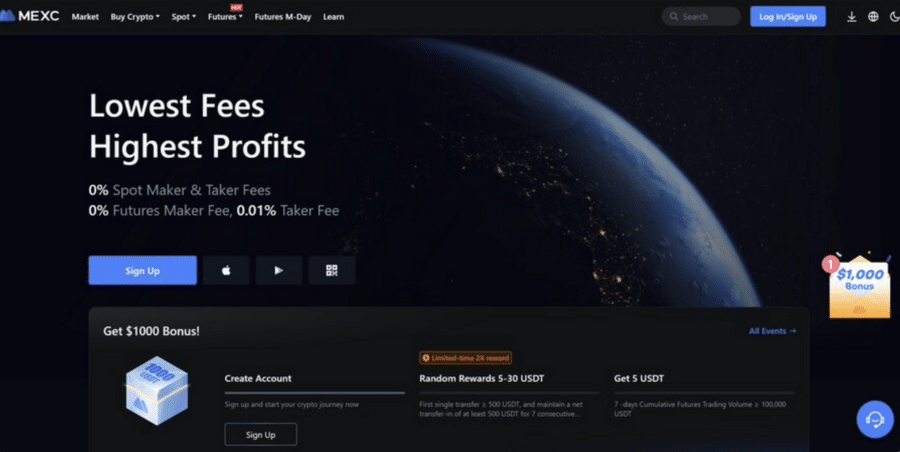

MEXC is a popular no-KYC crypto exchange that allows spot and futures crypto trading without requiring users to disclose their identities. Unique to MEXC is the 0% maker and taker fee for spot trading, a competitive edge not found in other KYC-free exchanges.

For futures trading, MEXC charges a minimal taker fee of 0.01% and no maker fee, which is lower than most crypto exchanges. Users can register using a crypto wallet like MetaMask, bypassing email registration.

After registration, they can deposit, trade, and withdraw cryptos, with a withdrawal limit of 30 BTC per 24 hours. This limit can increase to 80 BTC upon completing basic KYC.

Moreover, the platform offers more than 1,800 spot trading pairs and hundreds of futures trading options. It’s worth noting that buying cryptos with traditional currency on MEXC requires KYC verification.

This is done through third parties like MoonPay, Simpex, Banxa, or Mercuryo, allowing various payment methods, including Visa, Mastercard, Apple Pay, Google Pay, and Sepa transfers. Furthermore, MEXC caters to experienced and beginner traders, offering advanced charting tools, an order book view, and innovative features like copy trading and a savings option with variable APRs.

| Supported Coins | 1700+ |

| Trading | 0% fees for spot trading; Futures taker fee: 0.03% |

| Devices | Web browser, Mobile app (iOS, Android) |

| Top Features | High withdrawal limit (up to 30 BTC daily, extendable to 80 BTC with basic KYC), features like copy trading, savings option, and advanced charting tools. |

Pros

- No KYC for privacy-focused trading

- 0% fees for spot trading

- High withdrawal limit, up to 30 BTC daily

- Over 1,800 spot trading pairs are available

Cons

- KYC is required for traditional currency purchases

3. Margex – High-Leverage No-KYC Platform With A Copy Trading Feature

Margex is a well-known crypto trading platform that does not require KYC verification. Its strong security and beginner-friendly features appeal to many traders.

The platform offers up to 100x leverage on futures, which can significantly boost trading profits. However, traders should note the increased risk associated with higher leverage. The platform is designed to be accessible for traders of all skill levels and provides many educational materials on market analysis.

It’s worth noting that the platform prioritizes security through the MP Shield System, designed to prevent price manipulation by assuring fair prices and liquidity from diverse suppliers.

Margex provides demo accounts for newbies, allowing them to acquaint themselves with the platform without any monetary risk. It also features copy trading and staking options. These offer attractive yields on cryptos like ETH, enabling users to generate passive income.

Margex provides demo accounts for newbies, allowing them to acquaint themselves with the platform without any monetary risk. It also features copy trading and staking options. These offer attractive yields on cryptos like ETH, enabling users to generate passive income.

An added advantage of Margex is its comprehensive alert system, which includes notifications for price changes, market cap, volume, and more. This helps traders make informed decisions. Furthermore, the platform supports Visa and Mastercard for deposits, providing easy access to its trading services.

| Supported Coins | 30+ |

| Trading | Taker Fee: 0.06%; Maker Fee: 0.019% |

| Devices | Web browser (No mobile app)` |

| Top Features | Up to 100x leverage on futures, user-friendly with educational resources, offers staking options with attractive yields. |

Pros

- Up to 100x leverage on futures

- User-friendly with educational resources

- Offers copy trading and staking options

Cons

- High leverage can also increase trading risks

4. Phemex – Popular Exchange Offering 150+ Trading Pairs With No KYC And Low Fees

Phemex is a promising crypto investing and trading platform that allows users to buy cryptos with traditional currencies or exchange them for other digital currencies. Offering over 150 crypto pairs, Phemex does not require a KYC process for trading and swapping.

To start trading, users must connect their MetaMask wallet to Phemex and transfer their cryptos from the wallet to the platform. Additionally, Phemex allows the purchase of cryptos using debit or credit cards or by depositing fiat currencies. For these transactions, users must authenticate themselves with MoonPay or Mercuryo.

While KYC verification is not mandatory on Phemex, opting for it grants access to additional benefits like premium membership and bonuses. Incentives include waived trading fees for transactions up to $1 million daily and rewards like social media engagement coupons, quizzes, deposits, or copy trading.

While KYC verification is not mandatory on Phemex, opting for it grants access to additional benefits like premium membership and bonuses. Incentives include waived trading fees for transactions up to $1 million daily and rewards like social media engagement coupons, quizzes, deposits, or copy trading.

Phemex also features copy trading and trading bots, allowing users to create their own bots or replicate the trades of others. Experienced traders can use margin trading with up to 5x leverage, allowing them to trade with funds significantly higher than their actual account balance. However, it’s crucial to understand that such high-leverage trading also increases risk levels.

| Supported Coins | 150+ |

| Trading | Spot Maker Fee: 0.1%; Futures Maker Fee: 0.01%, Futures Taker Fee: 0.06% |

| Devices | Web browser, Mobile App (iOS, Android) |

| Top Features | Up to 100x leverage on contract trades, sub-accounts for separate trading activities, earn program offering high APY. |

Pros

- Over 150 crypto pairs, no KYC for trading

- Benefits for users completing KYC

- Features copy trading and trading bots

- Margin trading with up to 5x leverage

Cons

- Some VIP features and bonuses are only for KYC users

5. CoinEx – Promising KYC-Free Exchange With Low Trading Fees

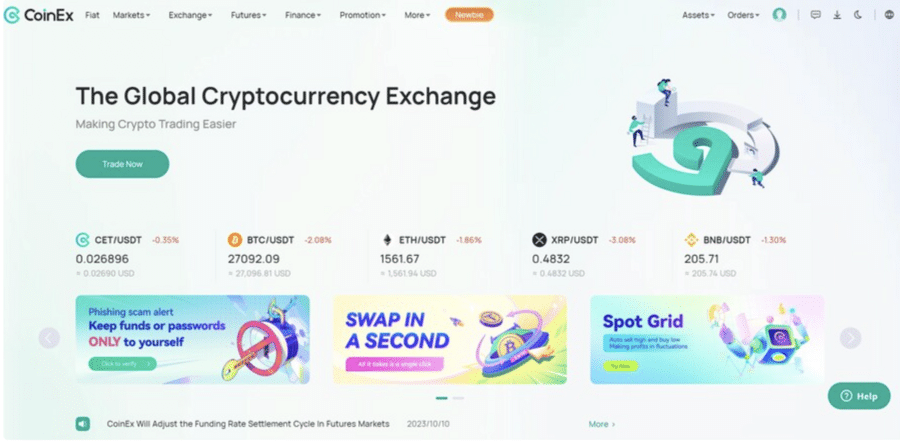

CoinEx is an exchange based in Hong Kong that offers trading services for spot and futures cryptos. A key feature of CoinEx is that it does not require a KYC process for general trading. The platform enables users to trade in the margin, become market makers in yield farming, and stake idle coins.

The exchange operates on a maker/taker fee structure. Trading costs are 0.2% to start with, whether you’re buying instantly (taker) or setting a limit order (maker). These fees can be reduced by holding CET tokens, CoinEx’s native crypto.

However, there are limitations for users who do not complete the KYC process. Without KYC verification, your crypto transactions are capped at a value of $10,000 within 24 hours.

Completing the KYC process increases this transaction limit.CoinEx also allows the purchase and sale of cryptocurrencies using a credit card. This process involves third-party services like MoonPay, AdvCash, and Mercuryo, which require KYC verification. Overall, CoinEx combines accessibility for unverified users with additional services for those who complete KYC, offering a balanced approach to crypto trading.

| Supported Coins | 700+ |

| Trading | Maker Fee: Variable; Taker Fee: Variable |

| Devices | Web browser, Mobile App (iOS, Android) |

| Top Features | Offers margin trading with leverage up to 10x, has features like crypto swap and a comprehensive trading suite. |

Pros

- No mandatory KYC for trading

- 0.2% starting trading fee, reducible with CET tokens.

- $10,000 withdrawal limit without KYC

- Allows margin trading and staking

Cons

- Buying crypto with fiat requires KYC

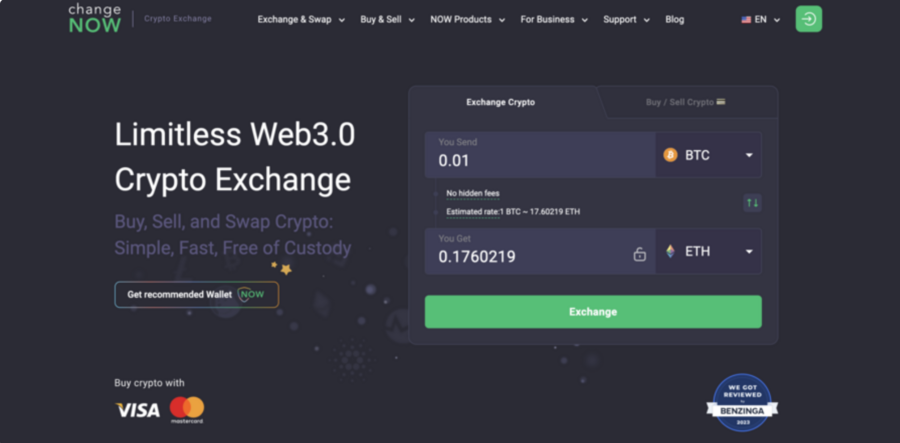

6. ChangeNOW – Popular Non-Custodial Exchange With No KYC Requirements

Launched in 2017, ChangeNOW is a non-custodial crypto exchange platform that doesn’t require a KYC. This means it doesn’t hold user funds but enables direct token swaps to hardware wallets. This significantly improves security and user control over assets.

Operating mainly as a no-KYC platform, ChangeNOW doesn’t usually require user identification. However, identification is necessary in two situations: when a risk management system detects suspicious activity and for significant transaction amounts.

The platform supports trading over 450 cryptos, including popular ones like Bitcoin and Ethereum. It also offers services like crypto lending, flexible loan terms, and the option to borrow stablecoins against crypto assets. Users can stake NOW tokens, the platform’s native token, for passive returns.

Transactions are typically processed within 5 minutes. ChangeNOW has no exchange limits and offers both fixed-rate and floating-rate swaps. It uses advanced procedures to protect user payments and information. Its non-custodial character means users control their private keys, lowering the risk of losing assets from cyber-attacks.

Additionally, ChangeNOW ensures user support through responsive and accessible help channels, including live chat and social media, providing round-the-clock assistance.

| Supported Coins | 450+ |

| Trading | Variable, depending on the exchange pair |

| Devices | Web browser, Mobile App (iOS, Android) |

| Top Features | Non-custodial and anonymous swap and offers limitless swaps with a fast and simple process. |

Pros

- Non-custodial, no KYC needed

- Supports over 450 cryptos

- Fast, limit-free swaps

- Offers crypto lending and staking

Cons

- KYC is required for large transactions

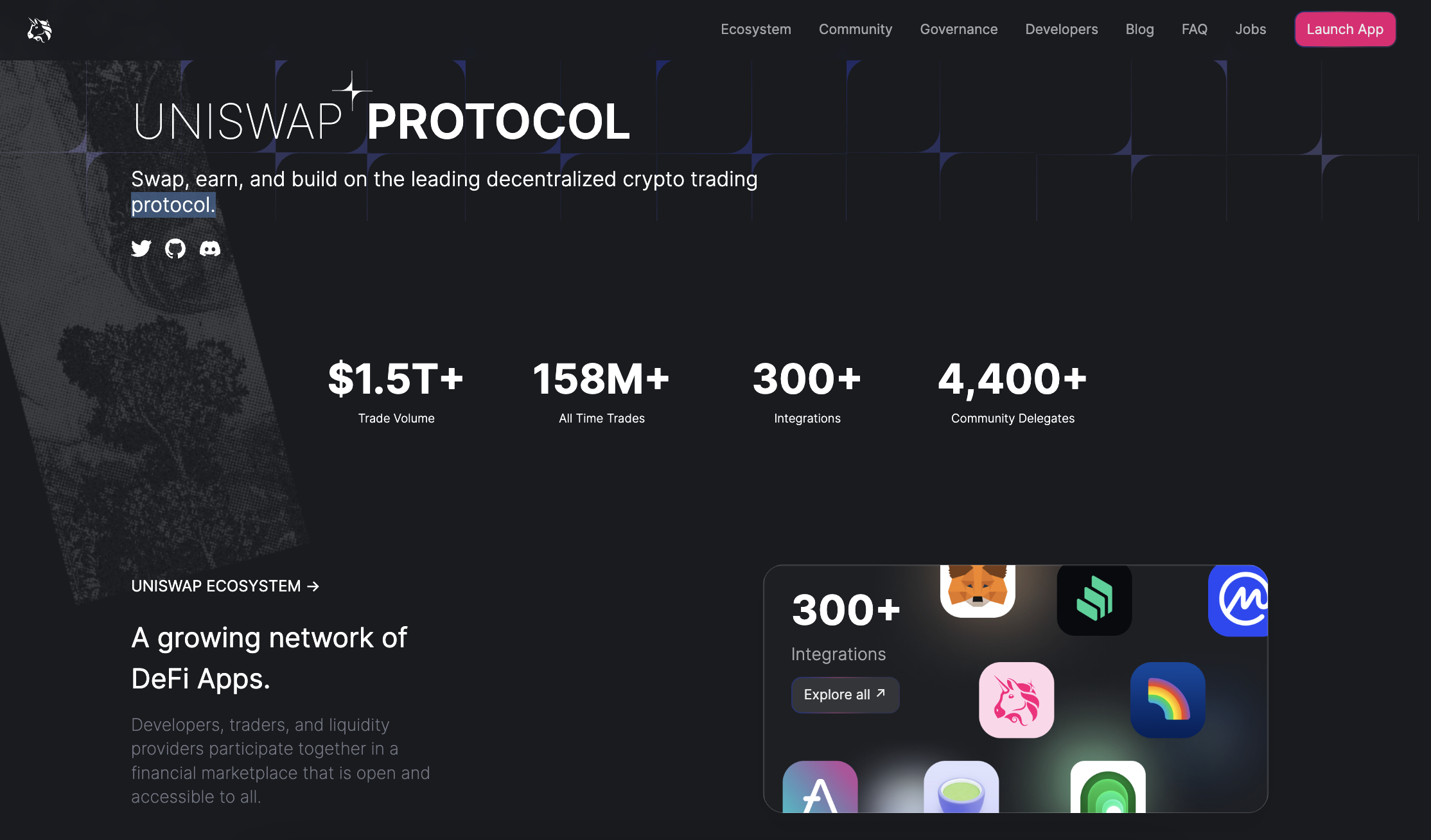

7. Uniswap – Cross-Chain Crypto Trading Without Account Registration or KYC

Uniswap is also one of the best crypto exchanges without KYC to consider today. As a decentralized platform, Uniswap does not have any account registration requirements. Users simply need to connect their crypto wallet to Uniswap and can begin trading right away. This means that you can buy and sell cryptocurrencies in complete privacy.

Uniswap supports multiple blockchain networks, meaning you can engage in cross-chain trading. This includes Ethereum, Celo, Avalanche, Binance Smart Chain, Base, Polygon, Optimism, and Arbitrum. This means you could swap MATIC (Polygon) with BUSD (Binance Smart Chain) without needing to complete multiple exchanges.

What’s more, Uniswap uses automated market maker (AMM) technology when facilitating trades. In simple terms, this means that you can trade cryptocurrencies without needing another market participant. This is because Uniswap trades go through liquidity pools. This enables you to buy or sell thousands of cryptocurrencies instantly and seamlessly.

That said, if there isn’t enough liquidity on your chosen pair, you might experience slippage. This means you could get an unfavorable price when completing your trade. In terms of fees, Uniswap charges 0.3% per trade. This amounts to just $3 for every $1,000 traded. In addition to crypto trading, Uniswap also supports passive income tools.

Here’s how it works; we mentioned that Uniswap utilizes liquidity pools to process trades. Liquidity pools are funded by users who want to generate income on their idle tokens. For example, suppose you have some BUSD and BNB. You could deposit these tokens into a liquidity pool and every time somebody performs a swap, you’ll earn a percentage of the trading fee.

| Supported Coins | All tokens on the following networks: Ethereum, Celo, Avalanche, Binance Smart Chain, Base, Polygon, Optimism, and Arbitrum |

| Trading | 0.3% per trade |

| Devices | Web and mobile browsers |

| Top Features | Supports cross-chain trading, Low trading fee of 0.3%, Earn passive income by funding liquidity pools |

Pros

- Trade cryptocurrencies across multiple blockchain networks

- No account registration or KYC processes

- One of the largest decentralized exchanges for trading volume

- Buy and sell cryptocurrencies at just 0.3% per trade

Cons

- Doesn’t support the Bitcoin network

- Many trading pairs have insufficient liquidity

8. PancakeSwap – KYC-Free Exchange Specializing in Binance Smart Chain Tokens

If you’re looking to trade tokens on the Binance Smart Chain, PancakeSwap is the best no KYC crypto exchange. The platform lists thousands of BSC tokens and is often the go-to place for newly launched projects. That said, PancakeSwap also supports cross-chain functionality. Some of its supported networks include Ethereum, Polygon, Base, and Arbitrum.

You can swap any supported tokens on these networks at the click of a button. Like Uniswap, PancakeSwap does not require you to open an account or provide personal data. After connecting your wallet to the PancakeSwap website, you can begin trading. After completing a trade, the respective tokens will be deposited into your wallet.

Although PancakeSwap is a growing no KYC crypto exchange, nearly 1 million traders used the platform in the prior 30 days. This translated to over 13.4 million individual trades. When it comes to fees, swap commissions vary depending on the liquidity pool. The four pricing tiers are 0.01%, 0.05%, 0.25%, and 1%.

Fees are shown when setting up an order, so be sure to make a note of them before proceeding. PancakeSwap offers several other features that might be of interest – especially if you’re looking to generate passive income. For example, you can deposit crypto tokens into a liquidity pool and earn a share of collected trading fees.

Additionally, PancakeSwap also supports liquid staking. However, only two pairs are currently supported and the maximum APY is just over 3%. Although PancakeSwap offers a user-friendly experience, it does lack in the analytics department. It offers very little data on supported pairs, making it challenging to make informed trading decisions.

| Supported Coins | All tokens on the following networks: Binance Smart Chain, Ethereum, Polygon, zkSync, Arbitrum, Linea, Base, Aptos |

| Trading | Varies depending on the liquidity pool; 0.01%, 0.05%, 0.25%, or 1%. |

| Devices | Web and mobile browsers |

| Top Features | Supports yield farming and liquid staking, Trade tokens across multiple blockchain networks, User-friendly experience on web and mobile browsers |

Pros

- User-friendly no KYC crypto exchange that supports anonymous trading

- One of the best platforms to trade BSC tokens

- Cross-chain functionality is supported

- Also one of the best crypto staking platforms

Cons

- Trading fees can be as high as 1%

- Fiat payments are supported but require a KYC procedure

9. dYdX – Leveraged Crypto Token Exchange With High Trading Volumes and Low Fees

dYdX is a no KYC crypto exchange that specializes in leveraged markets. This means that you can trade popular cryptocurrencies with more money than you have in your dYdX account. Bitcoin, for example, can be traded with leverage of 20x. This amplifies a $100 stake to $2,000 in trading capital. Some of the best altcoins can also be traded with leverage.

This includes Ethereum, Chainlink, Cardano, Bitcoin Cash, Dogecoin, Solana, and many others. At dYdX, you’ll be trading crypto tokens via perpetual derivatives. These operate like futures but without an expiry date. Moreover, perpetual derivatives support long and short positions, so you can attempt to profit from declining market prices.

dYdX has a competitive trading fee structure that varies depending on your volume. For example, if you’re trading less than $1 million per month, you’ll pay 0.05% per slide. This declines incrementally as your monthly volume increases. There are also discounts available when you provide liquidity to the exchange.

Another feature of dYdX is that it comes packed with trading tools. This includes advanced pricing charts, drawing tools, and a full suite of technical indicators. However, these tools won’t be suitable for complete novices. Nonetheless, dYdX is an anonymous crypto trading platform that doesn’t require users to register an account.

You can trade instantly once you’ve connected a wallet to the exchange. Supported wallets include MetaMask, Trust Wallet, Coinbase Wallet, and Rainbow. We also found that dYdX is the largest crypto exchange for trading volume. Over the prior 24 hours, more than $387 million has been traded. Do note that dYdX only supports crypto payments – meaning no fiat deposits.

| Supported Coins | Bitcoin, Ethereum, Cardano, Bitcoin Cash, Dogecoin, Polkadot, Litecoin, Chainlink, Uniswap, Solana, Monero, Polygon, EOS, AAVE, and many other cryptocurrencies. |

| Trading | Commissions start from 0.05% per slide. Discounts are available for larger trading volumes and market makers. |

| Devices | Web and mobile browsers. Also offers a mobile app for iOS. |

| Top Features | Trade cryptocurrencies with leverage of up to 20x, No account registration required, High-level trading tools including technical indicators |

Pros

- Best no KYC crypto exchange for trading leveraged tokens

- Apply leverage of up to 20x

- Go long or short on your preferred markets

- Trading fees start from just 0.05% per slide

Cons

- Not suitable for beginners who simply want to invest in crypto

- No support for fiat money payments

10. SushiSwap – KYC-Free Exchange Supporting Thousands of Tokens and Competitive APYs

SushiSwap is another option to consider when searching for a cryptocurrency exchange without KYC. Launched in 2020, SushiSwap operates on the Ethereum network. You can trade thousands of ERC20 tokens without needing to register an account or provide any verification documents. There’s no need to make a deposit either – as swaps are processed via your crypto wallet.

SushiSwap has since launched a cross-chain feature that supports more than a dozen networks. This means you can swap tokens on different networks without leaving the SushiSwap platform. Supported networks include Arbitrum, Fantom, Linea, Polygon, Base, Binance Smart Chain, Harmony, and many others.

We also found that SushiSwap is suitable for beginners. You simply need to choose which tokens to swap and the quantity. SushiSwap will display the trading fee and estimated exchange rate before confirming the order. Once confirmed, the tokens will be transferred to your connected wallet within seconds.

What’s more, SushiSwap is a safe no KYC crypto exchange. It never holds client-owned cryptocurrencies, as trades are facilitated by liquidity pools and smart contracts. Therefore, your crypto tokens never leave the blockchain network. Another benefit of SushiSwap is that it offers competitive APYs on liquidity farming pools.

For example, you’ll currently get an APY of 11.75% on ILV/ETH. APYs of 12.85% are available when funding a MAGIC/ETH. However, we did find that SushiSwap often struggles with liquidity and trading volume. For instance, in the prior 24 hours, just $2.5 million has been traded. Moreover, SushiSwap doesn’t support Bitcoin, which will be a major drawback for some.

| Supported Coins | All tokens on the following networks: Ethereum, Arbitrum, Fantom, Linea, Polygon, Base, Binance Smart Chain, Harmony, ThunderCore, Gnosis, Avalanche, BitTorrent, Celo, Fuse, Moonbeam, OKX Chain, and Telos |

| Trading | 0.3% per trade |

| Devices | Web and mobile browsers |

| Top Features | Easily swap crypto tokens without opening an account, Supports more than a dozen networks for cross-chain trading, Competitive APYs when funding liquidity pools |

Pros

- Trade crypto from over a dozen blockchain networks

- No account or personal information required

- Trades are facilitated by liquidity pools and smart contracts

- Earn competitive APYs when adding liquidity to the exchange

Cons

- Much lower trading volumes when compared to other exchanges

- Limited trading tools or analytics

11. Raydium – Solana-Based Crypto Exchange With Low Fees and No Account Requirements

Raydium is one of the best crypto exchanges without KYC for trading SOL-based tokens. Built on the Solana blockchain, Raydium offers competitive trading fees and lightning-fast transaction speeds. Each swap attracts a commission of just 0.25%. 0.22% goes back to the respective liquidity pool while the balance is used to repurchase Raydium’s native token, RAY.

In terms of supported markets, the majority of Solana ecosystem tokens can be traded. However, although Raydium plans to support cross-chain trading in the future, no other networks are currently supported. This means that you won’t be able to trade some of the best utility tokens, such as Ethereum, XRP, or BNB.

Nonetheless, Raydium is ideal if you own SOL-based tokens and want to earn passive income. For example, you can stake RAY tokens with an APY of 7.49%. More than $4.4 million worth of RAY is currently being staked. You can also earn passive income through yield farming. While APYs on some pools are super-competitive, liquidity is often an issue.

When it comes to usability, Raydium is aimed at users who want to trade crypto anonymously. No accounts are required to trade, so KYC processes are not in place. Supported wallets include Solflare, Torus, and Ledger. WalletConnect is also supported, which covers plenty of other Solana wallets.

| Supported Coins | All tokens on the Solana network |

| Trading | 0.25% per trade |

| Devices | Web and mobile browsers |

| Top Features | Decentralized exchange built on the Solana blockchain, Low trading fees of just 0.25%, Swaps are processed in seconds |

Pros

- Best no KYC crypto exchange for trading SOL-based tokens

- Low trading commissions of just 0.25% per slide

- Instantly trade tokens after connecting a compatible wallet

- Also one of the best yield farming crypto platforms

Cons

- Doesn’t support any blockchains other than Solana

- Low liquidity levels on many markets

Top Crypto Exchanges Without KYC Compared

So how do the top KYC-free crypto exchanges stack up next to each other? Use this table to see which crypto exchange without KYC best suits your needs as a crypto user.

| Exchange | Supported Cryptos | Mobile App | Fee |

|---|---|---|---|

| BestWallet | All ERC20 and BSC tokens | Yes | Starting from 0.1% |

| MEXC | 1,700+ | Yes | Starting from 0.01% |

| Margex | 30+ | No | Starting from 0.06% |

| Phemex | 300+ | Yes | Starting from 0.1% |

| CoinEx | 700+ | Yes | Starting from 0.2% |

| ChangeNOW | 450+ | Yes | Starting from 0.5% |

| UniSwap | 1,000+ | No | Starting from 0.3% |

| PancakeSwap | 700+ | No | Starting from 0.01% |

| dYdX | 500+ | iOS only | Starting from 0.05% per slide |

| Sushi | All ERC20 Tokens | No | Starting from 0.3% |

| Raydium | All Solana tokens | No | Starting from 0.25% |

What is a No KYC Crypto Exchange?

In a nutshell, non KYC exchanges allow you to trade without revealing your identity. This is in contrast to the majority of crypto exchanges, which now have KYC procedures in place. For example, popular exchanges like Binance and KuCoin previously supported KYC-free accounts when depositing and withdrawing crypto assets.

KYC was only required when funding an account with fiat money. However, with governments increasing regulations to combat money laundering offenses, most exchanges have since implemented KYC processes. This is even the case with peer-to-peer exchanges.

That said, there are still a handful of crypto exchanges without KYC, such as Best Wallet, Uniswap, and PancakeSwap. These no KYC crypto exchanges have a common denominator – decentralization. This means that there’s no centralized operator to facilitate trades.

Instead, decentralized exchanges use liquidity pools. This allows traders to buy and sell cryptocurrencies without needing another market participant. What’s more, decentralized platforms don’t have an account opening process. Users can get started instantly by connecting a wallet to the exchange before completing their trade.

Crucially, no KYC crypto exchanges can accept fiat money deposits. This means that you won’t be able to buy cryptocurrencies with a debit/credit card, bank transfer, e-wallet, or any other fiat method. While this might be inconvenient for some, the benefit is that you won’t need to reveal your identity or upload any KYC documents.

Benefits of Using a No KYC Crypto Exchange

Using a KYC-free crypto exchange offers several potential benefits for users, including privacy, accessibility, and speed. In the following section, we’ll be looking at the main advantages in greater detail.

You Can Trade Cryptocurrencies Anonymously

Most people use no KYC crypto exchanges for an anonymous trading experience. This means that there are no requirements to provide personal information when getting started. In contrast, traditional crypto exchanges collect a range of data from their users.

This includes the trader’s name, nationality, home address, date of birth, and contact details. While most traders don’t mind providing this information to crypto exchanges, some do. What’s more, the KYC process often doesn’t stop with personal information.

In most cases, you’ll also be required to upload verification documents. This includes a proof of identity document, such as a passport or driver’s license. And to verify the trader’s home address, a recently issued bank statement or utility bill is also needed.

These processes are not required when using a KYC-free exchange. Instead, users can buy and sell cryptocurrencies without any identification or document requests.

There’s No Account Registration Required

The best no KYC crypto exchanges allow you to trade without opening an account. For example, Best Wallet simply requires users to connect their private wallet to its exchange. Once the wallet is connected, you can begin buying and selling cryptocurrencies.

Here’s an example of how it works:

- The user visits the Best Wallet website and connects their MetaMask wallet

- Their MetaMask wallet is currently storing 1 ETH

- The user wants to swap Ethereum for Tether – so they search for the ETH/USDT market on Best Wallet

- After confirming the swap, the Best Wallet smart contract deducts 1 ETH from the user’s wallet

- In turn, an equivalent amount of USDT is deposited back into the user’s wallet

- The user disconnects their wallet from Best Wallet having completed their desired trade

You Can Trade Crypto in a Country With Strict Regulations

Traditional crypto exchanges will often prohibit users from certain countries. These are often countries with strict regulations on cryptocurrencies. For example, China has banned all crypto-related transactions since 2021.

This means that Chinese traders will often use a no KYC crypto exchange. After all, no identification crypto exchanges do not ask for the user’s country of residence. This ensures that cryptocurrencies are accessible on a global basis and not hindered by draconian regulations.

You Will Avoid Exchange Risks Related to Hacks and Bankruptcy

We mentioned that the top crypto exchanges without ID requirements are decentralized platforms. This in itself is a major benefit, especially when it comes to platform-related risks.

- For example, consider that in 2021, the FTX exchange filed for bankruptcy. At the time, not only was FTX one of the largest exchanges, but it was also one of the most trusted.

- The FTX bankruptcy has resulted in billions of dollars worth of unrecoverable customer funds.

- In other words, if you had crypto tokens stored on FTX, you likely won’t see them again.

There have been many other examples of crypto exchanges going bankrupt, being hacked, or engaging in malpractices.

By using a no KYC crypto exchange that has a decentralized framework, you can avoid these risks. For example, exchanges like Best Wallet never touch client-owned funds. The entire Best Wallet ecosystem is functioned by smart contracts.

This means that crypto trades go through the blockchain. So, as soon as your trade is confirmed, the tokens are deposited directly into your connected wallet.

You Can Keep Your Personal Data Private and Secure

Another benefit of no KYC crypto exchanges is that you don’t need to risk data privacy leaks. For example, in late 2020 it was reported that BTC Markets – one of Australia’s largest exchanges, ‘accidentally’ leaked the full names and email addresses of all registered users. The exchange had over 270,000 registers at the time.

A more serious breach could have leaked additional personal data, such as home addresses, dates of birth, and KYC documentation. Fortunately, such exchanges do not collect personal data or verification documents, so data leaks are not a risk.

Drawbacks of No KYC Crypto Exchanges

You also need to consider the drawbacks of using a no KYC crypto exchange. For example, you won’t be able to deposit or withdraw funds with fiat payment methods – such as a debit/credit card or bank wire. This means that you can only make investments with crypto tokens.

Moreover, most no KYC crypto exchanges are decentralized platforms. Some decentralized exchanges attract low liquidity levels, meaning you might get an unfavorable market price. You should also consider that not all such exchanges are legitimate. Make sure you do your homework before choosing a provider.

Tips on Selecting the Best No KYC Exchange: Our Methodology

Now that you know how no KYC crypto exchanges work, you’ll need to choose a suitable platform. In this section, we discuss our methodology when ranking crypto exchanges with no KYC.

Safety and Reputation

When creating a shortlist of the best no KYC crypto exchanges, we initially focused on safety. After all, not all crypto exchanges are credible. We researched how long each exchange has been operational – the longer the better. We also examined how the exchange handles client funds.

For example, Best Wallet, UniSwap, SushiSwap, and many other no KYC exchanges are decentralized. This means that client funds are never held by these exchanges. Instead, trades are completed securely via smart contracts.

Therefore, you don’t need to worry about the exchange going bankrupt or being hacked – your tokens always remain in your private wallet. In addition, we also researched the reputation of each no KYC exchange.

We analyzed comments and feedback on social media networks, including Reddit and Twitter. We also looked at review platforms like TrustPilot for additional insights.

Supported Crypto Markets

You’ll also need to assess what crypto markets are supported when choosing an exchange. From our research, the best no KYC exchanges are decentralized – meaning that they typically support thousands of tokens. However, the specific tokens supported will depend on which networks the exchange is compatible with.

For example, Best Wallet supports the Ethereum and Binance Smart Chain networks. This means that it lists the majority of ERC20 and BSC tokens. Uniswap also supports a wide range of cryptocurrencies. In addition to Ethereum and Binance Smart Chain, Uniswap is compatible with the Celo, Avalanche, Base, Polygon, Optimism, and Arbitrum networks.

If you’re looking to trade more complex cryptocurrency markets, you might consider dYdX. This no KYC exchange specializes in perpetual futures – so you can cryptocurrencies with leverage of up to 20x. What’s more, dYdX supports long and short markets.

Trading Fees and Exchange Rates

The best no KYC crypto exchanges offer competitive trading fees. For example, Best Wallet doesn’t directly charge commissions when you buy and sell tokens. Instead, you simply need to cover the fee charged by the liquidity pool facilitating the trade.

That said, most no KYC exchanges charge a percentage commission on the amount being traded. At Uniswap and SushiSwap, you’ll pay 0.3% per slide. Raydium is slightly more competitive at 0.25%. Some liquidity pools on PancakeSwap charge 1%, which is considered expensive.

In addition to trading commissions, you also need to consider the exchange rate being offered. For instance, while Ethereum could be listed at $1,600 on one exchange, you might pay $1,700 on another. This means that you can pay well above the market average when choosing the wrong exchange.

In contrast, Best Wallet has developed an aggregation system that connects to dozens of liquidity pools. This means that it sources the best available exchange rate at the time of the trade.

Trading Tools and Analytics

We found that many no KYC exchanges offer limited trading tools. For instance, while you can easily swap tokens, you might not have access to analytics. This means that you’ll need to perform research and analysis on another platform, which isn’t convenient.

Moreover, many no KYC exchanges lack advanced charts or technical indicators. Instead, they merely facilitate trades. As such, if you’re looking for an all-in-one no KYC exchange, you’ll need to choose a provider that supports your preferred tools and features.

That said, we found that Best Wallet will soon be launching fully-fledged analytics tools. This includes integration with TradingView, which supports advanced charts and indicators. Best Wallet will also support sentiment bars that show whether the market is bullish or bearish on specific cryptocurrencies.

Passive Income Tools

Our methodology also examined whether passive income tools were offered by each no KYC exchange. This ensures that you can generate income on your idle crypto tokens.

For example, Best Wallet is launching staking tools within its decentralized exchange and wallet. Once you deposit tokens into a secure staking pool, you’ll begin generating passive rewards.

We also came across no KYC exchanges that support yield farming. This enables you to earn a share of trading fees when you provide liquidity to the exchange.

- For example, suppose you deposit $1,000 worth of Ethereum and Tether.

- This means you’re adding $1,000 to the ETH/USDT liquidity pool.

- Let’s also suppose that in total, the liquidity pool has $20,000 worth of liquidity.

- This means you own 10% of the pool and thus – you’ll be entitled to 10% of collected trading fees.

When using a no KYC exchange for passive income, it’s best to stick with decentralized platforms. In doing so, you won’t need to trust that your funds are being kept safe by the exchange. On the contrary, tokens are deposited into smart contracts, which are secured by the blockchain.

Device Type

You also think about which device you want to trade on and whether the no KYC exchange supports it. For example, the majority of no KYC exchanges offer a browser-based service. This means that you can trade on any web browser.

If you’re looking to trade on a smartphone, it’s best to choose a provider that offers a native app. Best Wallet offers a mobile app for iOS and Android – which doubles up as an exchange and a wallet.

Are NO KYC Crypto Exchanges Legal?

It’s crucial to understand the legality of no KYC crypto exchanges before proceeding. This is a complex area, considering that cryptocurrencies are not defined as legal tender in most countries. What’s more, regulatory guidelines and legislation will vary from one jurisdiction to another. That said, rules are consistent globally when it comes to fiat money payments.

Put simply, if you plan to use a traditional payment method to buy cryptocurrencies, you will need to go through a KYC process. For example, a debit/credit card or an e-wallet. This is because fiat payments are bound by anti-money laundering regulations. This is no different from using an online stock broker or a forex trading platform.

That said, even if you’re not planning to deposit fiat money, the world’s largest exchanges now require KYC processes before you can trade. For example, Binance previously allowed users to trade cryptocurrencies anonymously up to a certain trading volume. Once this trading volume was reached, the user would need to provide personal information and KYC documents.

However, Binance now restricts trading to non-KYC users. Similarly, peer-to-peer (P2P) exchanges previously allowed KYC-free trading. This is because buyers and sellers were trading directly with one another. However, this is no longer the case – as national regulators have since clamped down on anonymous P2P trading.

For example, Reuters reports that according to FinCEN, P2P exchanges must comply with the Bank Secrecy Act. This means keeping customer records – which can’t be done without implementing a KYC process. The exceptions to these rules are decentralized exchanges like Best Wallet, Uniswap, SushiSwap, and PancakeSwap.

The reason for this is that decentralized exchanges only handle crypto-asset trading. Although you might come across a decentralized exchange that facilitates fiat payments, this will go through a third party that will have its own KYC processes. Therefore, no KYC exchanges are perfectly legal and safe – but you can only trade cryptocurrencies anonymously.

Conclusion

This guide has ranked the best no KYC crypto exchanges for safety, supported markets, fees, and other key metrics. Overall, our number one pick is Best Wallet.

Best Wallet offers a decentralized wallet and exchange that gives you full control over your crypto assets. You can trade thousands of tokens without paying commissions and you’ll get the best exchange rate in the market. Best Wallet doesn’t have an account opening process or any KYC requirements – so you trade anonymously.

FAQs

What exchange can I use without KYC?

If you want to trade cryptocurrencies without KYC, you’ll need to use a decentralized exchange. Best Wallet, UniSwap, and PancakeSwap are some of the best options in the market.

Can you buy crypto anonymously?

If you’re looking to buy crypto anonymously, you’ll need to use a decentralized exchange. However, you won’t be able to use fiat money anonymously – as this legally triggers a KYC process.

Are no KYC exchanges legal?

The legalities of no KYC exchanges depend on the jurisdiction. That said, if fiat money is involved, KYC processes will be required.

Does Uniswap require KYC?

No, Uniswap is a decentralized exchange, so it doesn’t require KYC.

References

- https://www.fincen.gov/history-anti-money-laundering-laws

- https://www.wsj.com/articles/crypto-is-illegal-in-china-binance-does-90-billion-of-business-there-anyway-2a0af975

- https://www.cnbc.com/2022/11/21/collapsed-crypto-exchange-ftx-owes-top-50-creditors-3-billion-filing.html

- https://www.itnews.com.au/news/btc-markets-exposes-customer-names-emails-in-botched-blast-send-558443

- https://www.imf.org/en/Blogs/Articles/2021/07/26/blog-cryptoassets-as-national-currency-a-step-too-far

- https://www.finra.org/rules-guidance/key-topics/aml

- https://www.reuters.com/legal/transactional/cryptocurrency-anti-money-laundering-enforcement-2022-09-26/

Michael Graw

Michael Graw