What is Ethereum, and How Does it Work?

When launched in 2015, Ethereum was the world’s first smart contract-capable blockchain. Today, Ethereum still leads the market with tens of billions locked in smart contracts to earn yields, swap tokens, and a myriad of other uses.

In this article, we’ll answer the question, ”What is Ethereum?” and explore what may lie ahead for what many have dubbed a “world computer.”

Key Takeaways

- The Ethereum blockchain uses ether (ETH) as its cryptocurrency. Ether acts as “gas” to power the blockchain, paying for transactions and smart contract interactions.

- Ethereum’s smart contracts allow the network to provide more functionality than a simpler decentralized ledger as found with other blockchains, like Bitcoin.

- From a value of less than a dollar pre-launch, ETH rocketed to nearly $4,900 in 2021, making it one of the most performant crypto investments ever for early investors.

- Decentralized apps (dApps) on the Ethereum network center on decentralized finance, including lending and borrowing and decentralized exchanges where users can swap tokens.

What is Ethereum?

Ethereum is a decentralized global network of connected computers that follows a set of rules called the Ethereum protocol. The network’s native programming language, Solidity, enables the use of smart contracts, which are computer programs that run on the network itself.

Each of these contracts lives at an address on the network, and anyone can interact with the contracts, regardless of location, credit score, or other criteria. These smart contracts allow Ethereum to host a wide range of applications ranging from decentralized finance (DeFi) to trading assets in metaverse worlds to decentralized voting.

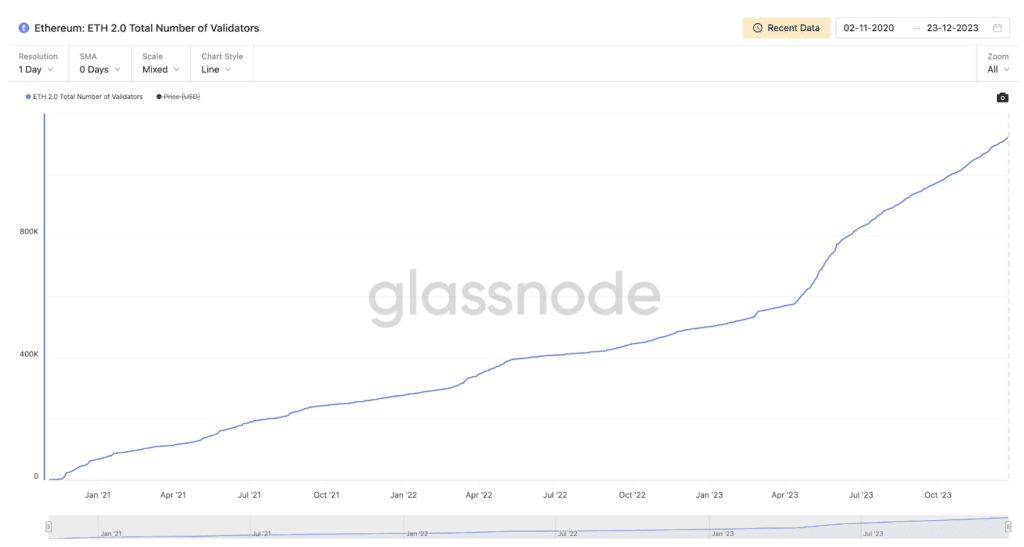

The Ethereum network is powered by more than a million validator nodes worldwide, each working to update the blockchain and verify transactions.

Often, the term Ethereum is also used to describe the cryptocurrency of the Ethereum network. While this Ethereum definition isn’t technically accurate (ether (ETH) is the cryptocurrency), you’ll still see both terms used interchangeably.

In practice, ETH is both fuel for the network and a medium of exchange used to buy other goods or assets or to pay for services.

The Origin and Development of Ethereum

Ethereum was originally conceived in 2013 by Vitalik Buterin, a programmer and co-founder of Bitcoin Magazine. By 2014, Vitalik had authored the Ethereum Whitepaper, an in-depth explanation of the theoretical blockchain network, including details of how it would work. In the oft-cited paper, Vitalik described Ethereum as a “A Next-Generation Smart Contract and Decentralized Application Platform,” contrasting the planned network’s differences with Bitcoin. At the time, Bitcoin was the only cryptocurrency.

Vitalik announced the new Ethereum blockchain project at the North American Bitcoin Conference in Miami, in January 2014.

Several co-founders worked together to bring Ethereum to life, including Vitalik as well as Gavin Wood, Anthony Di Iorio, Joseph Lubin, and Charles Hoskinson. Amir Chetrit, Jeffrey Wilcke, and Mihai Alisie are also considered co-founders of the project.

Gavin Wood went on to co-found Polkadot. Charles Hoskinson later co-founded Cardano. Joseph Lubin became known as the founder of Consensys, the blockchain company behind the industry-leading MetaMask crypto wallet.

Development continued throughout 2014, during which the team built Frontier, which would become the first live version of the Ethereum blockchain.

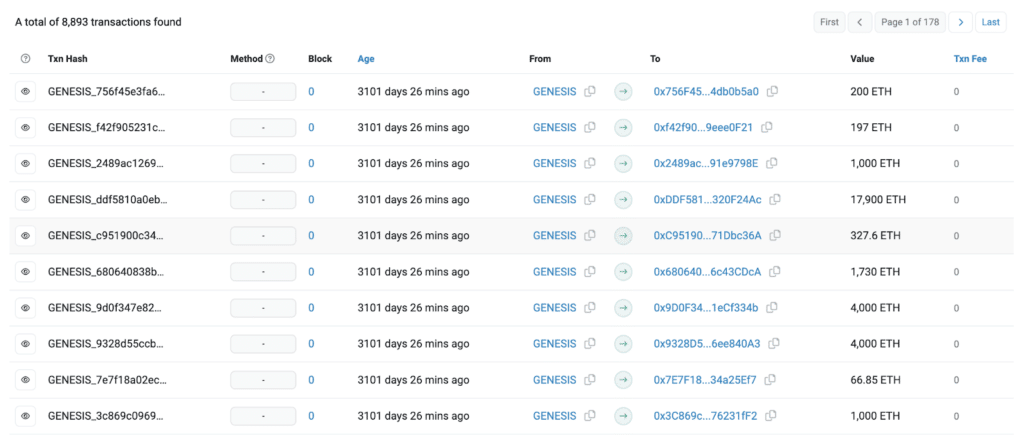

On July 30th, 2015, the Ethereum network went live, launching the Genesis Block, containing nearly 8900 transactions.

Frontier gave Ethereum miners a framework to begin mining ether and secure the network. When founded, the Ethereum network used proof-of-work consensus, much like Bitcoin.

Proof-of-work consensus requires miners to invest resources (electricity) to solve for a nonce, a number used only once. Ethereum later converted to proof-of-stake consensus, a less energy-intensive consensus mechanism first proposed in Peercoin’s 2012 white paper.

How Ethereum Works: The Technology Behind the Currency

Ethereum uses a blockchain, much like Bitcoin, grouping transactions into blocks and then linking these blocks using cryptographic hashing to create a chain. However, where Ethereum diverged from Bitcoin’s role as a digital currency and decentralized ledger is Ethereum’s ability to support complex smart contracts.

This gives Ethereum both a currency (ether), similar to bitcoin, but also to ability to use that currency and other digital assets in innovative ways. The nickname “world computer” refers to Ethereum’s role as both a blockchain and a software platform.

How Does Ethereum Work?

To understand how Ethereum works, let’s consider an example. First, let’s look at the types of transactions supported by blockchain.

- Normal transaction: ETH sent directly from one wallet address to another.

- Internal transaction: ETH transfer using a smart contract as an intermediary.

- Token transfer: A transfer of ERC-20 or ERC-721 tokens.

We’ll use a normal transaction for this example: Person A sends ETH to Person B.

- A transaction is created by Person A. For example, Jack wants to send Jill 2 ETH. Jack’s payment includes a gas fee paid in ether.

- The transaction is hashed (encoded cryptographically) to create a transaction ID, also called a txhash. To make the transaction unique and prevent double-spending, the hash also includes a nonce (a number used only once).

- The transaction is then broadcast to the Ethereum network. A validator selects the transaction and includes it in a block for verification.

- A subset of validators verify that transactions in the block are legitimate. If these validator nodes agree that the transactions follow protocol rules, the block and its transactions become finalized.

In the end, Jack’s wallet address is debited 2 ETH plus the gas fees paid; Jill’s wallet address is credited 2 ETH. More complex transactions run on the Ethereum Virtual Machine (EVM), which provides support for smart contracts while isolating validators from code run within the virtual environment.

The Role of Blockchain in Ethereum

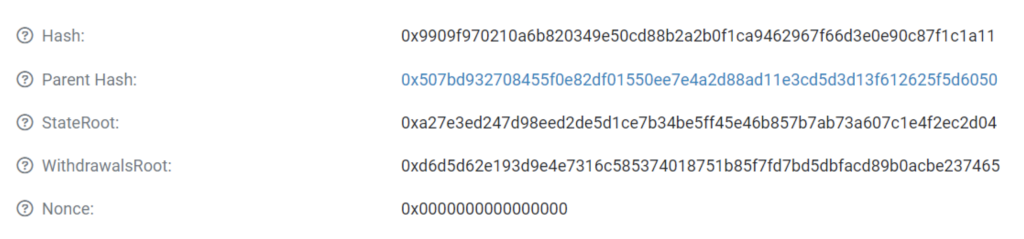

The Ethereum blockchain acts as a ledger, meaning a record of transactions and wallet address balances. Each block is a container to hold transactions. Each also contains a hash of the previous block, linking the blocks sequentially to form a chain.

For example, block # 19085581 had a hash of 0x507bd932708455f0e82df01550ee7e4a2d88ad11e3cd5d3d13f612625f5d6050. This value becomes part of the next block’s hash (19085582). Block # 19085581 is now the parent block for 19085582. The child block now gets its own hash, as shown below.

Blocks serve as containers but also record the state of the blockchain, like a snapshot in time. Once validated, the block is added to the chain, and the new version of the chain propagates throughout the network.

Unlike Bitcoin, which limits blocks by data size, Ethereum uses a target block size based on gas (transaction fees). The network targets 15 million gas per block but can expand blocks to 30 million gas as needed based on network congestion.

Like Bitcoin, the Ethereum blockchain is immutable. Once a transaction is finalized, it remains that way on the blockchain forever.

Encryption and Security Measures

Ethereum uses hashing throughout every stage of blockchain transactions. Hashing refers to cryptographic encryption that encodes data as a hexadecimal (letters and numbers) value, also called a hex.

- Each transaction is hashed.

- Blocks are hashed.

- Wallet addresses are hashed.

Ethereum uses the Keccak-256 algorithm to calculate the hash, resulting in a 256-bit string of letters and numbers that is 64 characters long. However, the protocol prepends “0x” to the beginning of hash values to denote both numbers and letters. This makes block hashes, for example, 66 characters long.

Ethereum Wallet Addresses and Keys

The protocol also uses hashing for wallet private keys and public addresses.

In the Genisis Block, wallet address 0x756F45E3FA69347A9A973A725E3C98bC4db0b5a0 received 200 ETH. The address is derived from hashing but uses some extra steps to arrive at a 40-character hex versus a 64-character hex. The prepended 0x brings the character count to 42.

- Private keys use a 66-character hash, including the leading 0x.

- Public keys use a 130-character hash, including the leading 0x.

- Public wallet addresses use a 42-character hash, including the leading 0x.

Public keys are derived from private keys. Public wallet addresses, also known as externally owned accounts, are derived from the last 20 bytes of the public key.

Ethereum’s Keccak-256 algorithm always creates the same hash for the same input. However, encryption is one way, and there is no way to reveal a private key from a public key or address.

Ethereum uses private keys to sign transactions.

For example, if Jack wanted to send Jill 2 ETH, Jack would use a wallet app to initiate the transaction. Jack would need to input Jill’s public address. When approving the transaction, Jack’s wallet uses his private key to approve the transaction while keeping the key hidden.

If Jack has been careful to protect his private key, only Jack can control his assets on the blockchain. However, anyone who gets access to the private key or the wallet’s recovery phrase can control Jack’s assets.

What is Ether?

Ether is the fuel for the Ethereum blockchain. Although the term Ethereum is often used to describe the cryptocurrency of the Ethereum network, ether is the actual currency used.

- Ethereum typically refers to the blockchain, protocol, or network.

- Ether is the cryptocurrency that pays for transactions and processing power on the network.

However, two other units of account come into play as well: wei and wei.

- Gwei: Each ETH equals 1 billion gwei.

Short for gigawei, gwei is often used in gas fee quotes, although Ethereum wallets usually convert fees to USD or other currencies for convenience.

- Wei: Each gwei equals 1 billion wei.

Wei refers to the smallest denomination of ether.

Gas fees on Ethereum vary based on bandwidth, space, and computational difficulty of smart contracts.

ETH Supply

Validators on the Ethereum network earn fees paid in ether for adding valid blocks to the blockchain. The Ethereum protocol mints these new rewards, inflating the supply.

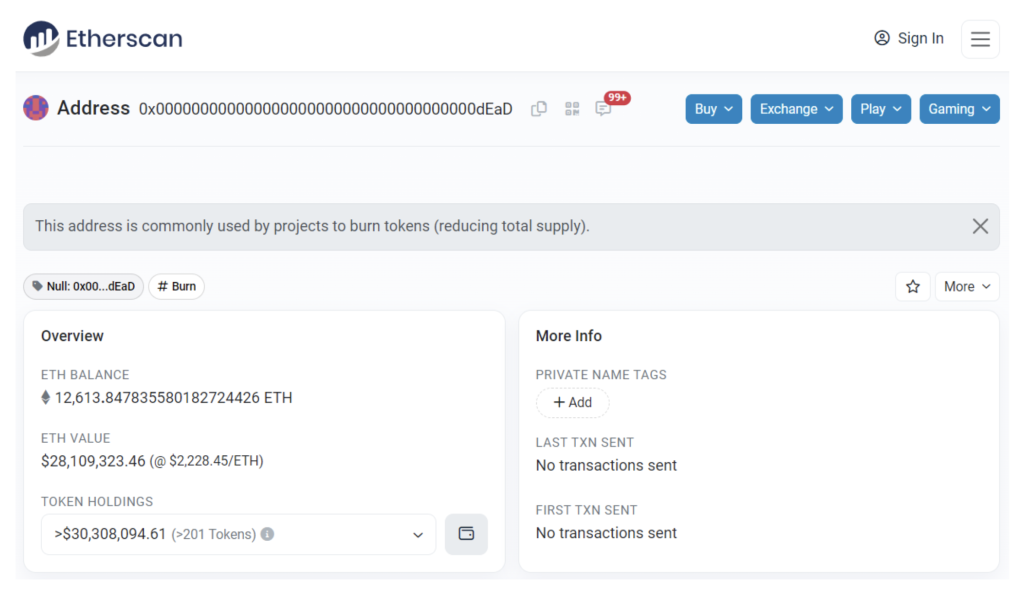

The protocol also burns base transaction fees, decreasing supply by sending ether to an unrecoverable address.

Overall, the result has been slightly deflationary since Ethereum Improvement Proposal (EIP) 1559 was approved by the community, enabling the protocol to burn base fees.

What is Ethereum 2.0?

Ethereum 2.0 refers to Ethereum’s conversion from proof-of-work (PoW) consensus to proof-of-stake (PoS) consensus. Until December 1, 2020, Ethereum exclusively used PoW to validate transactions. Beginning in late 2020, Ethereum launched a PoS chain, called the Beacon Chain. The two chains, Beacon and Mainnet, ran in parallel until September 15th, 2022, when the two chains joined in “the merge.”

The move to Ethereum 2.0 brought staking to the network, allowing ETH holders to support the network’s security and earn a yield from staking rewards via Ethereum staking platforms.

The merge also laid the foundation for sharding, a planned upgrade that would allow the Ethereum network to split the state of the Ethereum blockchain into 64 smaller chains called shards, each of which maintains its own transaction history and blockchain state.

Shard chains are no longer part of the roadmap, however. Instead, Ethereum developers are targeting Danksharding, a scaling method to increase transactional capacity, perhaps reaching as high as 100,000 transactions per second. Currently, the Ethereum network processes 20-30 transactions per second.

Can You Mine Ethereum?

Ethereum’s switch to proof of stake meant an end to mining for Ethereum. However, Ethereum Classic still uses proof of work and remains mineable. The two chains forked in 2016, with most of the community remaining with the main chain we now know as Ethereum 2.0.

How to Buy Ethereum

As the second-largest cryptocurrency by market capitalization, Ethereum is readily available on crypto exchanges worldwide. Crypto exchanges like Coinbase and brokers like eToro offer the easiest way to get started by letting people buy ETH and other cryptocurrencies with USD, GBP, or other fiat currencies.

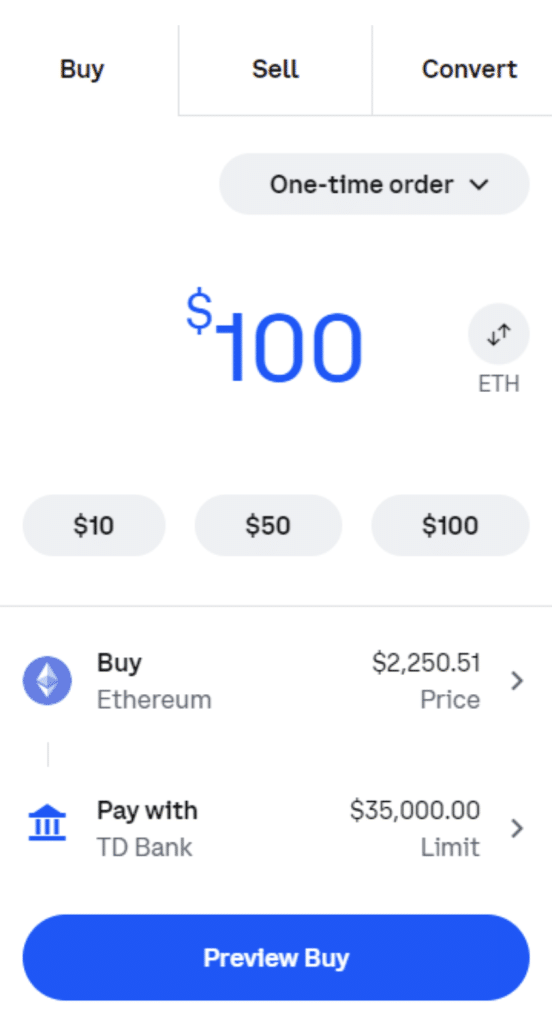

To get started, you can follow these basic steps using Coinbase as an example.

- Sign up for an account. Visit Coinbase and tap the “Sign Up” button.

- Complete identity verification. Coinbase requires users to verify their identity by uploading a copy of their passport or government-issued identification. This step is to comply with regulations.

- Link a payment method. Coinbase supports bank accounts and debit cards in many countries. Some areas also support PayPal as a payment method.

- Choose an investment amount. Consider how much you want to invest and whether you want to invest on a regular basis. Coinbase supports one-time deposits and recurring purchases funded by your chosen payment method.

- Buy ETH. When you’re ready to buy, you can use the Buy & Sell button to complete your purchase in a few clicks. Alternatively, Coinbase also offers advanced trading where you can trade with lower fees.

Once you’ve made your purchase, you may want to store your ETH in a self-custody wallet, which we’ll cover next.

Choosing an Ethereum Wallet

A crypto wallet holds the private keys that control your crypto assets on the blockchain. You can choose between hot or cold wallets — or use both types together. More on that in a bit.

Hot wallets generate and store your private keys on a device connected to the internet. Hot wallets include software wallets like browser extensions or mobile apps.

Cold wallets generate and store your private keys offline. Cold wallets are usually hardware devices that connect via USB when needed or use QR codes to communicate with a wallet app.

- Hot wallets offer more convenience. You can easily connect to decentralized applications to use your cryptocurrency. However, as software, they may have bugs or flaws that could make them more vulnerable to exploits.

- Cold wallets stay offline and work much like two-factor authentication. To spend or send ETH or tokens, you’ll need to press a button to confirm the transaction on your device.

You can also use both. For example, MetaMask, the most popular hot wallet, supports Ledger and Trezor hardware wallets, two of the leading brands. This setup lets you connect to dApps easily while protecting your assets with keys stored offline in your hardware wallet.

Utilizing Ethereum: From Payments to Investments

We already know ether is used to pay for transactions on the network. However, ETH is a currency with many uses, and the popularity of the Ethereum blockchain means ETH has value outside the network as well.

- Buy NFTs. Non-fungible tokens (NFTs) represent ownership. The most common use is the NFT collections most of us are familiar with, including the Bored Apes collection. However, an NFT can represent ownership of anything. At some point, you may see real estate and other assets commonly available in tokenized NFT form.

- Swap for other assets. You can swap your ETH for other cryptocurrencies on decentralized exchanges like Uniswap.

- Buy real-world goods and services. Retailers like Newegg accept ETH as payment for electronics and other items.

- Earn yields. The world of DeFi offers countless ways to earn a yield with your ETH. For example, the simplest of these is through liquid staking. Platforms like Lido let you deposit your ETH into a smart contract in exchange for a liquid staking token that pays a yield from staking rewards. You can then hold or swap your tokens as needed — or even use them as collateral in a lending app like Aave.

- HODL. Of course, you can simply hold your ETH for potential future price appreciation. The crypto community calls this HODLing. If you’ve staked your ETH through an exchange like Coinbase or a liquid staking protocol like Lido, you can earn a healthy yield, often about 3.5%, just to wait.

Common Misconceptions and Myths about Ethereum

Crypto is still a new industry, rife with myths, misconceptions, and simple misunderstandings. Let’s examine a few.

- Ethereum and crypto are anonymous. Cryptocurrency is pseudonymous, meaning your wallet address becomes your identity for the purpose of the transaction. Following the right set of footprints, it’s often easy to match a person to a wallet address.

- ETH and crypto are only for techy people. On the contrary, cryptocurrencies were invented to give people more freedom in financial transactions. Certain aspects of the experience still need some usability improvements, but wallets, exchanges, and decentralized applications have all become much more accessible.

- Ethereum 2.0 will process 100,000 transactions per second. Not yet. While numbers like that may be on the horizon with the development of Danksharding, the Ethereum team also states that several other upgrades must take place before that becomes a possibility.

- Vitalik runs Ethereum. This is false. While Vitalik Buterin (co-founder and author of the Ethereum white paper) remains active in the project, Ethereum is community-governed. ETH holders vote on Ethereum Improvement Proposals (EIPs). If a proposal passes, the developers get to work on implementing the changes.

- All smart contracts are safe. This isn’t true. Some protocols, such as Aave and Uniswap, have undergone dozens of independent audits, while others haven’t been audited at all. Many crypto projects make their source code available so coders around the world can evaluate the code. However, bugs can still occur, and smaller projects can fly under the radar unnoticed. Research decentralized applications carefully before connecting your wallet.

Ethereum Regulation and Legal Aspects

Buying, selling, and owning ETH is legal in most parts of the world, including major markets like the US and UK. However, there’s still regulatory uncertainty around certain aspects, including staking and, in particular, DeFi.

Regulatory bodies like the SEC are looking closer at decentralized exchanges, which are currently unregulated. However, many of these are community-governed as well, meaning it’s difficult to see who the SEC would pursue or how regulations could apply.

Generally, crypto assets fall into three categories pertaining to their vulnerability to government bans or regulations.

- Safest: Bitcoin. With a fair launch and decentralization, most investors feel Bitcoin falls into the safest category. Other fair launch (no pre-sale) projects may share this category.

- Safer: Ethereum. ETH had a pre-sale. However, comments from the SEC suggest that regulators see the project as now sufficiently decentralized.

- Not as safe: Everything else. Smaller projects can become easy targets for well-funded regulators and law enforcement officials, including the LBRY project (sued by the SEC and now defunct) or Tornado Cash, in which the US DOJ charged the project’s developers with money laundering. The trial has not yet started.

As a newer industry, crypto still has some growing pains to endure, and many legal aspects are yet to be defined in courts. For investors, this brings added risks. However, the uncertainty could be contributing to keeping prices lower than they would be with more clarity.

Evaluating Ether as an Investment

Early ETH investors have enjoyed astronomical returns, with ETH climbing from less than a dollar at launch to nearly $5,000 by 2021. However, it’s likely unrealistic to anticipate those types of gains going forward. Ether’s price is also volatile. As of this writing, ETH is down nearly 60% from its all-time highs.

Arguably, the Ethereum project is in a much better position now than it was when hitting all-time highs. With the merge safely behind, incremental improvements can help the project reach its full potential and address issues with scalability.

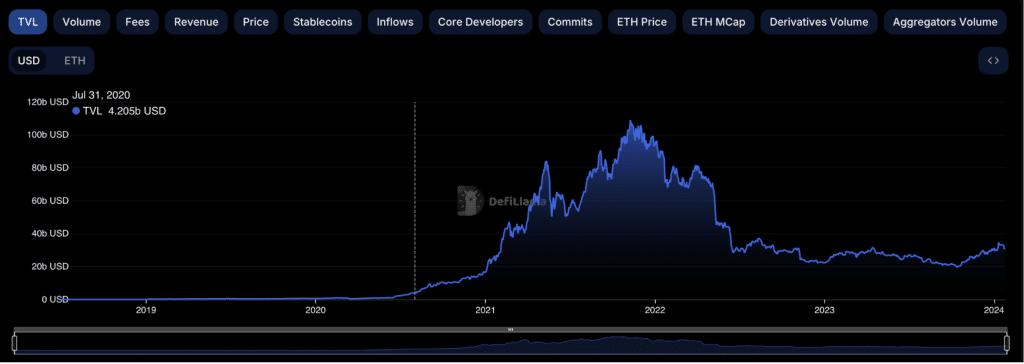

The network remains active, and the community is growing. Total value locked (TVL), a measurement of funds locked in smart contracts on the network, remains well below 2021 to 2022 levels.

However, TVL is steady and has seen a slight uptick in recent months. There are likely as many reasons to be optimistic about ETH’s future as there are reasons to be cautious.

- On the positive side, big players like BlackRock and GrayScale are trying to bring spot ETH ETFs to market. Long-term, increased demand is bullish for prices when supply is limited.

- On the other hand, regulatory uncertainty could keep ETH prices lower. Additionally, newer smart contract networks like Tron, Solana, Polygon, Avalanche, and Sui could take some of Ethereum’s market, making ETH less attractive.

Advantages and Disadvantages of Ethereum Investment

Let’s dive into the pros and cons of investing in Ethereum in March 2024:

Pros

- Continued ecosystem growth fuels demand for ETH.

- ETFs could bring more regulatory clarity.

- Staking rewards provide a proven yield.

- An ETH investment offers portfolio diversification.

Cons

- Volatility can cause sudden price changes.

- High fees can affect usability, creating less demand.

- Newer networks like Solana offer faster transactions at lower costs.

The Risks and Challenges of Ethereum

Even as one of the more established blockchain networks, the road ahead for Ethereum remains uncertain. Some of Ethereum’s challenges stem from outside forces, like regulators, whereas others come from the structure of the network itself.

- Ethereum’s number of validators could affect efficiency. The number of validators on the Ethereum network has grown steadily since the conversion to proof of stake. On an Ethereum test network, an overabundance of validators was shown to decrease efficiency.

- Transaction costs remain high. Rising transaction costs, particularly when the network is busy or when ETH’s price spikes, make Ethereum impractical for many smaller transactions. Over time, scalability solutions like Danksharding and rollups could help increase throughput and ease gas costs.

- Ethereum is comparatively slow. At an optimistic 20 to 30 transactions per second, Ethereum compares poorly with alternatives like Tron (2,000 TPS), Avalanche (4,500 TPS), and Solana (up to 65,000 TPS). Layer 2 networks like Arbitrum help users transact faster but may not offer the same levels of liquidity and the same dApps found on Ethereum Mainnet.

- Price volatility could alienate traditional investors. Ethereum ETFs on the horizon and growing awareness could bring more demand from retail and institutional investors. However, price volatility could temper demand.

Practical Aspects of Using Ether

Trading and using ether comes with a small learning curve, but many of the strategies for using ETH safely parallel those of traditional finance.

- Use strong passwords. On exchanges, in particular, use strong and unique passwords to prevent access to your trading account. Also, set up two-factor authentication that requires approval from a device in your possession.

- Protect your private keys. Your wallet’s private keys control your ETH and other assets on the blockchain. Never share your keys or save your seed phrase on your computer (or to a cloud service).

- Consider a hardware wallet. A cold wallet generates and stores your private keys offline, offering the most protection.

- Avoid suspicious links. Phishing, imposter sites, and fake apps exist. Exercise caution and go directly to the website by typing the correct address rather than trusting links you find on discussion boards, social media, websites, or email messages.

- Research protocols before connecting your wallet. If you’re considering using a decentralized application, search for audit reports and hacks.

Educate yourself on how protocols work. DeFi brings more autonomy to users but also comes with some risks. Lending apps and perpetual exchanges can cause your holdings to be liquidated in some cases. Decentralized exchanges allow easy swaps, but as your trade volume increases in a specific trade, exchange prices become less optimal.

The Future of Ethereum

As the largest smart contract network in the world, the future appears bright for Ethereum. Ethereum 2.0 laid the groundwork for future optimizations, including sharding strategies and better support for rollups, a way of processing transactions on a separate EVM and then passing the finalized transactions to the Ethereum Mainnet.

Adoption remains the main catalyst for ETH going forward. Newer networks boast faster and cheaper transactions, but perhaps at the expense of reliability. As Ethereum development continues, many of the blockchain’s transaction cost and speed challenges may be resolved.

Ether’s price reflects current demand versus supply but also considers what lies ahead. During the depths of the bear market, many predicted a price for ETH under $ 500. The market bounced before reaching that range. Currently, ETH trades at nearly 60% below its all-time high, but some anticipate much higher prices in the years ahead, with some estimates placing ETH at nearly $30,000 by 2030.

Closing Thoughts: Is Ethereum Right for You?

Ethereum remains one of the most promising cryptocurrencies for investors. However, as a group, cryptocurrency investments bring more risk compared to many traditional investments.

The conversion to Ethereum 2.0 tamed the once-inflationary asset, balancing ether minted as staking rewards with a well-defined burning strategy for base fees. Increased demand for the network against a slightly deflationary supply makes ETH more attractive both as an investment and as a store of value.

Sustainable staking yields make Ethereum a standout compared to other crypto investments that don’t offer a yield natively. For some investors, staking yields represent getting paid to wait, similar to dividend stocks.

Ethereum isn’t a fit for all investors, however. Price volatility and even existential risk amid regulatory uncertainty potentially make Ethereum and other cryptocurrencies riskier than traditional investments. Always consider risks alongside rewards, and never invest more than you can afford to lose.

References

- Ethereum Whitepaper (ethereum.org)

- A Next-Generation Smart Contract and Decentralized Application Platform (ethereum.org)

- Vitalik Buterin reveals Ethereum at Bitcoin Miami 2014 (youtube.com)

- About Polkadot, a platform for Web3 (polkadot.network)

- Charles Hoskinson – IOHK Leadership (iohk.io)

- About Our Founder – Joseph Lubin (consensys.io)

- Etherscan Block 0 (etherscan.org)

- PPCoin: Peer-to-Peer Crypto-Currency with Proof-of-Stake (peercoin.net)

- Ethereum Blocks (ethereum.org)

- Ethereum Accounts (ethereum.org)

- EIP 1559 FAQ (ethereum.org)

- Ethereum Roadmap (ethereum.org)

- PROOF-OF-STAKE (POS) (ethereum.org)

- Danksharding (ethereum.org)

- DAO fork (ethereum.org )

- Supplemental Information and Reopening of Comment Period for Amendments Regarding the Definition of “Exchange” (SEC.gov)

- SEC Granted Summary Judgment Against New Hampshire Issuer of Crypto Asset Securities for Registration Violations (SEC.gov)

- Tornado Cash Founders Charged With Money Laundering And Sanctions Violations (justice.gov)

- Spot Ether ETF Applications Decisions Delayed by SEC (coindesk.com)

- The Most Pressing Issue on Ethereum is Validator Size Growth (coindesk.com)

- What is KZG? (ethereum.org)

Connor Brooke

Connor Brooke

Nick Pappas

Nick Pappas

Eliman Dambell

Eliman Dambell