What is Cryptocurrency?

Cryptocurrency is a digital asset that functions as money, represents value, or performs a utility function on a blockchain. In this guide, we’ll explore the question, “What is cryptocurrency?”

We’ll also discuss blockchains, how cryptocurrencies work, cryptocurrency exchanges, and how to use cryptocurrency. Let’s get started with some background first.

Types of Cryptocurrency

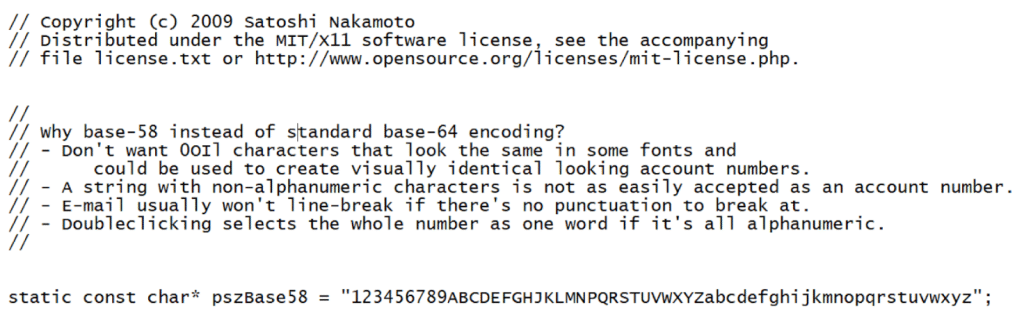

Bitcoin sparked the modern crypto revolution in 2009 when it was launched by an anonymous person or team named Satoshi Nakamoto.

Today, Bitcoin is the most well-known cryptocurrency and is often called digital gold due to its scarcity; only 21 million bitcoins will ever exist.

Over time, new cryptocurrency projects launched, some with the goal of faster transactions and others with the goal of adding new functionality to blockchain networks.

Litecoin launched in 2011 as a fork of Bitcoin, a modified version of the Bitcoin code. Litecoin processes transactions in a fourth of the time compared to the Bitcoin network.

Then, in 2015, the Ethereum network launched, bringing powerful programming capabilities to the crypto world and leading to programs that run on the blockchain called smart contracts.

Today, there are tens of thousands of cryptocurrencies. Many of these are tokens that operate on existing blockchain networks but are not required by the network.

Ether (ETH), for example, powers the Ethereum network. You can send ETH to someone else, and the network fees for the transaction are also paid in ETH. Executing a smart contract also costs ETH, making ETH both a store of value and a utility token for the Ethereum blockchain. By contrast, PEPE, a popular token for traders that adopts Pepe the Frog as its mascot, has no utility on the Ethereum blockchain where it’s hosted. PEPE is fun, but it’s not necessary for the network.

Top Cryptocurrencies

While there are thousands of cryptocurrencies in existence, most won’t survive. Leading projects enjoy a higher overall value, with the order changing as market adoption evolves.

These are the current leading cryptocurrencies by market capitalization (total market value):

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT)

- BNB (BNB)

- Ripple (XRP)

- Solana (SOL)

- US Dollar Coin (USDC)

- Cardano (ADA)

- Dogecoin (DOGE)

- Avalanche (AVAX)

Of the current top ten cryptocurrencies by market capitalization, two (USDT and USDC) are stablecoins, which refers to crypto tokens pegged to another currency — USD in this case. Both assets assert USD backing or equivalent assets to maintain their $1 peg.

The other cryptocurrencies listed above fuel their respective networks, meaning they are used to pay for network transactions. This utility also gives them value, particularly for widely used networks like Bitcoin and Ethereum.

Values for these cryptocurrencies are not fixed. Instead, the market determines the value.

How Does Cryptocurrency Work?

When used as a currency, cryptocurrencies work much like existing fiat currencies in basic ways, such as transferring value. Fiat refers to traditional money like the USD or GBP.

Fiat is an order or decree. So, fiat money is money because governments say it’s money.

On the other hand, cryptocurrency derives its value as money from the market. Trading markets determine the value of a given crypto asset.

You can send cryptocurrency to vendors to pay for goods or services or send cryptocurrency to settle a debt, for example.

Let’s look at a simple Bitcoin transaction that actually happened: Pizza Day.

Early on in Bitcoin’s timeline, Laszlo Hanyecz used 10,000 bitcoins to pay for two Papa John’s pizzas. At the time, the value of 10,000 bitcoins made it a fair trade. At today’s bitcoin price, those 10,000 bitcoins would be worth about $440 million, just under 20% of Papa John’s (PZZA) current total stock market value.

Laszlo Hanyecz had mined the coins using CPU processing power (and electricity) to help validate transactions on the Bitcoin network. The coins were paid as a mining reward for blocks successfully added to the blockchain. More on mining later in the guide.

Laszlo then sent the coins from one crypto wallet to another to pay for the two-pizza transaction. On the Bitcoin network, sending bitcoins comes with an additional cost called a transaction fee or network fee. This fee is paid to miners, people like Laszlo Hanyecz.

Banks and payment services also charge payment fees.

The difference, in this case, is that crypto networks provide a way to send value from A to B without an intermediary. There’s no bank or payment service to say you can or can’t make a given transaction. Generally, crypto networks work to prevent double-spending rather than consider the purpose, wisdom, morality, or legality of the transaction.

Like all money, cryptocurrencies can act as a medium of exchange as long as there is a belief that others will also accept the same cryptocurrency as a medium of exchange in the future.

How are Cryptocurrencies Created?

Many cryptocurrencies, like Bitcoin” grow their supply through mining, a process in which the network provides new coins as a reward for validating transactions on the network. The mining process requires “work” as miners need to solve a cryptographic puzzle. These are called proof-of-work protocols.

Other protocols use proof of stake, proof of history, or other methods to reach a consensus, an agreement that transactions are valid. Proof-of-stake networks also provide rewards, adding more currency as a result of the consensus process.

- Mining uses proof-of-work to create new coins for the network as mining rewards.

- Minting refers to using an algorithm to create new coins or tokens as staking rewards — or as tokens for use on a blockchain. PEPE, for instance, is a minted token on the Ethereum network that was not the result of staking or mining, whereas new ETH supply comes from staking.

Coins like bitcoin or litecoin, in which there was no mining prior to launch are called “fair launch” cryptocurrencies. Everyone had an equal chance to build a position before the coins became popular.

How are Cryptocurrencies Different From Fiat?

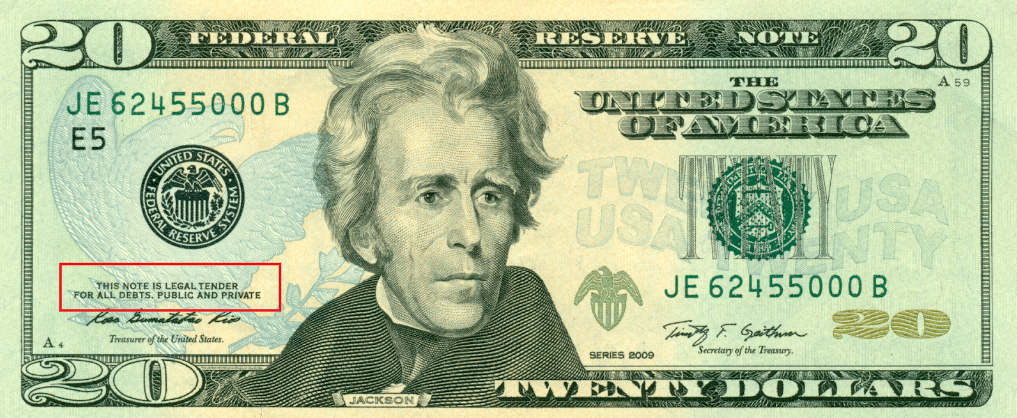

The word fiat comes from Latin and translates to “let it be done,” meaning governments declare a currency to be legal tender.

For example, US currency bears the following:

“This note is legal tender for all debts, public and private.”

In the US and most other countries, fiat currencies are anchored to debt rather than a physical asset like gold. Although it’s an oversimplification of the process, it’s fair to say that new dollars are borrowed into existence.

Cryptocurrencies, on the other hand, are not anchored by debt, nor are they declared to be money in most cases. (A few countries have adopted Bitcoin as a legal tender, however.)

People can choose to use cryptocurrencies as money, a store of value, an investment, or speculative trades.

Centralization vs. Decentralization

Fiat currencies are centralized, with their supply — and thereby their value — controlled by governments and central banks. Many of the largest cryptocurrencies are decentralized, with changes to the protocols and emissions (additional coins or tokens) determined by a worldwide community. Changes to Bitcoin, for example, require voting on a Bitcoin Improvement Proposal (BIP) with approval by 95% of miners.

Decentralization isn’t universally true for all cryptocurrencies, however. The supply and validation methods for Ripple, one of the most popular cryptocurrencies, are determined by a single company, Ripple Labs.

Some cryptocurrencies use decentralized consensus (agreement on transactions), while other aspects are tightly controlled by a centralized group. Often, there is also a transition from centralized to decentralized control. Cardano would be an example that began as a centralized network but is moving toward decentralization.

What Is a Blockchain?

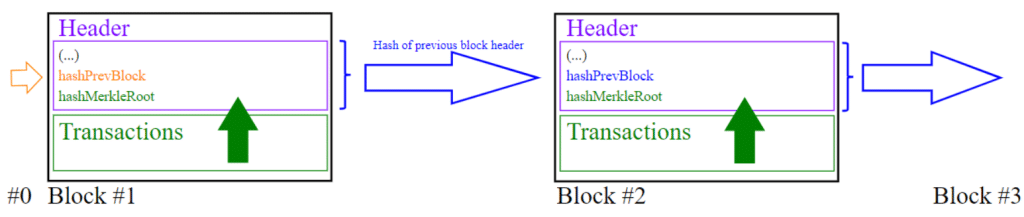

In its simplest form, a blockchain is a ledger, a record of transactions. Blockchains get their name from their structure.

- Transactions are grouped in blocks by miners or validator nodes.

- Each block references the previous or parent block using a cryptographic hash.

- These connected blocks form a chain.

Because each block references its previous or parent block, the transactions in blockchains are difficult to change.

If a bank or a company wanted to reverse a transaction in traditional finance, they could do so quite easily by changing a value in a database. By contrast, cryptocurrency networks secure transactions by creating a chain that prevents earlier transactions from being easily changed.

This near-permanence is called immutability, and while it doesn’t make it impossible to change a transaction, it makes doing so extremely difficult. Transactions within blocks become more permanent as additional blocks are added to the chain.

For example, on the Bitcoin network, the cost to change a previous transaction outweighs the potential benefit. To change a transaction, you would have to re-mine every block after the block that holds the transaction in question — and you’d have to do it faster than the rest of the network can mine new valid blocks. (Bitcoin chooses the longest chain.)

After six block confirmations, a Bitcoin transaction is considered finalized. However, from a practical standpoint, smaller transactions are permanent after one confirmation due to the cost of re-mining a block.

The Bitcoin network uses proof of work to secure the blockchain, which we’ll cover next.

Proof of Work vs. Proof of Stake

For a ledger to be trusted (and for cryptocurrency to have value), there must be a way to agree the transactions are valid. In traditional finance, banks and institutions are typically the final arbiters. Crypto blockchains take a different approach. The network must reach a consensus and then have a method to secure the transactions so they can’t be changed.

The most common consensus methods are proof of work (PoW) and proof of stake (PoS).

Proof of Work

As a concept, proof of work dates back to a 2002 paper authored by Adam Back detailing a method to limit email spam and denial of service attacks by requiring a modest amount of CPU “work” to solve a cryptography problem.

Satoshi adopted the idea for Bitcoin, making Bitcoin miners guess the correct hash value to add a new block to the blockchain. The time and cost associated with this work made it cost-prohibitive to change existing transactions in the blockchain.

That’s the disincentive.

At the other end of the equation is the financial incentive: A miner can earn bitcoins by directing hashing power to mining new blocks to earn mining rewards.

Proof of work is still considered by many to be the most secure way to protect a blockchain. Several well-established networks like Bitcoin, Litecoin, Dogecoin, Bitcoin Cash, Ethereum Classic, and Monero use PoW.

Proof of Stake

One common criticism leveled against PoW is its energy consumption. As an alternative to PoW, proof of stake has become a popular, energy-friendly option. First pioneered by Peercoin, which uses both PoW and PoS, proof of stake requires that validators put up collateral.

This collateral puts something valuable at stake. If a validator breaks protocol (a set of rules), that validator could have its stake slashed, meaning all or part of the staked cryptocurrency can be taken from the validator.

A validator is a computer on the network that runs specialized software to ensure transactions are valid and that other validator nodes follow protocol.

Proof of stake networks often have minimum staking requirements for each validator, but they also might offer Delegated Proof of Stake (DPoS), which makes it possible for people with smaller balances to team up and stake to a qualifying validator.

Other consensus methods may be used as well, such as:

- PoH: Proof of History

- PoET: Proof of Elapsed Time

- PoC: Proof of Capacity

The Role of Consensus in Crypto

Consensus (agreement between nodes) in crypto blockchains gives us a way to transact in a trustless way. This means we don’t have to trust a bank, institution, or a third party to account to track balances and verify transactions. Everything we need to see can be verified with a crypto wallet and a blockchain explorer for Bitcoin, Ethereum, or whichever network you’re using.

A consensus mechanism ensures that all nodes agree on the state of the blockchain ledger and that all transactions are legitimate.

As users, consensus allows us to feel confident in the validity of transactions, and we can choose crypto networks based on the security their consensus mechanisms provide. Some feel more confident in PoW networks, while others prefer PoS or other consensus methods. In either case, we don’t need to trust a third party that may not work in our best interest. Instead, we trust the process and can verify the results on a public blockchain.

Ways to Acquire Cryptocurrency

There are three primary ways to acquire cryptocurrency. Let’s explore the options.

Mining

The first bitcoins were mined with desktop CPUs. The same is true for litecoins, dogecoins, and newer projects like Kaspa and Zephyr. Initially, Ethereum was mined as well. The original Ethereum chain called Ethereum Classic is still mined using PoW.

Only proof-of-work coins can be mined in the traditional sense. Mining algorithms adjust for difficulty as hash power increases with the addition of more or better miners. As mining difficulty increases, hardware requirements also increase.

Today, Bitcoin can’t be mined competitively with CPUs or even high-end graphics cards. The Bitcoin mining industry is dominated by specialty hardware called Application-Specific Integrated Circuits (ASICs).

Some smaller coins, including Kaspa, Monero, Zephyr, and others, can still be mined with CPUs or graphics cards. However, it’s often more practical to buy these coins from an exchange when prices dip.

Earning

You can build a crypto stack through several ways of earning. In many cases, you’ll need to have some crypto already that you can put to work.

- Staking: Proof-of-stake networks like Ethereum and Solana allow you to “stake” your tokens to earn staking rewards. Often, staking rewards can yield 3% APY or more.

- Yield protocols: Smart contracts paved the way for decentralized finance (DeFi) applications. Popular decentralized apps (dApps) like Aave allow users to earn a yield by lending crypto to others. GMX, another well-known DeFi app, lets you own a part of the profits (or losses) in a decentralized exchange – paid in crypto.

- Play-to-earn: Crypto-based games like Axie Infinity and The Sandbox provide ways to earn crypto in the game.

- Crypto rewards cards: A handful of crypto rewards cards, like those from Coinbase or Gemini, let you earn crypto “cash back” when you make purchases.

- Work for crypto: Freelance platforms may offer ways to get paid in crypto for the work you perform. Alternatively, payment apps like Cash App, Strike, and Venmo allow users to send crypto payments between users.

Buying

Often, buying crypto with fiat money offers the most efficient way to build a position.

In the next section, we’ll discuss places to buy cryptocurrency.

Where to buy Cryptocurrency?

The most common way to buy cryptocurrency is to use a crypto exchange like Coinbase, where you can buy crypto with USD, GBP, and other supported currencies. The first exchange dates back to 2010, when Bitcoin Market launched. Several of today’s exchanges date back to the same era. Coinbase was founded in 2012. Kraken and Bitstamp both launched in 2011.

- Centralized exchanges: A centralized exchange (CEX) is run by a company, and most require identity verification. Examples include Coinbase and Kraken. These exchanges support trading fiat currencies for crypto and store your crypto in a custodial wallet until you withdraw.

- Decentralized exchanges: A decentralized exchange (DEX) is run by software. Smart contract developers publish apps to the blockchain that let you trade one cryptocurrency for another or fund your account using fiat through a third-party provider. Popular DEX platforms include Uniswap and Pancakeswap.

- Brokers: Similar to centralized exchanges, brokers let you buy crypto with traditional currencies. The difference is that you’re buying from or selling to the broker rather than trading directly with other traders. eToro and Robinhood are popular examples.

- Payment apps: Cash App, PayPal, Venmo, and other payment apps now support buying and selling for popular coins. Some only support Bitcoin.

- Wallet apps: Crypto wallets like MetaMask offer a way to buy crypto through a third-party provider like MoonPay or Mercuryo.

- Peer-to-peer networks: Platforms like Bisq and HODL HODL offer peer-to-peer bitcoin trading. Trade with others worldwide. Prices may differ from market prices on centralized exchanges, however.

- Bitcoin ATMs: In many countries, you can buy bitcoins from an ATM-like machine in a gas station or convenience store.

Is Cryptocurrency Safe?

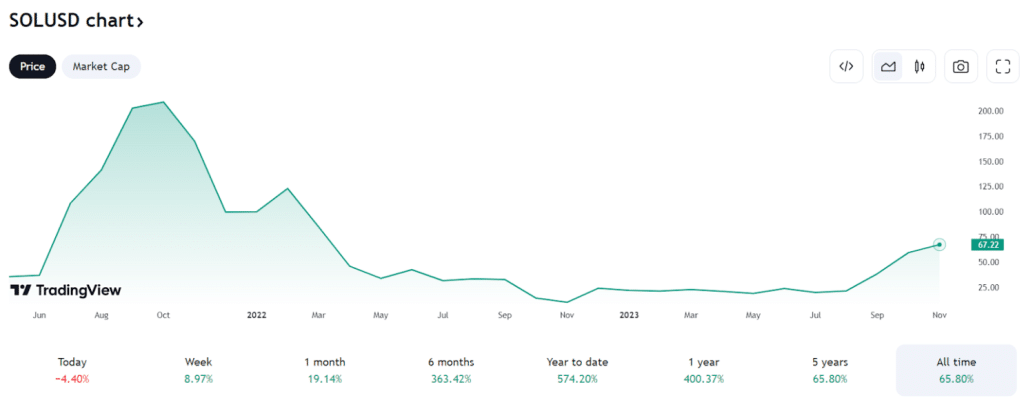

Cryptocurrency values are volatile, which brings upside opportunities as well as risks. Solana (SOL), a popular smart-contract cryptocurrency, surged nearly 9,500% from launch to reach an all-time high of $260.

A year later, SOL fell below $10. Like all assets, cryptocurrencies carry price risk.

But there are other safety considerations as well — and ways to mitigate risks.

- Price risk: As a young asset class with relatively low trading volume, crypto values are volatile. When building a position, consider dollar-cost averaging — buying over time to lessen the effect of market volatility.

- Platform risk: Crypto exchanges offer a convenient way to store your cryptocurrency with custodial wallets, but they also control the private keys to the wallet. If the exchange freezes withdrawals or becomes insolvent, your crypto is at risk. Consider moving larger balances to a self-custody wallet you control. We’ll cover crypto wallets in just a bit.

- Smart contract risks: Smart contracts are powerful tools but can also be vulnerable to hacks, bugs, or malicious code. Research protocols carefully before connecting to a smart contract. Look for code audits by trusted security firms.

- Political risk: Governments can make it difficult or even illegal to trade certain cryptocurrencies. In 2021, China banned crypto trading and mining. Make political risk part of your buying decision.

- Rug pulls and abandonware: Promising crypto projects may not ever get off the ground, becoming abandonware; some projects or protocols may even be scams. Again, due diligence becomes a top priority.

Crypto Safety vs. Traditional Finance

In many ways, crypto can be safer than traditional assets due to its transparency. The code for smart contracts is often available to view, giving the community a way to identify issues or concerns. Code audits also highlight smart contract features and risks.

Many cryptocurrencies also limit supply. Bitcoin is limited to 21 million coins. Ethereum (Ether) supply is not strictly capped. However, the protocol burns base transaction fees, making the ETH slightly deflationary, given current market conditions.

By contrast, traditional currencies like the USD typically expand in supply. For example, M2, a measure of the US money supply, increased by 155% in the ten years following Bitcoin’s launch. During the same period, bitcoin’s value climbed from less than a penny to over $3,800.

Several countries are also experiencing hyperinflation with fiat currencies. Venezuela suffered 400% inflation in 2023 as the bolivar’s value collapsed.

Where to Store Crypto?

Most new crypto investors store their crypto on the exchange where they made the purchase. Modern exchanges use cold storage, keeping assets stored in offline crypto wallets. While convenient, this structure also means the exchange holds the private keys that control your assets.

Between 2011 and 2014, hackers reportedly siphoned off thousands of bitcoins from the Mt. Gox exchange. More recently, the CEO of the FTX exchange was convicted of fraud, allegedly using (losing) customer deposits in other risky trades.

Exchanges themselves can be a risk, but there’s also a risk that someone could gain access to your account. This risk parallels the risks found with online banking.

As a self-custody alternative, you can use a crypto wallet. Self-custody crypto wallets hold the private keys that control your crypto.

- Hot wallets like MetaMask for Ethereum or Electrum for Bitcoin generate and store the private keys on a device that can connect to the internet. Hot wallets are apps that run on a computer or mobile device.

- Cold wallets, typically hardware devices, store your private keys but do not connect to the internet. These devices then communicate with your computer or mobile device to authorize or decline transactions. Popular choices include Trezor and Ledger devices.

How Can You Use Cryptocurrency?

In many cases, cryptocurrency serves as a utility token on the network. ETH and SOL are good examples; both tokens serve as “gas” to power transactions, including smart contracts. This demand can give crypto value. Other cryptocurrencies, like Bitcoin, were intended to be used as money.

Here are some of the ways you can use cryptocurrency:

- Use crypto as money: Hundreds of merchants ranging from Newegg to Burger King accept cryptocurrency. Additionally, crypto-funded debit cards like the Coinbase card or BitPay card let you spend your crypto like cash.

- Part of an investment portfolio: Some crypto tokens can make promising investments. Chainlink, for example, is a company that plans to connect private and public blockchains, possibly making real-world assets available anywhere in tokenized form. The company’s token (LINK) is typically seen as an investment rather than a currency.

- Earn DeFi yields: DeFi protocols like Aave and Radiant provide a way to earn a yield by lending cryptocurrency without an intermediary. The entire process is powered by smart contracts.

- Earn staking rewards: By staking your crypto, such as ETH or SOL, you can earn a yield much higher than most bank savings accounts.

- Cross-border transactions: Often, sending crypto is the cheapest way to send money to others, especially compared to payment services like MoneyGram or Western Union.

- Store of value: If you choose carefully, cryptocurrency can be an effective store of value, similar to old or silver (but easier to transport).

- Transact privately: Crypto networks allow you to transact without revealing your identity or sharing your buying preferences with financial institutions.

How to Use Cryptocurrency for Secure Purchases

Online vendors that support crypto purchases use a built-in process.

For example, when shopping for a computer with Newegg, you can pay with Bitcoin.

- Add the item to your cart.

- Select your shipping method.

- Choose “Bitcoin” under billing.

- Open your Bitcoin wallet app.

- Scan the provided QR code or copy and paste the provided payment address.

- Complete the transaction in your Bitcoin wallet.

- Watch your email for a confirmation.

Payment completion times vary by network.

Alternatively, you can use a crypto card like the Coinbase Visa. Coinbase’s card lets you allocate crypto to the card and spend it like cash. Coinbase also pays crypto rewards (up to 3%) for purchases made with the card. Rewards change each month.

Best Crypto Exchanges

When you’re ready to buy crypto, a centralized trading platform offers the easiest path. Leading exchanges provide multiple payment options, including bank transfers, debit cards, or even PayPal in some cases.

Consider these platforms if you’re just getting started:

eToro

Founded in 2007, eToro led the market with innovative features like its copy trading feature. The option lets you view the trading stats of lead traders and select a trader to follow. When the lead trader makes a trade, the trading balance you allocated to the copy trade also makes the same trade. Copy trading lets anyone trade like an experienced trader.

eToro also offers a demo account so you can practice trading without risking real money.

The eToro platform offers 80+ cryptocurrencies alongside stocks and exchange-traded funds. Tradable assets vary by location.

eToro Overview

| Number of cryptocurrencies | 80+, including BTC, ETH, SOL, DOGE, ARB, HBAR |

| Payment methods |

|

| Trading fees | 1% + spread |

| Cost to buy $100 worth of Bitcoin | $1.00 |

Pros

- Beginner-friendly platform

- Predictable trading fees

- Copy trading

- Demo account

Cons

- Withdrawal fee

- Inactivity fee

- Smaller crypto selection

Coinbase

Coinbase is now the largest publicly traded crypto exchange in the world and is among the most trusted platforms for buying and selling cryptocurrencies. The platform provides Simple Trades, a newbie-friendly way to buy, sell, and trade as well as an advanced trading platform with lower trading fees.

A Visa crypto card lets you spend your crypto like cash while also earning crypto rewards.

The Coinbase exchange offers 250+ tradable cryptocurrencies a monthly subscription option that allows you to trade without fees.

Coinbase Overview

| Number of cryptocurrencies | 250+, including BTC, ETH, SOL, ADA, LINK, AVAX, TIA |

| Payment methods |

|

| Trading fees |

|

| Cost to buy $100 worth of Bitcoin | $0.60 – Coinbase Advance limit order |

Pros

- Beginner-friendly platform

- Wide crypto selection

- Connect to Coinbase Wallet

- Crypto rewards card

Cons

- Higher fees for Simple Trades

- Busy interface

Kraken

Founded in 2011, Kraken is one of the oldest crypto exchanges and has built a strong reputation in the crypto community. The exchange offers both an easy-to-use trading platform and an advanced platform called Kraken Pro.

Additional crypto features include staking services (not available in the US) and margin trading for qualified accounts. The platform also offers futures trading in select markets.

Kraken Overview

| Number of cryptocurrencies | 240+, including BTC, SOL, ETH, AVAX, ADA, DOGE, TIA |

| Payment methods |

|

| Trading fees |

|

| Cost to buy $100 worth of Bitcoin | $0.16 – Kraken Pro limit order |

Pros

- Easy-to-use platform

Proof of reserves

Margin and futures trading for qualified accounts

Cons

- High fees for debit cards

- Scaled-down service in the US

How to Invest in Cryptocurrency

Earlier, we discussed ways to buy cryptocurrency. The most common of these methods is to use an exchange like Coinbase or a broker like eToro.

To invest in cryptocurrency on eToro, you can follow these simple steps.

- Visit eToro to open an account. Follow the prompts to provide your name, address, email, and phone number.

- Verify your identity. To comply with regulations, eToro requires a copy of your government-issued identification.

- Deposit funds for trading. Connect a bank account, debit card, or PayPal account. You can trade with as little as $10 on eToro.

- Choose a cryptocurrency. Many new traders start with BTC, but eToro offers 80 tradable cryptos.

- Make your crypto purchase. Search for the cryptocurrency you selected, then tap the trade button and complete the trade details to open your trade.

Top Cryptocurrencies

Many new crypto investors choose top cryptocurrencies as an initial investment. For instance, crypto market studies from 2023 show about 420 million crypto owners worldwide, with 219 million (more than half) Bitcoin owners globally. Bitcoin is still king in the crypto market.

Leading cryptocurrencies you can consider include:

- Bitcoin (BTC)

- Ethereum (ETH)

- BNB (BNB)

- Ripple (XRP)

- Solana (SOL)

- Cardano (ADA)

- Avalanche (AVAX)

- Dogecoin (DOGE)

- Tron (TRX)

- Polkadot (DOT)

- Polygon (MATIC)

- Chainlink (LINK)

Established cryptocurrencies provide larger trading markets and may bring less risk. However, future returns might not mirror the early days when each of these assets rose from much lower prices.

New Cryptocurrencies

You can also consider new cryptocurrencies or lesser-known projects with room to grow. These might include coins and tokens that solve a problem or improve upon older crypto protocols.

Here are several you can consider:

- Celestia (TIA)

- Sei (SEI)

- Internet Computer (ICP)

- Fetch.ai (FET)

- Kaspa (KAS)

- Hedera (HBAR)

- Fantom (FTM)

- Seamless (SEAM)

Cryptocurrency Legality

Crypto trading is legal in most countries throughout the world.

However, regulations vary, and in some jurisdictions, there remains some confusion over which cryptocurrencies must be registered as securities and which are more likely to be commodities.

In the US, the SEC has sued several exchanges, including Coinbase and Kraken, for selling “unregistered securities.”

What is a Security?

In the US, a security is an investment contract, meaning the buyer has an expectation of financial return based on the efforts of others. Whether an asset is a security has historically been determined by the “Howey Test,” which is comprised of four elements:

- An investment of money

- In a common enterprise

- A reasonable expectation of profit

- Derived from the efforts of others

A lack of regulatory clarity in the US and elsewhere could create challenges for trading if exchanges stop supporting crypto assets targeted by government agencies.

In recent filings, the SEC named several cryptocurrencies as securities.

- SOL

- ADA

- MATIC

- SAND

- ICP

- DASH

- NEXO

However, many in the crypto community disagree.

Crypto Legal Tender

Cryptocurrencies can serve the same function as money in private trade, but most governments don’t see cryptocurrencies as legal tender.

Currently, just two countries have passed legislation to accept cryptocurrency as legal tender.

Central African Republic: Bitcoin

El Salvador: Bitcoin

Crypto Taxes

Many jurisdictions like the US and the UK see cryptocurrencies as property. This means gains on crypto are usually taxable.

Naturally, earnings paid in crypto are taxable as well, much like any income.

In the US, for example, the following are all taxable events:

- Capital gains

- Staking earnings

- Mining earnings

- Airdrops

- Crypto payments

- Interest and yields from crypto protocols

- Interest from lending crypto

The US collects taxes in US dollars, so all transactions must be converted to USD value at the time of the transaction to determine the taxes due.

Should You Invest in Cryptocurrency?

Cryptocurrencies and blockchains promise to revolutionize financial markets and reach our everyday lives as real-world assets become tokenized, making their value accessible from anywhere.

However, with thousands of blockchain projects underway, it’s fair to say that not all will succeed and that some projects may just never gain the needed traction.

It’s often best to balance the risk and potential reward of cryptocurrency by allocating a portion of your total investment portfolio to cryptocurrencies you’ve researched and understand well.

Two time-tested investment strategies can help mitigate the risk.

- Diversification: If you choose to invest in cryptocurrency, consider buying more than one to diversify your portfolio. But also consider making cryptocurrency part of a larger diversified portfolio that includes several sectors.

- Dollar-cost averaging: Crypto prices are volatile, and with relatively small market capitalization, trading prices for coins and tokens can be pushed around by outside influences like news. Dollar-cost averaging, buying a fixed dollar amount on a set schedule, helps to smooth out purchase prices and optimizes your purchases by buying more when prices dip.

Pros and Cons of Cryptocurrencies

Let’s explore some of the advantages and disadvantages of digital assets.

Pros

- Potential inflation hedge

- Fast transaction speed

- Cross-border money transfer

- Decentralization makes crypto the people’s money

- Trustless transactions without an intermediary

Cons

- Price volatility

- Regulatory uncertainty

- Difficult wallet management

Read More: Pros and Cons of Bitcoin

References

- https://finance.yahoo.com/news/celebrating-bitcoin-pizza-day-time-163536216.html

- https://github.com/bitcoin/bips

- https://roadmap.cardano.org/en/shelley/

- http://www.hashcash.org/papers/hashcash.pdf

- https://www.peercoin.net/docs/proof-of-stake

- https://www.blockchain.com/explorer

- https://etherscan.io/

- https://ca.finance.yahoo.com/news/solana-still-buy-2022-182500912.html

- https://www.reuters.com/world/china/china-central-bank-vows-crackdown-cryptocurrency-trading-2021-09-24/

- https://consensys.io/blog/what-is-eip-1559-how-will-it-change-ethereum

- https://fred.stlouisfed.org/series/M2SL

- https://www.usnews.com/news/best-countries/slideshows/the-10-countries-where-inflation-is-the-highest?onepage

- https://www.justice.gov/opa/pr/russian-nationals-charged-hacking-one-cryptocurrency-exchange-and-illicitly-operating-another

- https://www.reuters.com/legal/ftx-founder-sam-bankman-fried-thought-rules-did-not-apply-him-prosecutor-says-2023-11-02/

- https://www.sec.gov/news/press-release/2023-102

- https://www.sec.gov/news/press-release/2023-237

- https://www.coindesk.com/policy/2023/06/08/solana-foundation-sol-is-not-a-security/

Ben Beddow

Ben Beddow

Connor Brooke

Connor Brooke

Nick Pappas

Nick Pappas