Bitcoin Price Prediction 2024 – 2030

Bitcoin remains the world’s largest cryptocurrency, used by millions of people globally as a way to make payments or as an investment vehicle. Although Bitcoin has periods of volatility, its first-mover status means it’ll likely stay at the top of the pile for years to come.

This article presents our in-depth Bitcoin price prediction, diving into the coin’s price history and making several forecasts for the future. We’ll also explore where investors can buy Bitcoin today before highlighting an alternative project that could rival BTC in the coming years.

Bitcoin, along with the rest of the crypto market, has reacted positively to the approval of Bitcoin ETFs in January 2024, an event that pushed Bitcoin prices above $60,000. Bitcoin hit its all-time high on March 8th 2024, crossing $70,000 and marking the highest price in its 15-year history.

Bitcoin Price Prediction Summary

Is Bitcoin a good investment? This is a question that crosses the minds of many investors. Throughout this article, we’ll explore our BTC price prediction in detail, highlighting our price estimates for the coin over the coming years. Below, you will find a brief overview of these estimates:

- End of 2024: With Bitcoin hitting a new all-time high in March, its growing popularity, the approval of bitcoin ETFs, an approaching Bitcoin Halving, and layer 2 advancements, the future looks bright for Bitcoin. As more and more people adopt it, there’s potential for it to continue growing in value in 2024, potentially even reaching a remarkable $90,000 by the end of 2024.

- End of 2025: Our analysis estimates that the BTC price could hit $101,000 by the end of 2025, with institutional adoption continuing to grow and the effect of the 2024 Bitcoin Halving expected to be felt in this year, with both of these factors combining to push Bitcoin briefly into the realm of six figure valuations before retracing below $100,000.

- End of 2026: Despite all the institutional adoption over the previous two years, Bitcoin is predicted to continue to stick to its four year cycle and decrease in value in 2026, dropping as low as $40,000, before rebounding and finishing the year at $60,000.

- End of 2030: The uptake of cryptocurrencies continues to surge, as crypto regulations around the globe give investors a framework to operate in and merchants are accepting cryptocurrencies as payment for goods and services. Bitcoin remains the gold standard of cryptocurrencies, and maintains a valuation around the $150,000 mark in 2030 despite a post-Halving-high drop.

History of the Price of Bitcoin

The first BTC transaction occurred in January 2009, and in the years that followed, Bitcoin became increasingly popular amongst internet users who wished to remain anonymous. This anonymity was made possible through Bitcoin’s innovative use of blockchain technology, which allowed network users to send and receive BTC without providing personal information.

The Bitcoin crypto price had its first bull run in late 2013, a year after the 2012 Bitcoin Halving event, and saw the Bitcoin price increase by almost 10,000% in just a few months. The next upward surge didn’t occur until mid-2017, a year after the 2016 Halving event, when the price of Bitcoin rocketed by 1,694% in under 11 months. By December 2017, Bitcoin was trading around the $20,000 level.

After a few more years of peaks and troughs, Bitcoin entered the limelight, as the coin’s price went on a huge bull run between March 2020 and April 2021, hitting highs of $59,890.02. After a temporary fall, BTC’s price recovered and surged to an all-time high of $68,789 in November 2021.

However, the Bitcoin stock price couldn’t sustain these remarkable highs and immediately plummeted, entering a sustained bear phase that saw the coin lose 50% of its value. After a brief hiatus, the second leg of this bear phase commenced, causing BTC’s price to drop to the $18,000 region. This continued until the start of 2023, which is when the leading crypto started spiking in value once again.

The first half of 2023 was excellent for BTC, with the price almost doubling since the start of the year, reaching $31,000 at the end of June. This was due to a slew of institutional interest, including major asset managers applying for spot Bitcoin exchange-traded funds (ETFs). Bitcoin closed 2023 above $42,000.

Numerous Bitcoin ETF applications were submitted to the United States Securities and Exchange Commission (SEC) in 2023, and the SEC approved all 11 of the Bitcoin ETF application it had received in January 2024, which, along with the Bitcoin Halving due at the beginning of Q2 2024, were deemed as a potentially explosive combination for the Bitcoin price.

So far in 2024 Bitcoin has seemed to agree to this “explosive” description, gaining over 65% in the first two months of the year and recording a new all time high of $70,086.70 on March 8th, 2024. This was the second time it hit a new ATH this month, with the last one coming on March 5th. The march 5th ATH was followed by a 10% over 6 hours, which was quickly regained. However, this ATH, which was a peek above $70,000 for less than a minute, was not followed by the same level of retracement, and Bitcoin is currently trading just 2.36% down from this level.

Before moving on to our Bitcoin price predictions for the years ahead, let’s recap the key points to bear in mind:

- Bitcoin (BTC) was conceptualized in late 2008 and officially ‘launched’ in early 2009

- BTC’s first bull run occurred in 2013 when the coin’s price rose by 10,000%

- BTC’s second major bull run was in 2017, when the coin’s value rose by 1,694% in just under 11 months

- Bitcoin showed sustained bullish momentum in 2020 and 2021, reaching an all-time high of $68,789 on November 10, 2021

- After hitting this all-time high, BTC’s price sank by 67% between November 2021 and February 2022.

- The first half of 2023 was excellent for BTC as the price nearly doubled from January to July, reaching a local high just shy of $32k amid a flurry of spot Bitcoin ETF applications from major asset managers. Bitcoin ended 2023 valued at just over $42k.

- ETF approvals were granted by the SEC in January 2024.

- Bitcoin hit its 15-year all-time-high in March 2024, briefly topping $70,000 for the first time ever.

- With the growing utility of the Bitcoin blockchain, and an upcoming Bitcoin Halving, bullish sentiment is largely expected to continue growing in 2024.

Will Bitcoin Ever Recover?

Many would look at the chart and say that Bitcoin, just 2.36% off its new ATH from March, has already recovered. But, while the global economy and cryptocurrency markets seem to have weathered the economic storm of the past few years well, there is still uncertainty about the future.

However, with a Bitcoin Halving event happening in early 2024 (events which have historically been followed by a bull market that peaks 12–18 months afterward), a new crypto-friendly president in Argentina, Bitcoin ETFs being approved at the beginning of 2024, and regulations for cryptocurrencies taking shape around the world, many would say Bitcoin’s continuing road to recovery is well paved—and that it is already walking that road.

There is, of course, nothing set in stone—especially in the wild world of cryptocurrencies.

Bitcoin Halving in 2024

Bitcoin Halving events occur approximately every four years, cutting the reward received for mining Bitcoin in half. The halving policy was written into Bitcoin’s mining algorithm to fight inflation and maintain scarcity, automatically executing at a predetermined time, without requiring the input of a third party.

Nobody knows the exact date of the next halving, but data suggests that it is going to happen around April 21 2024. This would be almost precisely four years since the previous halving event.

If the demand for Bitcoin remains steady, a reduction in the rate at which Bitcoin is being issued is likely to result in a price increase—and the combination of a reduced emissions rate, an overall limited supply, and FOMO from institutional investors with new access to this asset will only help to inflate demand. To add to this, Bitcoin prices have, historically, shown a tendency to increase 12–18 months following Bitcoin Halving events, hitting new all-time highs in the process.

Some believe the upcoming Halving is likely to trigger a trading frenzy, as traders may attempt to capitalize on this event by investing in Bitcoin ahead of the April 2024 Halving, hoping that the Halving will increase the value of their Bitcoin holdings.

How Did SEC Bitcoin ETF Approval Affect the Bitcoin Price?

The approval of bitcoin ETFs by the SEC was met with huge excitement by the crypto-sphere. Exchange-traded funds or ETFs are a straightforward way to invest in assets without having to acquire those assets directly. Since ETFs are easily tradable on stock exchanges, the SEC’s approval of bitcoin ETFs was anticipated to bring Bitcoin—and subsequently other cryptocurrencies—further into the financial mainstream and increase the price of the underlying asset, i.e., Bitcoin.

In the months running up to the Bitcoin ETF approval deadline, which was pushed back multiple times, investor speculation drove prices from ~$26k to bring Bitcoin within touching distance of $48k just days before the approval deadline.

After Bitcoin ETFs were approved—and after a hack to the SECs Twitter falsely tweeted that Bitcoin ETFs were approved just the day before—the price of Bitcoin actually declined, eventually dipping below $40,000 before gaining upward momentum to climb past $50,000, pausing at resistance at $52,000, before blasting past $60,000 at the end of February, as Bitcoin ETFs broke their own impressive trading volume record on the same day. It then started March by breaking its ATH twice, topping $70,000 for the first time.

Bitcoin Price Prediction 2024

Looking at Bitcoin’s price chart, it would seem like the world’s top cryptocurrency has started a bull run. Certainly, as mentioned, the scales seem to be tipping this way in 2024.

The most hyped Bitcoin Halving event ever is going to occur as the world, seemingly and hopefully, continues to recover from the economic crisis that has come in the aftermath of the global pandemic.

The regulatory framework for cryptos around the globe is continuing to improve, and we could also see more countries declare some form of cryptocurrency as legal tender in 2024—with Bitcoin and/or stablecoins the most likely candidates.

The SEC’s approval of multiple, spot Bitcoin ETF applications in January has already helped to drive institutional money into Bitcoin, helping the BTC price to increase over 47% in the first 2 months of the year, driving it above $60,000 for the first time since November 2021, before hitting a new ATH twice in early March, climbing above $70,000 for the first time.

While the price impact of the Halving is, historically, not felt until 12–18 months after the actual event itself, all the hype around Bitcoin adoption and ETF approval could change that narrative, and the Halving event might be a catalyst for a bull market 12 months earlier than many think.

Provided that nothing untoward happens, our prediction for Bitcoin’s price in 2024 is a staggering $90,000. Our potential low prediction for Bitcoin in 2024 is $36,000. Other predictions, like one from investment bank Standard Chartered, predict BTC can break six figures by the end of 2024.

Bitcoin Price Prediction 2025

From our current vantage point, 2025 looks to be a good year for Bitcoin, our Bitcoin forecast, and the Bitcoin price.

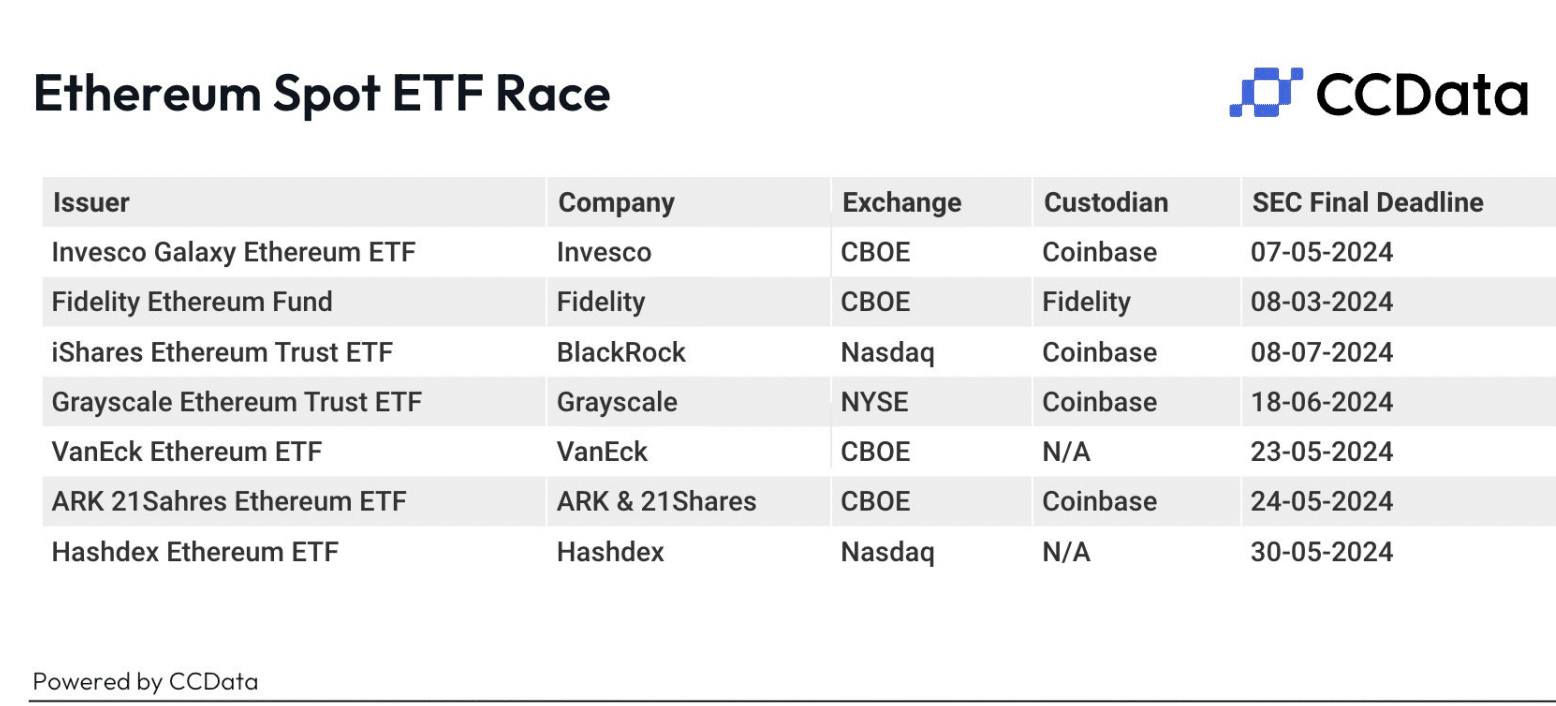

Institutional adoption of cryptocurrencies started to gather pace in 2024, and the potential for Ethereum ETF approval in 2024 will only rouse further investor interest in cryptocurrencies as the existence of such investment vehicles is seen by many as indicative of a positive regulatory future for cryptocurrencies.

Bitcoin will always remain one of the best long-term crypto projects due to its appeal amongst retail investors and those with limited market knowledge. Whenever newcomers wish to get involved with crypto, they naturally gravitate towards BTC, as it is viewed as the ‘safest’ option due to its popularity. Again, this is another factor that will play a role in sustaining demand.

In addition, our Bitcoin price prediction remains optimistic due to how well-placed the coin is to weather any storm. Not only is Bitcoin becoming more popular amongst investors, but it is also becoming more popular amongst politicians, as they realize that Bitcoin and crypto are growing in popularity with their constituents—a trend we expect to see continue into 2025 and beyond. There are also more than 34,000 Bitcoin ATMs worldwide, highlighting that the coin isn’t going away anytime soon.

All these points seem to point towards a future where Bitcoin no longer experiences the exponential price increases of days past. However, there is one final factor affecting a Bitcoin price forecast for 2025, and that is the Halving event of 2024.

Based on data from Bitcoin’s last 4 Halving, Bitcoin experiences explosive growth 12–18 months after the Halving event occurs, which means that this is set to happen in the middle of 2025—meaning that a bull run akin to 2017 or 2021 is potentially on the cards.

All of these elements combine to add support to the idea that, although Bitcoin’s exponential price increases may be a thing of the past, the coin still has great investment potential. Given the historical boom-bust cycle that has been present during Bitcoin’s lifetime, it could be expected that BTC and the rest of the crypto space could mimic the bull run of 2021 in 2025.

As such, our Bitcoin price prediction 2025 estimates the coin’s price could hit a high of $101,000 in 2025, peaking at about the $100,000 mark before retreating below it. We also predict a yearly low of $55,000.

Moreover, our Bitcoin price prediction 2030 forecasts that the price could exceed this level – thereby leading to another new all-time high. Other analysts have also weighed in on the future price of Bitcoin, with Bernstein analyst Gautam Chhugani stating that the firm believes Bitcoin could hit $150,000 by 2025.

Bitcoin Price Prediction 2026

While 2025 is predicted to bring new highs to the Bitcoin price as a result of the Halving, 2026 is expected to be less fruitful for investors. As Bitcoin continues to follow its four-year cycles 2026 is expected to be when the Bitcoin price experiences a downturn in the aftermath of the 2025 Bitcoin Halving induced highs.

That being said, with institutional access and investment in Bitcoin and the cryptocurrency market continuing to expand and grow as crypto regulations continue to take shape and increase investor confidence in digital assets, the drops between 2025 and 2026 are not expected to be as drastic as Bitcoin’s previous post-Halving drops.

This is why our Bitcoin price prediction for 2026 has a high of $85,000 and a low of $40,000, but an average of $60,000, as investors capitalize on the discounted price of Bitcoin.

Bitcoin Price Prediction 2030

Now, let’s delve into the future of Bitcoin’s price over the long term. Bitcoin is currently the only coin to be receiving support from both the crypto and traditional financial sectors, which sets it apart from other cryptocurrencies and bodes well for its long-term prospects. Today it is widely seen as ‘digital gold’ by members of both the crypto and traditional finance sectors, and we can expect this narrative to persist into the long term and help to support sustained, higher prices for Bitcoin.

We also expect the availability, accessibility, and, most importantly, the use of crypto to continue to grow. We don’t expect Bitcoin’s position as the flag bearer for the crypto movement to falter, and this position will likely only be strengthened as the adoption of cryptocurrencies grows. Everything is boding well for the future price of Bitcoin to remain strong.

One final thing affecting the Bitcoin price in 2030 might be the Bitcoin Halving event of 2028. If, as said before, we follow historical trends, then Bitcoin is likely to peak in 2029 with new all-time highs induced by the Halving of 2028, and 2030 is when we’ll be coming down from these highs. While the Bitcoin price might not be as high as it would be in 2029, our Bitcoin predictions include Bitcoin sustaining much higher prices than many might expect as the now mainstream adoption of cryptocurrencies and Bitcoin help to cushion the drop in price.

As a result, our 2030 prediction for the price of Bitcoin is that prices will be sustained around $150,000, with a high of $165,000 and a low of $130,000, as Bitcoins price shows stability. The CEO of Ark Invest, Cathie Woods, stated on the Coin Stories podcast that her company forecasts Bitcoin trading hands for as much as $1.48 million by 2030.

Bitcoin Price Potential Highs & Lows

Bitcoin will likely remain one of the market’s top trending cryptos for years to come, providing a solid platform for sustained growth in the Bitcoin price. With that in mind, the table below presents an overview of our Cryptonews predictions and price forecasts for the coming years, ensuring investors know which levels could act as support or resistance.

| Year | Potential High | Potential Low |

| 2024 | $90,000 | $36,000 |

| 2025 | $101,000 | $55,000 |

| 2026 | $85,000 | $40,000 |

| 2030 | $165,000 | $130,000 |

What Other Analysts Predict for Bitcoin’s Price

As it might’ve been noticed, we are not alone in making Bitcoin price predictions. With that said, here we’ve rounded up some Bitcoin future predictions from other website and analysts.

On the Changelly blog, Daria Morgen predicts that Bitcoin will surpass $100,000 in 2025 and be worth over half a million dollar in 2030, with a high of $820,623, and a low of $693,732 in 2030.

Changelly

In a Twitter post, CryptoCon, the creator of the Halving Cycles Theory, predicts that Bitcoin could top out as high as $180,000 in late 2025.

CryptoCon

George Tung of TheStreetCrypto predicts that Bitcoin will top out at “around $200,000” in 2025.

George Tung

The Fidelity Investments group’s Director of Global Macro, Jurrien Timmer, predicts that Bitcoin will see a large seven figure range, between $1–$10 million, in 2030.

Jurrien Timmer

The CoinCodex website uses algorithms to predict that if Bitcoin continues to grow at the average 22% per annum it has so far then it could hit $140,070 by 2030 and $1.26 million per coin by 2040.

CoinCodex

Where is the Best Place To Buy Bitcoin?

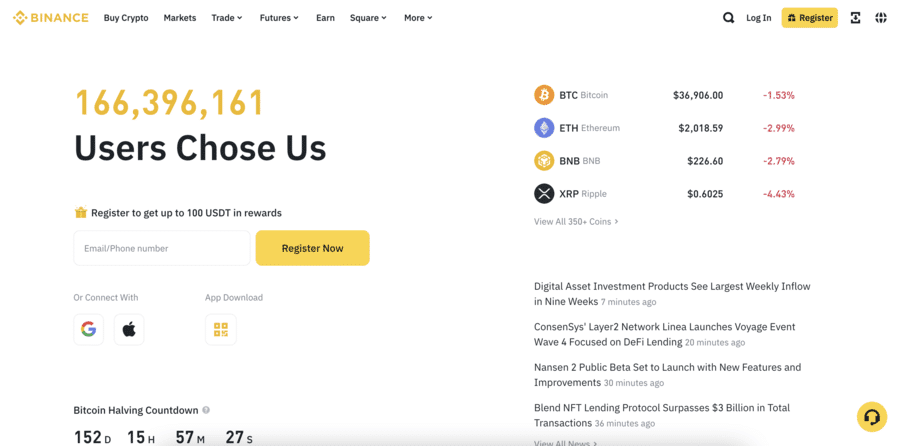

Binance is one of the leading exchanges in the world and quite possibly the best place to purchase Bitcoin. It generated over $21 billion in revenue in 2021 and offers a huge suite of products and services to customers. The spot trading price is a mere 0.1% and it has strong liquidity.

It has over 166 million users as well as a dedicated NFT marketplace and its own decentralized smart chain and native token (BNB). It has its proprietary non-custodial wallet to connect to the world of Web3 – tokens can be swapped cross-chain at a reasonable price.

It provides future products, APY for staking coins, an auto-invest feature, loans, and a project launchpad. Many of these are useful mechanisms for long-term wealth generation. It’s a comprehensive ecosystem and the world’s largest exchange by trade volume, by a significant margin. Binance offers proof of reserves and strong cybersecurity protocols including automatic 2FA for accounts.

Signup is quick and easy, taking less than 5 minutes to verify emails or phone numbers. The Binance interface is also very easy to use, making the purchase process smooth for market newcomers. Plus, if you ever want to sell or swap your Bitcoin, there is plenty of choice with Binance, the world’s largest exchange.

Is Bitcoin the Best Crypto To Invest in Today?

Before rounding off our Bitcoin prediction, it’s important to discuss whether BTC is the best crypto to buy right now, given the ongoing macroeconomic situation.

Bitcoin remains one of the ‘safest’ investments in crypto. However, with BTC currently priced around $68k an increase in price to $100k—which would take considerable volume and would mean that crypto was in a full bull run—would equate to a 47% profit, or a $47 return on every $100 invested.

Yet, even throughout the ongoing bear market, many projects have provided significantly higher ROI because they offer a high-risk high-reward opportunity.

Examples include the likes of Pepe, Sponge, Smog, and Dogwifhat, which all offered returns to the tune of thousands of percent in days or weeks rather than just hundreds of percent.

One new project that could outpace Bitcoin in the coming months is Bitcoin Minetrix, a unique project gaining traction in the investor community.

What is Bitcoin Minetrix?

While Bitcoin is the largest cryptocurrency in the world, many investors are interested in new alternatives that could potentially offer high growth potential. One such cryptocurrency asset is Bitcoin Minetrix ($BTCMTX) – a new project that revolves around the democratization of bitcoin mining through a stake-to-mine cloud mining platform.

Bitcoin Minetrix is not associated with any existing Bitcoin mining pools or companies. Instead, it is raising funds to build out a proprietary cloud mining platform where users will be able to stake their $BTCMTX to earn non-transferable Cloud Mining Credits. These Credits can then be burned to earn cloud mining power time that users can put to work mining Bitcoin.

In this way, Bitcoin Minetrix democratizes the mining and distribution of the world’s largest and most popular cryptocurrency, providing the average person with the ability to mine bitcoin without having to invest the time and money into purchasing and maintaining the hugely expensive mining rigs and mining farms. Read the whitepaper to learn more about how the Bitcoin Minetrix platform will work.

Bitcoin Minetrix may also be hitting the market at the perfect time, as some of the least profitable miners are expected to close up shop after the Halving, as they are no longer able to maintain profitability. This leaves the perfect space to be filled by opportunistic cloud miners.

The Bitcoin Minetrix presale has already raised almost $12 million of a target of $30 million to build out the stake-to-mine cloud mining platform. Those who contribute to the presale at the current stage can immediately stake their tokens to earn an APY, currently sitting at 58%.

Once the Bitcoin Halving has passed and this token hits exchanges it could explode in popularity. Follow Bitcoin Minetrix on X and join their Telegram channel to learn more and to receive presale updates.

| Presale Started | 29 September 2023 |

| Purchase Methods | ETH, USDT, Card |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

Bitcoin Price Prediction – Conclusion

To conclude, this Bitcoin future analysis has taken an in-depth look at the coin’s prospects, diving into the factors that could affect its price in the near and long term future.

The fact that Bitcoin hit a new all-time high twice already this year, along with its first-mover status and strong reputation should ensure it remains a market stalwart for years to come. With the next Bitcoin Halving approaching, many analysts are also excited by strong signs that the incoming bull run could be just the beginning. Having said that, crypto price prediction is certainly not set in stone, and there may be unforeseen events that end up changing the Bitcoin outlook for the next decade.

In terms of Bitcoin alternatives, investors looking to attain market-beating returns might also consider Bitcoin Minetrix. Currently on presale, it is trading at a discount in its current stage, offering early contributors a good staking APY, and looks to allow platform users to take advantage of the upcoming Bitcoin halving event.

$BTCMTX is priced at only $0.0139 in the current presale round.

Bitcoin Prediction FAQs

What will Bitcoin be worth in 2024?

Our Bitcoin price prediction for 2024 estimates that the coin could see highs of $90,000 by the end of the year, with potential lows of $36,000.

What will BTC be worth in 2025?

Our research and analysis has Bitcoin trading in a range between $55,000 and $101,000 in 2025.

What will Bitcoin be worth in 2030?

Making Bitcoin future predictions that far ahead is challenging; however, we estimate that BTC could reach highs of $160,000 in 2030. This is based on increasing institutional adoption and much greater accessibility and usage of Bitcoin, for and by the average global citizen in 2030.

What was the starting price of Bitcoin?

According to various reports, Bitcoin’s starting price was $0.09 back in July 2010. Prices remained around this level throughout 2010 before surging to $1 in February 2011.

What was Bitcoin’s highest price?

Bitcoin’s highest price was $70,086.70, which occurred on March 8th, 2024.

Is Bitcoin a good investment?

Bitcoin has proved to be a good investment in the past for investors with a high-risk tolerance level. It could still be a good investment for those who believe the coin is trading at a discount ahead of a potential bull run later in 2024.

References

- Why Bitcoin Hit its All-Time High – Time

- How close are crypto markets to first spot bitcoin, ether ETFs? – Reuters

- US SEC approves bitcoin ETFs in watershed for crypto market – Reuters.com

- Bitcoin ETFs hit volume record of $7.6B – Blockworks.co

- CMC Bitcoin Halving 2024 – CoinMarketCap.com

- SEC Account Hack Renews Spotlight on X’s Security Concerns – Reuters.com

- Spot Bitcoin ETFs Attract $10B in AUM in Less Than a Month – Nasdaq.com

- Bitcoin could hit $150,000 by 2025, predicts Bernstein – CNBC.com

- Cathie Wood on Investing, Spot Bitcoin ETFs, $1 Million Bitcoin and What Drives Her – Youtube.com

- Bitcoin Minetrix Whitepaper – BitcoinMinetrix.com

- Bitcoin Halving Is Coming and Only the Most Efficient Miners Will Survive – CoinDesk.com