Litecoin (LTC) was the second cryptocurrency after Bitcoin and the first ever altcoin in the cryptocurrency market. The coin was a fork (upgrade) of Bitcoin, so it shares many features with the world’s largest cryptocurrency.

During its early days, Litecoin was the second-largest cryptocurrency after Bitcoin. Although Ethereum and other altcoins have thumped Litecoin today, the coin remains a top Bitcoin alternative. But, should you invest in Litecoin?

With a focus on addressing Bitcoin’s shortcomings, this guide explains everything you need to know about Litecoin, including how it works, a Litecoin price analysis, and the risks of investing in the cryptocurrency.

Litecoin Price

Investing in Litecoin goes beyond understanding what LTC is. Before investing in Litecoin, it is crucial to understand recent price trends to gather insights.

According to CoinMarketCap, the Litecoin price as of January 2024 is just over $65. The performance of the Litecoin price shows an inverse relationship with Bitcoin, which is unusual. Often, the LTC price links to Bitcoin price actions. So, a Litecoin price swing follows that of Bitcoin.

Litecoin has had an impressive journey since its inception. Like most cryptocurrencies, the coin had a significant spike in 2021, reaching an all-time high of over $400. The price later dropped to around $170 after a market correction, which is significantly higher than its price at the time of writing.

Factors Influencing Litecoin Price

Apart from the constant market volatility, Litecoin’s price can rise and fall for many other reasons. We highlight some of them below:

- Bitcoin Performance: As it’s an extension of Bitcoin, a parallel relationship exists between Litecoin and Bitcoin’s price actions. When Bitcoin experiences a price surge, Litecoin and the broader crypto market experience the same due to Bitcoin’s dominance. An adverse Bitcoin price action will likely result in a decline in Litecoin’s price.

- Broader Payment Adoption: Litecoin is at the forefront of digital payments, but newer cryptocurrencies are saturating the space. With more integrations with businesses, financial institutions and payment processors, Litecoin will experience broader adoption. Improved adoption will increase its demand and positively impact its price.

- Market Sentiment: Coin price actions in the crypto markets are usually influenced by the general market sentiment. A positive outlook among traders and investors can cause a spike in coin prices, including Litecoin. Conversely, negative news can dampen investors’ sentiment, resulting in quick price depreciation.

- Macroeconomic Factors: External factors such as regulation, inflation, currency devaluation and other government policies can also impact Litecoin’s price. For instance, a clear regulatory framework from the Securities and Exchange Commission (SEC) around crypto trading will boost investors’ confidence and crypto demand. The higher the demand for popular cryptocurrencies such as Bitcoin, the more likely the Litecoin price will increase.

What Is Litecoin?

So, what is LTC? Litecoin is a popular cryptocurrency created from a Bitcoin fork or upgrade in 2011. The blockchain and its proprietary token are the second oldest in the market, making Litecoin a long-standing crypto project.

The Litecoin blockchain was created to address crucial issues facing the Bitcoin network. These include scalability issues, high transaction fees and slower transaction processing times. Upon its engineering, the Bitcoin spin-off offered secure, fast and low-cost transactions.

For context, the average Bitcoin block creation speed is roughly 10 minutes, which can be frustrating for businesses accepting Bitcoin payments. Conversely, Litecoin generates new transaction blocks every 2.5 minutes, making it one of the most popular cryptocurrencies for fast digital payments.

So, while Bitcoin is more popular as a store of value, Litecoin has become a cryptocurrency for digital transactions.

How Does Litecoin Work?

What’s a Litecoin? Simply put, Litecoin is a Bitcoin spin-off, and both blockchains share many similarities.

Proof-of-Work Consensus

Like Bitcoin, the Litecoin blockchain runs using the Proof-of-Work (PoW) consensus mechanism. This means that it verifies transactions using miners. These miners solve complex arithmetic problems (hashes) to get transaction blocks assigned to them.

Once a miner closes a translation block, it is permanently closed and stored on the blockchain, so no one can alter it. In other words, Litecoin miners keep the blockchain running and provide security to avoid double-spending or manipulations.

Litecoin Mining

Mining Litecoin requires sophisticated hardware because the process is energy-intensive. In other words, LTC mining isn’t for everyone. Each Litecoin miner gets a block reward of 6.25 LTC after solving a hash completely and validating their transactions.

Scrypt PoW Architecture

Unlike Bitcoin, Litecoin uses a unique PoW variant to facilitate faster transactions. The blockchain deploys the Scrypt PoW model. The mining architecture is also present in Dogecoin’s transaction validation system.

Litecoin Halving

Similarly, Litecoin uses halving to control its circulating supply. The coin’s total supply is capped at 84 million coins. If miners get new LTC tokens after each block validation, the coin’s supply will keep increasing and cause a price fall.

However, with Litecoin halving, the blockchain reduces miners’ block rewards by 50% every four years. For instance, the block reward was 12.5 LTC before the last halving event, which reduced rewards to 6.25 LTC per block.

Use Cases and Applications of Litecoin

Besides being traded on cryptocurrency exchanges, Litecoin’s utility spans various sectors. The blockchain and its coin can be used for the following:

- Digital payments

- E-commerce payment integrations

- Cryptocurrency investments

- Litecoin staking

- Non-fungible tokens (NFTs) and digital collectibles

With its diverse use cases, especially staking possibilities, Litecoin offers both institutional and retail investors the opportunity to earn money from active trading and passive investments.

Who Created Litecoin?

Now that you know what LTC is, review its history to assess its growth over the years. Google engineer, Charlie Lee, created Litecoin in 2011 by modifying Bitcoin’s open-source code. Lee aimed to develop a Bitcoin rival that would solve many critical issues facing the blockchain at the time. These included slow transaction processing speeds, high transaction fees, and security issues.

At the same time, he wanted a cryptocurrency that focused more on payments than being a store of value, especially as BTC had become a major store of value at the time.

After a successful Bitcoin fork two years after the Bitcoin launch, Lee would build the first altcoin and a decentralized global payment network to facilitate cross-border transactions.

Since its launch in 2011, Litecoin has made tremendous contributions to the broader crypto ecosystem, especially to the Bitcoin network. As its blockchain is similar to Bitcoin’s, Litecoin was used to test various Bitcoin upgrades, including Segregated Witness (SegWit) and the Lightning Network. These features only went live on the Bitcoin blockchain after their successful tests on Litecoin.

Litecoin Market Performance

Although Litecoin was the second-largest cryptocurrency when it launched in 2021, it has been overtaken by newer altcoins such as Ethereum, Tether and Ripple. For instance, Litecoin is #19 among the top cryptocurrencies by market capitalization. As of January 2024, its market cap is around $4.8bn.

Comparatively, Bitcoin’s market cap is around $776bn, while altcoins such as Ethereum and Tether stand at about $265bn and $95bn, respectively. Litecoin’s current market performance suggests a drop in demand as businesses and traders opt for alternative payment networks such as Solana, Cardano and Ripple.

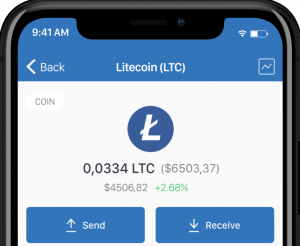

How to Buy and Store Litecoin

If you want to invest in Litecoin, you can find the cryptocurrency on various centralized and decentralized exchanges. We recommend choosing a reputable centralized exchange and following the steps below to buy and store Litecoin:

- Step 1: Choose a reputable brokerage and create a trading account.

- Step 2: Complete identity verification.

- Step 3: Deposit funds using crypto or fiat currencies.

- Step 4: Buy LTC.

- Step 5: Transfer the LTC tokens to your external wallet.

Why Should You Move Your LTC to an External Wallet?

Transferring your coins to an external crypto wallet provides more security than leaving them in your exchange wallet. There are two major types of crypto wallets:

- Cold or hardware wallets such as Trezor and Ledger.

- Hot or software wallets such as MetaMask and Coinbase Wallet.

Note that hardware wallets are more secure because they store your private keys (similar to passwords) offline. Because of this, they are not susceptible to security risks such as hacks and funds theft by malicious actors. To find the best crypto wallet for your needs, review the different wallet types to understand their pros and cons.

Risks and Challenges of Investing in Litecoin

Businesses’ demand for Litecoin as a digital payment has significantly declined as more scalable, faster and cheaper cryptocurrencies have entered the market. The current market trends also show that Litecoin’s longevity and association with Bitcoin have yet to translate to a price increase.

Litecoin founder Charlie Lee’s move to sell all of his LTC in 2017 caused many investors to dump their assets, as they were no longer confident in the project.

While Litecoin has tried to address its use case problem by allowing users to use their tokens on decentralized finance (DeFi) platforms, users can only lend LTC for yields, instead of staking for periodic rewards.

The fall in Litecoin’s demand has limited its utility and negatively affected its coin price, making it a fairly high-risk investment.

Regulatory and Legal Aspects of Litecoin

Regulation remains a significant consideration for cryptocurrency companies and investors. From the investor standpoint, varying laws about the use of cryptocurrencies exist at state levels. Similarly, there’s no uniform federal law governing cryptocurrencies in the US.

However, in the EU region, altcoins such as Litecoin are considered cryptocurrencies and represent digital stores of value. While they can be accepted as a means of exchange, they are not the same as central bank-issued legal tenders.

Before investing in Litecoin, understand your country and state laws around cryptocurrencies, especially altcoins, to avoid legal trouble. However, friendlier regulations around the usage and trading of altcoins in the future may positively impact Litecoin and other cryptocurrencies in its category.

Comparing Litecoin to Other Cryptocurrencies

Litecoin’s status as one of the largest cryptocurrencies is shaky. However, it remains a pioneer in cryptocurrency payments. Below, we assess how LTC stacks up compared to major competitors.

Litecoin vs Bitcoin

Litecoin and Bitcoin operate using the PoW consensus mechanism. However, Litecoin facilitates faster and cheaper transactions, making it more suitable for digital payments. Nonetheless, Bitcoin is a better store of value, has more use cases, and offers more longevity than Litecoin.

Litecoin vs Ethereum

Litecoin and Ethereum operate differently. Litecoin uses PoW, while Ethereum uses Proof-of-Stake (PoS). With its upgrade to PoS, Ethereum offers faster and cheaper transactions. Although Litecoin users may get better incentives from mining, Ethereum has thumped Litecoin as the second-largest cryptocurrency by market cap. It has more value and broader use cases.

Litecoin vs Solana

Solana and Litecoin are popular for digital payments. However, while Litecoin’s use case is limited to being a payment token, Solana is renowned for its infrastructure base layer (Layer 1 blockchain). Similarly, Solana’s supply is unlimited, while Litecoin’s maximum supply is capped at 84 million tokens. Regarding transaction speed, Solana can process 50,000 transactions per second, while Litecoin can process about 56 transactions within the same period.

FAQs

How much is 1 Litecoin?

The Litecoin price today (as of January 2024) is around $65, according to CoinMarketCap data. However, you may find it at slightly different prices across cryptocurrency exchanges.

Where can I buy Litecoin?

The easiest place to buy and invest in Litecoin is a regulated cryptocurrency brokerage. Consider reputable exchanges with verifiable licenses, excellent user experience, low fees and efficient customer support.

Is Litecoin actually safe?

Litecoin is a fork of Bitcoin, making it relatively safe. However, its declining liquidity and limited use cases call for caution when investing.