No cryptocurrency is more prominent than Bitcoin (BTC). In fact, for many people, Bitcoin is practically synonymous with crypto. Let’s take a look at the current Bitcoin price, this crypto’s history and market performance, and more. After going through this guide, you will have an understanding of what Bitcoin is, what affects the price, its use case, and much more.

Bitcoin Price

You can see the current price of BTC and the price history for this crypto above. At its inception, BTC was literally worth nothing. The price it started at was $0. The all-time high price for a single Bitcoin eventually soared to $68,789.63 on November 10th, 2021.

As you can imagine, people who had been holding even a small amount of BTC since the beginning suddenly found that they had life-changing wealth. This massive surge in the value of BTC is a large part of what draws investors to cryptos in the first place. Everyone hopes that the cryptos they invest in will similarly “moon,” making them rich.

About Bitcoin

Bitcoin was the first decentralized crypto in existence, paving the way for all that followed. Bitcoin serves a variety of functions. Some people buy and hold it as an investment. Others use it to buy or sell goods or services. It can also be used for crowdfunding, donations, and more. Typically, when people refer to the Bitcoin network, they capitalize the word. But when they refer to a unit of the cryptocurrency, they lowercase it. That said, there is no set rule on this, and you can do as you like.

The original Satoshi whitepaper states and its core code assures the limited number of coins in circulation will never be more than 21 million, which is estimated to be produced by 2140. Those wanting to get their hands on bitcoins will have to do so by either mining them, buying them, or earning them. Bitcoin price is still mostly governed by the law of supply and demand just like traditional currencies. This means that the price will rise when the demand is high and drop as the demand wanes. You can find Bitcoin live charts here.

Bitcoin price can behave in an unpredictable manner that goes with the novelty of the market itself. Its coin market capitalization is still small compared to heavy hitters among the fiat currencies. Bitcoin market capitalization surpassed USD 300 billion in December 2017, when Bitcoin price hit almost USD 20,000, and dropped to almost USD 100 billion in the summer of 2018.

Due to these fluctuations, trading with these virtual coins should not be approached lightly. At the same time, trading is hardly a gambling affair and you can still make sense out of buying and selling it with a bit of learning and a healthy dosage of common sense.

The most popular platforms to start trading are cryptocurrency exchanges. As you have to keep tabs on those volatile prices, this price tracker could be of help.

Currently, Bitcoin adoption is slow due to relatively high transaction fees. The research is done to reduce these fees e.g. Lightning Network.

As expected, the Global impact of bitcoins has spawned a number of similar projects that try to solve Bitcoin problems or apply crypto ledger to solve other issues. Projects which did make it, such as Ethereum (Ether, ETH – used for smart contracts) or Litecoin (LTC, used for fast and cheap transactions) have all spawned their coins which may or may not actually compete for the same turf as bitcoin.

How Does Bitcoin Work?

Bitcoin runs on the Bitcoin ledger, which is called the “blockchain.” The Bitcoin blockchain is decentralized, and proof-of-work (PoW) is used for consensus and transaction validation.

The validation process used for BTC transactions is referred to as “mining.” This is a demanding process that requires Bitcoin miners to run software that generates hashes in an attempt to match block hashes. You can think of it as solving a puzzle. At any given time, multiple miners are trying to solve the same puzzles. Whichever can do it first successfully creates a new block, and earns a reward.

It is useful to note that proof-of-work is not particularly efficient, and demands a great deal of energy. This has created demand for other more energy-efficient means of achieving consensus and validation. So, some competing cryptos have arisen that use alternatives like proof-of-stake, and which produce a smaller carbon footprint.

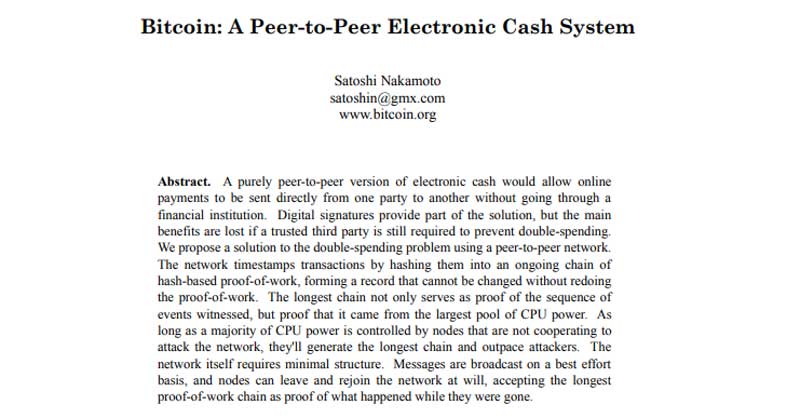

Who Created Bitcoin?

Bitcoin was created by Satoshi Nakamoto. Who or what Satoshi Nakamoto is, however, is unknown. It could be one person, or it could be multiple people. In 2012, Nakamoto stated that he lived in Japan, was male, and was 37 years old. But a lot of people believe based on Nakamoto’s command of English (and regional phrases) that he, she, or they are from Europe or North America.

Some guesses as to the identity of Nakamoto include Hal Finney, Dorian Nakamoto, Craig Wright and Nick Szabo. There are plenty of other possibilities as well. As of right now, it’s completely unknown who the real person or team behind the creation of Bitcoin is. We have covered the history of this coin in our in-depth Bitcoin history page.

How to Buy and Store Bitcoin

There are numerous ways on how to buy Bitcoin and keep it safe. If you want to obtain Bitcoin, here are the steps you must take:

- Join a cryptocurrency exchange platform. If the exchange offers wallet services and you are content to use them, then move on to step 3. Otherwise, move on to step 2.

- Get a crypto wallet. This is where you will be storing your Bitcoin.

- Verify your identity at the crypto exchange. This will unlock all the exchange’s capabilities.

- Make your first deposit in your crypto exchange account using your fiat currency.

- Exchange the money you just deposited in your account for Bitcoin.

- If you are using an external wallet, transfer the BTC to that wallet. Otherwise, you can keep it in your wallet at the exchange.

Years ago, when BTC was new, it was relatively complicated to purchase your first BTC. But nowadays, it is super fast and easy for anyone to do it. Selling Bitcoin is also a rapid and simple process. You just exchange it for another currency or cryptocurrency. You then can keep it in your account or you can withdraw it.

How Bitcoins are Created

Bitcoins are generated through a process called “mining.” Mining is a critical component of the maintenance and development of the blockchain ledger. It involves solving complex cryptographic puzzles to verify and record transactions on the network. Here’s how the process works:

- Transaction Verification: Miners collect transactions from a pool and verify their legitimacy. They check if the sender has the necessary balance and authorization to complete the transaction.

- Forming a Block: Once transactions are verified, they are bundled into a block. This block also references the previous block’s hash (creating a chain, hence the term ‘blockchain’) and a unique code called a nonce.

- Solving the Puzzle: Miners use their computational power to find the nonce that generates a hash for the new block. The hash must meet certain criteria the network sets – typically, it must be lower than a target value. This process requires immense computational effort and is known as proof of work.

- Adding to the Blockchain: When a miner successfully finds the correct nonce and thus the valid hash, they broadcast the block to other network participants (nodes) for verification. If the block is accepted, it is added to the blockchain.

- Reward: For securing the network and processing transactions, the miner who successfully creates a valid block is awarded new bitcoins. This reward is halved approximately every four years in an event known as “halving.” The initial reward was 50 bitcoins per block; as of my last update, it was 6.25. This reward is the only way new bitcoins are created, mimicking the process of mining precious metals like gold – hence the term ‘mining.’

Mining is a resource-intensive activity, requiring considerable electricity and computational power. The difficulty of mining adjusts approximately every two weeks to ensure that the rate of block creation remains constant over time despite changes in mining power. This process of generating new bitcoins through mining is also how the Bitcoin network confirms transactions and remains secure. There is a set upper limit for the amount of BTC that will ever be created: 21 million.

The Future of Bitcoin

Some major developments are slated for the near future for Bitcoin. For one thing, we might see a spot Bitcoin ETF getting approved by the Securities and Exchange Commission (SEC) in the US. If so, we could see a significant boost in the adoption of BTC. But a rise in volatility could also result, so that is something to watch out for if you plan to invest in this crypto.

During 2024, there will also be a halving event for Bitcoin. The effect of halving is to reduce the rate of BTC production. When that happens, the market tends to react to the reduction in future supply by increasing demand, which can drive up the price of BTC. Of course, there are no guarantees, but it could be a good time to buy Bitcoin. More on that you can see our Bitcoin Price Prediction guide.

Risks and Challenges

While the prospective Bitcoin ETF is a good thing, you should be wary about the timing surrounding its approval as an investor. If it takes longer than expected, we might actually see the price of BTC drop.

Next, there is the matter of institutional investors buying big into BTC. In moderation, that is also not a bad thing. But if they buy up too much of it, all of that BTC will just sit there unused in their accounts. This could result in something akin to the heat death of the universe, but for BTC.

Regulatory and Legal Aspects of Bitcoin

Bitcoin (and other cryptos) have existed in a murky regulatory climate around the world for many years. European regulators are starting to make laws that formally govern cryptos, however, and the US may soon do so as well.

As we mentioned before, the US SEC might approve BTC ETFs in 2024, which would be a major positive development on the regulatory front.

You probably have noticed that regulators have taken a lot of action over the past few years to crack down on companies in the crypto sector that have not been following the letter of the law.

This is just the start of regulators taking cryptos more seriously. It is not a bad thing, either—formalizing more laws around crypto will help protect investors, as does the SEC and CFTC going after companies that have operated in misleading or irresponsible ways.

Community and Ecosystem

The Bitcoin ecosystem comprises developers, exchanges, miners , stakers and investors, both retail and institutional. As we just discussed, whether this ecosystem grows or becomes stagnant is going to depend in large part on the actions of institutional investors in the coming years.

You can also participate in the Bitcoin community, which consists of forums, social networks, chats and meet-ups.

Comparing Bitcoin to Other Cryptocurrencies

Understanding the answer to “what is Bitcoin?” is most easily done in a broader context. So, let’s compare BTC to some of its rivals.

In terms of market cap, Ethereum (ETH) is right behind Bitcoin. These two cryptos are quite different, however. Bitcoin was built to fill a similar role to fiat currencies, whereas ETH was developed to power decentralized apps and smart contracts. Both cryptos have been criticized for the amount of energy they consume, but ETH switched to the more efficient proof-of-stake in September 2022.

Tether (USDT) is ranked #3 in terms of market cap. It is a stablecoin that is tethered to the US Dollar. So, whereas the value of 1 BTC rises and falls dramatically against the US Dollar, the value of 1 USDT usually is equal to 1 USD.

Coming in at #4 is Binance Coin (BNB). Customers at Binance can use BNB to pay lower fees than they would with other cryptos when they make transactions on the platform. This is a more specialized use case than BTC. BNB also is even more volatile than BTC.

FAQs

You now know the answer to the question, “What is BTC?” You also have some understanding of Bitcoin’s risks, challenges and future possibilities. Let’s conclude this post by answering a few frequently asked questions about Bitcoin.

Is Bitcoin actually safe?

It is safe to buy and use Bitcoin. But the volatility of this crypto means that it is a high-risk investment to hold. So, make sure you do not invest money you cannot afford to lose.

What is Bitcoin used for?

People use Bitcoin to buy and sell goods and services, send and receive money, and invest.

Who can use Bitcoin?

Anybody can use Bitcoin. You just need to obtain some BTC through an exchange and have a wallet in which to store it. You can then generate BTC addresses and begin using this crypto for transactions.