South Korea’s Crypto-keen K Bank Aims for IPO Amid BTC Boom

K Bank, a South Korean neobank that has seen rapid growth thanks laregely to its crypto operations, is set to make an initial public offering (IPO) bid.

Unnamed financial sector officials said on March 10 that K Bank’s board of directors has signed off on the move.

The goal bank now reportedly has the “goal of listing on the South Korean KOSPI stock market within the year.”

K Bank – A South Korean Crypto Success Story?

Per the news outlet Viva100, the firm is banking on “expected benefits” from a “recent increase in interest in Bitcoin” among crypto-keen South Korean retail investors.

K Bank provides “real-name” banking services (fiat on/off ramps) to Upbit, the nation’s biggest crypto exchange.

During the coronavirus pandemic, this partnership proved a huge success, as K Bank was the only platform that allowed new users to register for accounts online.

Crypto accounts have proved popular ever since, with Upbit-linked accounts still making up a large part of the bank’s revenues.

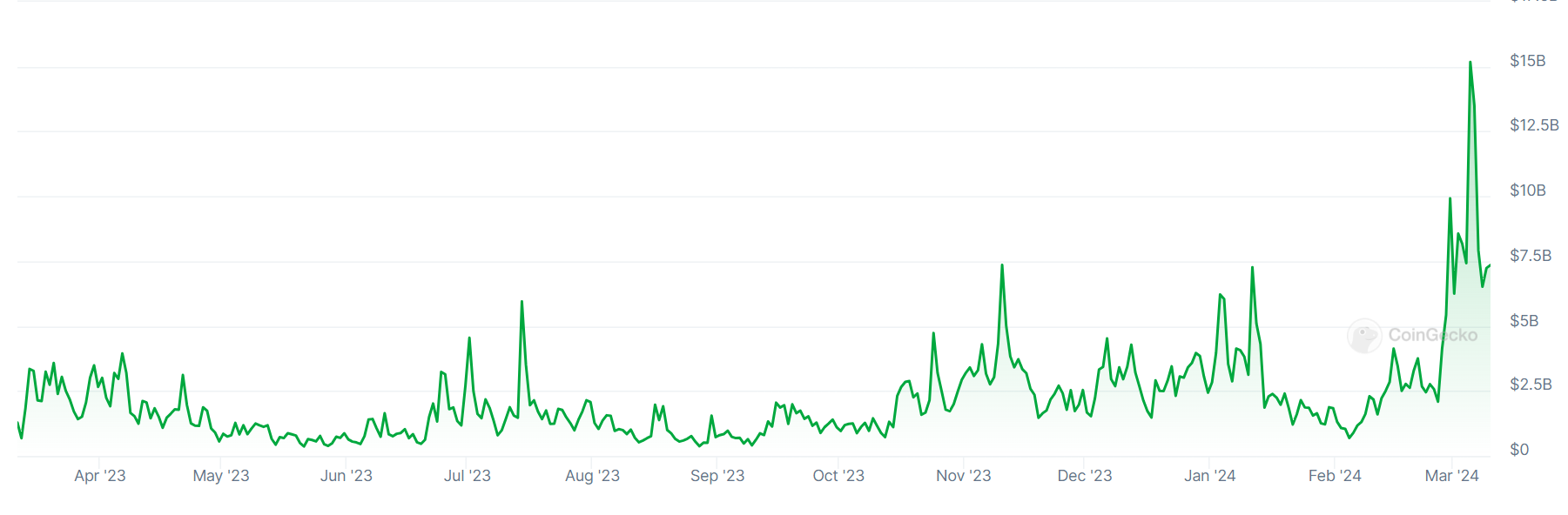

K Bank has seen a rapid rise in customer registrations during previous BTC bull markets. The bank appears confident of a further increase as Bitcoin continues to break all-time price records.

The media outlet noted that a new CEO, the digital finance expert Choi Woo-hyung, has recently taken over at K Bank, fostering a “positive internal and external environment for IPO preparation.”

More South Korean Crypto Firms to Launch IPOs?

The media outlet claimed the neobank reached out to “major securities companies” earlier this year.

In February the bank reportedly “selected NH Investment & Securities, KB Securities, and the Bank of America (BofA) as preferred negotiation partners.”

The outlet also claimed that the bank has begun an “internal recruitment process” as it forms a dedicated “IPO team.”

A previous bid to take the bank public in South Korea ended in disappointment. K Bank passed a preliminary KOSPI listing screening test while pursuing an IPO bid in 2022.

However, the bank was derailed by a 2022 stock market slump. The sluggish market forced it to effectively shelve its plans in February 2023.

South Korean stocks are undervalued compared to many of their peers. Now the government is trying to fix the "Korea Discount" by making company boards more accountable to shareholders https://t.co/HQphLNY7lh

— Bloomberg Markets (@markets) March 6, 2024

But K Bank surpassed the 10 million customers mark at the end of February 2024, as the BTC price began to rise. The media outlet wrote:

“The average number daily of new customers this year increased more than three times as fast as last year. The recent upward trend in Bitcoin is also acting as a positive factor for the K Bank [IPO bid].”

In 2021, during the last BTC bull market, K Bank posted revenues of $22.2 million in commission income from Upbit-linked accounts.

The Bank of Korea’s policy board is about to lose all of its early inflation fighters, adding uncertainties to forthcoming efforts to tamp down price pressure, a former policy director said https://t.co/cWrDp7ngMg

— Bloomberg Markets (@markets) March 5, 2024

Late last year, Upbit’s closest rival Bithumb unveiled plans to launch its own IPO bid. With retail investors returning to the market in force, the trading platform and its bid will likely be buoyed as BTC prices continue to climb.

At the hight of the 2021 BTC bull market boom, South Korean market analysts claimed that the Upbit operator Dunamu was planning to follow Coonbase onto the New York Stock Exchange.